Crypto.com markets itself as a one-stop shop for all things crypto.

Want to buy and sell coins? Check. Earn interest? Spend crypto with a Visa card? Manage your own wallet? Check, check, and check.

It’s ambitious. But does it actually deliver?

In this Crypto.com review, we’ll give you the pros and cons of Crypto.com. We’ll go feature by feature, from fees and security to customer support, and give you the full picture.

By the end, you’ll know whether Crypto.com fits your needs or if another exchange would be a better choice.

Quick verdict

Crypto.com is great for beginners who want an all-in-one app with easy access to:

- Hundreds of coins

- A crypto Visa card

- Built-in fiat off-ramps

It’s also one of the more secure platforms, with $750M in insurance and public proof-of-reserves.

But it’s not perfect:

- Customer support lags

- Crypto withdrawals can be expensive

- The best perks require holding or staking Crypto.com’s native token, CRO.

U.S. users also face limited features, and the app isn’t available in New York at all.

For casual investors and users who mostly use their mobile for crypto, it’s a good choice. For advanced traders hunting rock-bottom fees or desktop tools, it might fall short.

What is Crypto.com?

Founded in 2016 and based in Singapore, Crypto.com has grown into one of the biggest exchanges in the world. They claim they surpassed 100 million users in 2024.

The mission is clear. Become the “crypto super app” where you can do everything, from buying Bitcoin to paying for Netflix with crypto cashback.

Crypto.com is available in over 100 countries, including the U.S. But, not New York. That limitation aside, its global reach and wide product range make it one of the most recognizable names in crypto.

Key features of Crypto.com

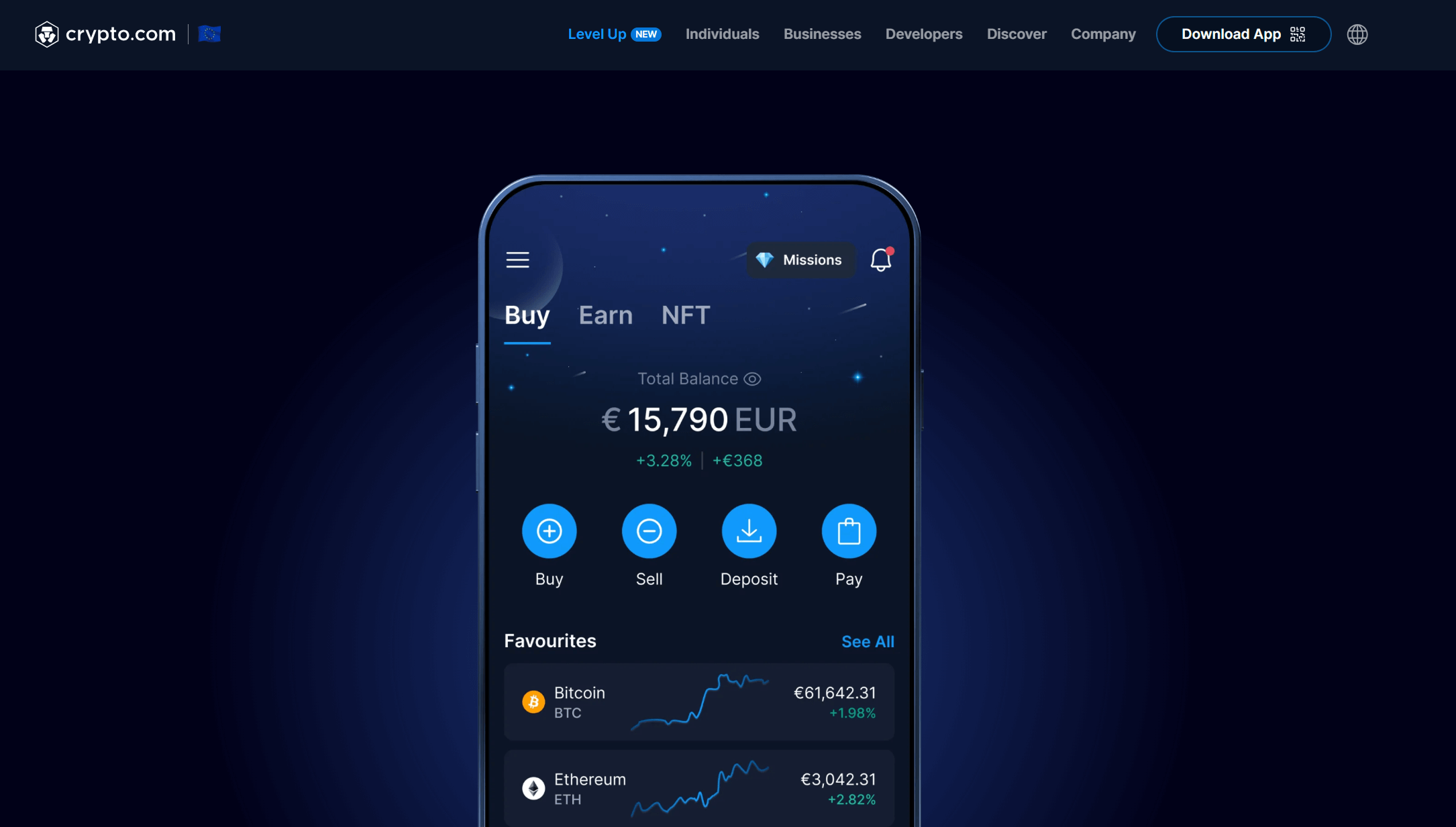

Crypto.com app

The mobile app is the core product.

Everything flows through it:

- Buying and selling coins

- Tracking prices

- Withdrawing money

- Topping up your Visa card

- Exploring rewards

The interface is clean and relatively intuitive, though the sheer number of tabs and features can overwhelm first-timers.

Crypto.com supports 400+ cryptocurrencies on the app. That’s a huge selling point. If you’re curious about altcoins, you’ll likely find them here. For example, Coinbase and Gemini list far fewer.

You can fund your account with a:

- Bank transfer

- Debit card

- Credit card

- PayPal (in some regions)

For U.S. users, ACH transfers are free, but card purchases come with a steep 2.99% fee. In the EU, card fees can be up to 4%. The smart move is to stick with bank transfers whenever possible.

Crypto.com exchange

Crypto.com runs a separate Exchange platform that offers more traditional trading features like order books and advanced charting.

This is where you’ll find the maker/taker fee schedule: standard rates start at 0.075% for takers and 0.05% for makers, competitive with Binance and much lower than Coinbase. High-volume traders and CRO token holders can lower those fees even more.

Here’s the catch: U.S. users can’t access the Exchange. They’re limited to the app, which uses a spread-based pricing model.

That means you won’t see transparent fees. Instead, the price you get includes a hidden markup. It’s convenient but less precise, and active traders may find it frustrating.

Crypto.com Visa card

One of Crypto.com’s biggest draws is its Visa debit card program. You top up the card with either crypto or fiat from your app. Then, you can spend it anywhere Visa is accepted, or withdraw cash at ATMs.

The sweetener is cashback in CRO tokens. It ranges from 0% to around 5% depending on your card tier. Higher tiers also unlock perks like Spotify or Netflix rebates and airport lounge access.

But here’s the trade-off: to qualify for the better tiers, you need to stake a large amount of CRO for months. And the cashback rates were cut in 2022, which left many early adopters annoyed.

Still, compared to most other crypto cards, Crypto.com’s Visa is one of the most polished and widely accepted options. And there are no annual fees.

Crypto.com wallet

In fact, Crypto.com has two types of wallets:

- Custodial wallet (app): This is the default. When you buy crypto on the app, it sits in a wallet managed by Crypto.com. You don’t hold the private keys, which makes it dependent on the platform’s security. But, it’s beginner-friendly.

- Crypto.com DeFi wallet: A separate, non-custodial app where you control the keys. It supports thousands of tokens and has built-in swaps, NFT storage, and DeFi app access. You can transfer assets between the main app and the DeFi Wallet easily.

For most beginners, the custodial wallet is fine. But if you plan to hold large amounts or want to explore DeFi, the DeFi Wallet is a better option.

Earn and staking

Crypto.com’s Earn program lets you earn interest on crypto deposits. The advertised rates can be attractive (10+% for certain tokens), but they depend heavily on three things:

- Which asset you deposit

- Whether you lock it up for 1 or 3 months (vs. flexible)

- Whether you stake CRO

Rates are always subject to change and often get reduced without much warning. U.S. users also have fewer options due to regulations.

We’d suggest checking the live in-app offers before committing.

Is Crypto.com safe?

This is one of the first questions new users ask: Is Crypto.com safe?

Security measures

Crypto.com has strong security measures. They include:

- 100% cold storage for customer crypto via a partnership with Ledger.

- $750M insurance program covering theft or breaches.

- $120M additional insurance through its U.S. Custody Trust Company in 2025.

- Proof-of-Reserves page that lets anyone verify that assets are fully backed 1:1.

- Compliance with top standards (ISO certifications, SOC 2 audits, PCI-DSS).

On the fiat side, U.S. balances are FDIC-insured up to $250,000.

The 2022 hack

In January 2022, Crypto.com suffered a hack where attackers stole roughly $34M in ETH, BTC, and other tokens from 483 users.

The company halted withdrawals, reimbursed all affected customers, and upgraded its 2FA systems.

The breach was of course unsettling. But, the swift response and reimbursement prevented long-term fallout. All in all, the exchange’s response to the attack has been very good.

Bottom line

No exchange can promise perfect safety. But Crypto.com is among the more secure platforms thanks to cold storage, insurance, audits, and regulatory licenses in multiple countries. Beginners can feel confident, though self-custody via the DeFi Wallet is still the ultimate safety net.

Fees: What beginners actually pay

Fees are where Crypto.com gets tricky. On paper, it offers 0% fees if you fund via bank transfer and trade in the app. But in practice, spreads and withdrawal costs can add up.

- Buying crypto: ACH/bank transfer → 0% fee. Debit/credit cards → 2.99% (U.S.), up to 4% (EU).

- Trading on Exchange: 0.075% taker / 0.05% maker to start; lower with CRO staking or high volumes.

- Withdrawing crypto: Fixed network fees shown in-app (e.g., BTC withdrawals often cost $15–20 equivalent). This is one of the platform’s biggest pain points.

- Withdrawing fiat: Free for ACH in U.S., ~€1 for SEPA in EU, about $25 for international wires. Minimum withdrawal is typically $100 or €80.

Tip for beginners: Always fund via bank transfer, not card. And if you want to move crypto to another wallet, plan ahead and avoid frequent small withdrawals.

Getting started: common beginner questions

How to cash out from Crypto.com

- Sell your crypto in the app to fiat (USD, EUR, GBP, etc.).

- Funds land in your Fiat Wallet.

- Tap Withdraw → Fiat → Bank Account.

- Choose ACH (U.S.), SEPA (EU), or local method.

- Confirm. Transfers usually take 1–3 business days.

Alternatively, you can top up your Crypto.com Visa Card with fiat or crypto and spend it directly, or withdraw cash at ATMs.

How to get tax documents from Crypto.com

- U.S. users may receive a Form 1099-MISC (for rewards) or 1099-B (for trades). These are available in-app under Settings → Tax Documents by January 31 each year.

- All users can export full transaction histories as CSV files.

- The free Crypto.com Tax tool supports multiple countries and can automatically generate tax reports.

How to claim welcome bonus on Crypto.com

Crypto.com runs periodic welcome bonus promotions for new users. The current structure typically involves:

- Signing up and completing KYC.

- Meeting activity requirements (like trading a set volume within 30 days).

- Claiming the bonus in the app’s Rewards Hub.

Rewards are usually paid in CRO. Terms change often, so always check the live promotion details when signing up.

It’s quite possible that the rewards change by the time you’re reading this. So, make sure to check the current rewards on their page.

Crypto.com customer support: hit or miss

Crypto.com customer support is one of its weakest areas.

The main channels are:

- In-app live chat (24/7).

- Help center articles.

- Card-specific hotlines (for Visa card issues only).

There is no general phone support, and many users report slow responses or scripted answers.

On Trustpilot, Crypto.com has an abysmal 1.4/5 rating, with customer service being a common complaint.

To be fair, crypto exchanges are notorious for bad ratings. Kraken and Binance also stand just slightly above Crypto.com, at 1.6. But, Coinbase is at an impressive 3.9, which shows it can be done.

For routine questions, the help center works…fine. But if your account is locked or a withdrawal is delayed, expect potential frustration. This is an area where Coinbase and Kraken tend to outperform Crypto.com support.

Where Crypto.com shines & where it falls short

Pros

- Huge selection of coins (400+).

- Integrated ecosystem: trading, Visa card, NFT marketplace, DeFi wallet.

- Strong security: cold storage, insurance, proof-of-reserves.

- Competitive fees (if you fund via bank transfer).

- Beginner-friendly app with simple buy/sell flow.

- Visa card perks like cashback and rebates.

Cons

- High crypto withdrawal fees.

- Mediocre customer support (no general phone line).

- Best perks locked behind CRO staking.

- Not available in New York; limited features in U.S. overall.

- App spreads can hide real costs compared to exchange order books.

Competitor comparisons

- Coinbase: Easier to use and stronger customer support, but fewer coins and much higher fees. Best for pure beginners who want simplicity above all else.

- Binance (global): Lower fees and deeper liquidity, but not available to U.S. users in full. Binance.US has fewer coins than Crypto.com.

- Kraken: Comparable numbers of tokens and excellent security reputation. Fees are competitive, but it lacks extras like a Visa card or NFT marketplace.

Crypto.com’s niche is being the super app.

If you want everything under one roof, it’s probably the best at it. If you just want cheap trades or the simplest interface, a competitor may suit you better.

Final verdict: should you use Crypto.com?

After this Crypto.com review, it’s clear that the platform has carved out a unique spot for itself. It’s secure, globally available, and feature-packed.

Beginners who want to explore altcoins, earn rewards, and maybe spend crypto on a card, will find it appealing.

But it’s not without flaws. Withdrawal fees sting, support lags, and U.S. users in particular don’t get the full product. And if you don’t care about CRO staking, you’ll miss out on many of the best perks.

Bottom line:

- Use Crypto.com if you want an all-in-one crypto app with lots of features and you’re comfortable on mobile.

- Choose a different platform if your priority is ultra-low fees, best-in-class support, or you live in a restricted region.

It’s not perfect, but for many beginners, Crypto.com is a safe and legitimate entry point into crypto.

FAQ

Is Crypto.com trustworthy?

Yes. Crypto.com is generally considered safe thanks to cold storage, $750M+ in insurance, and proof-of-reserves that show assets are backed 1:1. It was hacked in 2022, but all users were reimbursed and security was upgraded.

No platform is risk-free, but Crypto.com is among the more trustworthy exchanges available.

What is the most trusted crypto website?

There’s no single winner.

- Coinbase is often viewed as the most trusted in the U.S. due to heavy regulation and a public listing.

- Kraken is praised for security and transparency.

- Crypto.com earns trust with proof-of-reserves and insurance.

The best choice depends on your region, features, and whether you want to self-custody with your own wallet.

Which is better, Crypto.com or Coinbase?

- Coinbase is simpler, has better customer support, and is highly regulated, but fees are higher and coin selection is smaller.

- Crypto.com offers 400+ coins, a Visa card, and often lower costs via bank transfer, though support is weaker and features vary by region.

Beginners may prefer Coinbase, while feature-seekers may prefer Crypto.com.

Is Crypto.com good for beginners?

Yes. The app makes buying and selling easy, supports many coins, and includes bank transfers, fiat withdrawals, and a crypto Visa card. Beginners can also explore staking and the DeFi Wallet later.

Downsides include confusing fees, high withdrawal costs, and slow support. Overall, Crypto.com is beginner-friendly if you’re comfortable using a mobile-first platform.