No KYC: Best Anonymous Crypto Exchanges 2025

Jane Savitskaya

You think a good no-KYC crypto exchange is an oxymoron? Let me prove you wrong.

Most crypto exchanges these days want to know your full life story before you can even trade a coin. ID, address, proof you’re a real human being — it’s all part of KYC or Know Your Customer verification process. But what if you prefer not to hand over all your personal info just to trade some memecoins?

You’re not alone.

This article covers the best no KYC crypto exchanges, explains why KYC exists in the first place, and weighs all the perks and downfalls of anonymous crypto trading.

Key takeaways

- KYC means handing over your personal info. Some exchanges demand it, others don’t.

- No-KYC platforms let you trade crypto without uploading an ID or proof of address.

- The tradeoff? You’ll gain privacy and faster access, but lose some protections and features.

- These platforms are best for privacy-conscious users, not total beginners or large-scale fiat investors.

- Our top 10 list includes trustworthy, well-known no-KYC exchanges with solid features and real user bases.

- Sure, no-KYC platforms are not all shady back-alley websites. But you still need to do your homework.

What is KYC and why most exchanges require it

KYC stands for “Know Your Customer,” and it’s exactly what it sounds like. Crypto exchanges request your personal info: your name, address, ID, sometimes even a selfie or a short video footage — all to prove you’re not a bot, a criminal, a scammer, or a walking money-laundering operation.

The main reason for requesting such data is security. And also because financial regulators require it. If a crypto exchange wants to stay on the good side of the law, especially in the US or EU, KYC is a must.

For the average user like you, this means jumping through a few hoops before you’re allowed to use the platform.

But not everyone is ready to accept that level of scrutiny. Sometimes it’s too bothersome, sometimes unnecessary. If you’re just looking to make a few trades with crypto you already own, a no-KYC crypto exchange allows you to get straight to trading.

Of course, regulators are not particularly fond of no-KYC. That’s why these platforms operate in legal gray zones, avoiding certain countries or blocking fiat entirely.

Using a no-KYC platform is not illegal it’s not totally risk-free either. All in all, for users who prioritize privacy and seamless transactions, these exchanges offer a solid alternative.

Best 10 no-KYC crypto exchanges in 2025

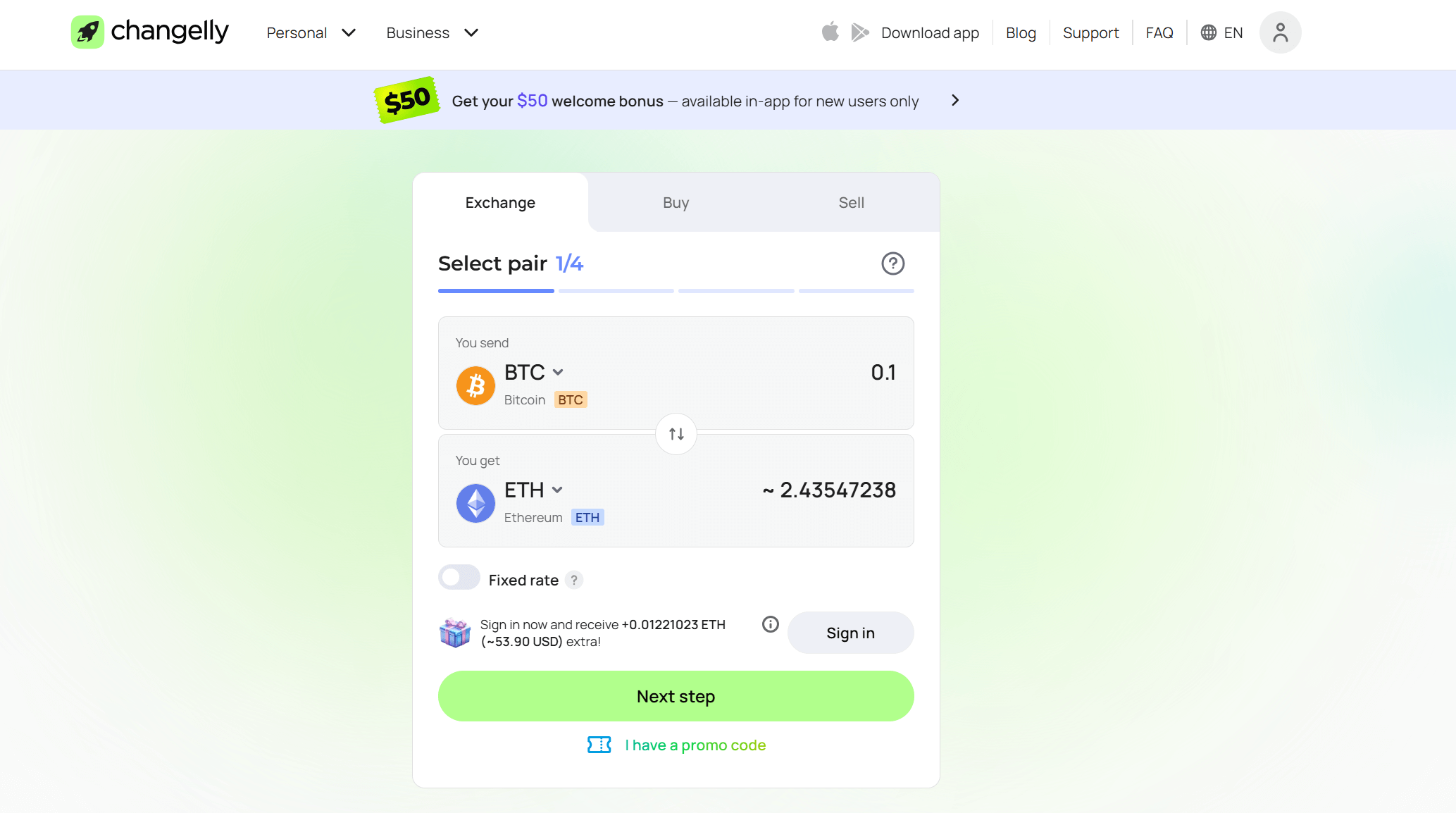

1. Changelly

A good pick for fast, hassle-free swaps between major cryptocurrencies. Great for quick conversions, although not ideal for active traders.

Key features:

- Instant crypto-to-crypto swaps

- Over 500 supported coins

- No account needed for basic swaps

- Non-custodial — funds stay in your wallet

Pros:

- Super easy to use

- Supports a wide range of tokens

- No registration for most transactions

Cons:

- Higher fees than typical spot exchanges

- Limited trading tools

- No fiat trading without KYC

2. BingX

BingX offers a rare mix of no-KYC trading and advanced features like copy trading and derivatives. It’s best for users who want more than just basic features.

Key features:

- Spot, futures, and copy trading

- No KYC required up to certain withdrawal limits

- Wide range of assets, including crypto indices

- Beginner-friendly UI

Pros:

- Supports leverage and copy trading

- Decent liquidity and active user base

- Clean interface with a solid mobile app

Cons:

- Partial KYC limits some features

- Not available in certain countries

- Leverage can be risky if you don’t know what you’re doing

3. Margex

Margex is a privacy-oriented exchange focused on margin trading. Ideal for traders who want anonymity and leverage without the usual KYC wall.

Key features:

- Up to 100x leverage

- No KYC required at all

- BTC-based account system

- Built-in risk management tools

Pros:

- Fully anonymous

- Great for leverage traders

- Simple onboarding

Cons:

- BTC-only deposits and withdrawals

- No spot trading

- Might be too niche for casual users

4. Zoomex

Trading with Zoomex, you get a smooth no-KYC experience with low fees and high leverage. It’s built for degens, but still pretty beginner-friendly.

Key features:

- Spot and futures trading

- Up to 150x leverage

- No KYC required for most functions

- Competitive trading fees

Pros:

- Clean interface, fast execution

- Supports advanced trading with no ID checks

- Low fees compared to big-name exchanges

Cons:

- Limited fiat options

- Newer platform with a smaller reputation footprint

- Not much in the way of tutorials or education

5. BestWallet

Despite the name, not just a crypto wallet. BestWallet doubles as a no-KYC gateway to DEXs and token swaps. It’s perfect for mobile-first users who want privacy.

Key features:

- Mobile wallet with built-in swap features

- Connects to multiple DEXs

- No KYC at all

- Supports multiple chains

Pros:

- True self-custody

- Private by design

- Easy swap access without needing a separate exchange

Cons:

- No order books or trading tools

- Swaps can be pricey depending on network fees

- Mobile only. No desktop version (yet)

6. ChangeNow

A long-time player in the no-KYC swap scene. ChangeNow is perfect for quick, secure asset swaps without an account.

Key features:

- 900+ crypto assets supported

- Instant, account-free swaps

- Fixed or floating rate options

- Non-custodial platform

Pros:

- No sign-up needed

- Great selection of tokens

- Simple UX even for newbies

Cons:

- No trading dashboard

- Slightly higher rates for convenience

- Not suitable for active or pro traders

7. GhostSwap

If you really prioritize privacy, GhostSwap can offer you maximum stealth. Built on privacy-focused chains, it’s not everyone’s cup of tea, but it does what it promises.

Key features:

- Privacy-first DEX

- Supports Monero, Pirate Chain, and other anonymous coins

- No KYC, no accounts, no tracking

- On-chain swaps only

Pros:

- Full anonymity

- Supports truly private assets

- No logins or email required

Cons:

- Niche coin support

- Limited liquidity

- Not beginner-friendly

8. SwapRocket

A DEX aggregator with no KYC, low fees, and a growing user base. Great for token swapping across chains without getting tangled in registration forms.

Key features:

- Aggregates liquidity across multiple DEXs

- Cross-chain support (ETH, BNB, Polygon, etc.)

- No KYC required

- Fast swap engine

Pros:

- Competitive rates

- Clean, modern UI

- Easy to use even without prior DEX experience

Cons:

- Still evolving — some features under development

- No fiat support

- No trading interface beyond simple swaps

9. WEEX

WEEX mixes pro-level trading tools with a no-KYC option. It’s like using Binance before it went full compliance mode.

Key Features:

- Spot and futures trading

- Leverage up to 200x

- Optional KYC (not required for most actions)

- Customizable trading interface

Pros:

- High leverage

- Full-featured platform

- Fast onboarding without ID

Cons:

- Not fully transparent about corporate structure

- Limited educational content

- Could be overwhelming for casual users

10. TorrentSwap

TorrentSwap is still under the radar, but it’s gaining traction among privacy-focused users. Think grassroots DEX vibes with decent functionality.

Key features:

- Fully decentralized, no KYC

- Token swaps only

- Runs on P2P smart contracts

- Focus on privacy coins and altchains

Pros:

- No data collection whatsoever

- Permissionless access

- Low gas fees on supported chains

Cons:

- Not widely adopted

- Minimal support or documentation

- Risk of low liquidity on less popular tokens

Perks and risks of using no-KYC exchanges

Before you go full ghost mode, it’s worth knowing what you’re getting into. Because trading without KYC sounds great: privacy, speed, no unnecessary bureaucracy, but it’s not all sunshine and rainbows. Let’s start with sunshine and rainbows, though.

Perks

- Privacy. No forms, no selfies, no handing over your identity to a company that might “accidentally” leak it. You stay anonymous. That’s the whole point.

- Fast onboarding. No need to wait to get verified. Most no-KYC platforms let you trade within minutes of landing on the site.

- Fewer geo-restrictions. KYC often comes with regional lockouts. No-KYC platforms usually don’t care where you live as long as you have crypto.

- Easier access to DeFi. Many decentralized exchanges are no-KYC by design. If you want to interact with Web3 or privacy tokens, it’s your best bet.

Risks

- Limited fiat options. No KYC usually means no easy way to deposit or withdraw fiat. Don’t expect PayPal or bank transfers here.

- Fewer safety nets. If something goes wrong and funds disappear, trades fail, there’s often no customer service or dispute resolution. You’re on your own.

- Legal grey zones. Some no-KYC platforms operate in the shadows. They might get geo-blocked, banned, or vanish overnight. Don’t store your life savings there.

- Higher scam risk. The reality is if anyone can launch a platform without oversight, you’ll get a few bad actors. Always double-check who you’re dealing with.

How to pick the right no-KYC exchange

In a reality where launching a platform is as easy as starting a blog, how can anyone tell a legit exchange from a fake one?

Here’s what you should look at:

Reputation

First things first, Google the name. It’s an obvious step, but many users somehow skip it. Look for reviews, Reddit threads, and any signs of shady behavior. Too many people claim it’s a scammer’s den? Well, must be better to avoid it.

Trading volume & liquidity

You want an exchange that actually has users. Because low liquidity comes with slippage, bad prices, and an overall frustrating experience.

Security track record

Check if the platform has a history of hacks, wallet leaks, or downtime. Give it mental bonus points for things like cold storage, multi-sig wallets, and transparency around how they handle user funds.

Supported assets

Make sure the exchange supports the coins you actually want to trade. Some no-KYC exchanges are Bitcoin-only, others offer hundreds of tokens. But it’s not about quantity if you’re only trading ETH and USDT.

Fees

No-KYC doesn’t mean free. Take your time to check the fee structure. Some platforms charge a flat swap fee, others take a cut on every trade. Also, watch out for sneaky withdrawal fees — those can be brutal.

User interface

It shouldn’t feel like you’re solving a math problem when you’re trying to place a trade. A clean UI, fast execution, and a mobile app (if you need one) can make your trading experience a lot more pleasant.

Withdrawal limits

Some platforms let you trade without KYC, but limit your withdrawal options. Make sure the limits fit your needs, or prepare to get verified later.

Final thoughts

No-KYC crypto exchanges are a great match for users who need privacy, speed, and control over their trading. That is, if you’re ready to sacrifice fiat ramps, fancy dashboards, and VIP support. If that’s the case, you will find platforms that let you get in, trade, and get out without handing over your passport and a blood sample.

Just remember: There’s no “forgot password” button when you’re using a decentralized swap with zero support. And there’s no safety net if you YOLO into a rug pull on some sketchy DEX.

Start small. Stay alert. Use common sense.

Don’t forget why these platforms are KYC-free in the first place.