June 2025 is anything but boring. There are currently 7 hot crypto projects that are getting the most attention: $KAITO, $HYPE, $FART, $TRUMP, $ALCH, $ZK, and $CFG.

In classic crypto fashion, we’ve got a little bit of everything flying across the charts this month:

- AI-fueled platforms

- High-speed trading protocols

- Absurd meme coins (yes, fart sounds are involved)

- Political tokens making campaign rallies look like pump-and-dumps

- Serious plays trying to drag real-world finance onto the blockchain

Some of the projects are brand new, some are veterans making a comeback, and some are here for utility. And a few… well, let’s just say they’re here for the vibes.

From explosive airdrops to billion-dollar perp volumes, and from sound effects to tokenized US Treasury bills, this month’s mix shows just how wide the crypto hype spectrum really is.

Let’s break down the stories, price action, and chaos behind the hottest tokens of June 2025.

Quick overview: 7 hot crypto projects in June 2025

- Kaito ($KAITO): An AI-powered crypto research engine that turns chaotic on-chain info into clean insights, and pays users to share valuable content. Massive airdrop fueled early hype, but adoption is still a question mark.

- Hyperliquid ($HYPE): A DeFi-focused Layer 1 powering on-chain perpetuals and its own HyperEVM chain. Dominates DEX perp volume and has become a serious contender in the trading infrastructure race.

- Fartcoin ($FART): A Solana-based meme coin that literally makes a fart sound when you send it. It’s pure chaos, zero utility, and somehow still a top 100 coin.

- Trump Coin ($TRUMP): A politically charged memecoin tied to Donald Trump, launched during his 2025 inauguration. Massive early pump followed by heavy volatility and media-driven swings.

- Alchemist AI ($ALCH): A no-code AI development platform that turns plain-text prompts into full crypto apps. Early-stage, but gaining traction thanks to the AI narrative and Solana speed.

- zkSync ($ZK): Ethereum Layer 2 using zk-rollups for fast, cheap transactions. Still recovering from an April airdrop exploit, but remains a key player in Ethereum’s scaling ecosystem.

- Centrifuge ($CFG): A serious DeFi project focused on tokenizing real-world assets like Treasury bills and credit funds. Low-key but positioned well if RWA adoption continues to grow.

Kaito ($KAITO): AI-powered crypto research engine

If ChatGPT and Crypto Twitter had a baby, it would probably look a lot like Kaito.

Launched in 2022, it’s an AI-powered platform that scrapes everything from X threads to on-chain data and turns it into bite-sized insights. No more doomscrolling, just type your question, and the bot does the digging.

What sets Kaito apart? It gamifies crypto research.

Users earn “Yaps” for sharing insights or content, with the promise of future token rewards. It’s part research tool, part social reward system, and part marketing genius. That formula helped it explode in 2025.

Price trends

In April, KAITO sat quietly at $0.67. Then came the $74 million airdrop in May (yes, you read that right), which sent the token flying past $2. It’s since cooled off, now hovering around $1.70, with a market cap just over $415 million.

Growth drivers

AI is hot, and Kaito is riding that narrative hard. Airdrop mania, attention-based rewards, and listings on major exchanges (like Binance) gave it a huge boost. The “get paid to post good research” angle clicked hard with the crypto X crowd.

Challenges & risks

But there are warning signs. Platform traffic dropped more than 50% since February, and only 24% of the total supply is circulating. The rest? Locked — until August. If interest dips before then, a wave of unlocks could nuke the price.

Future outlook

Kaito has hype, a clever model, and strong backing — but it’s still a speculative play. If it keeps building and users stick around, it could carve out a real niche in Web3 research. If not, it risks becoming another short-lived airdrop darling.

Hyperliquid ($HYPE): On-chain perp king with DeFi muscle

Hyperliquid is gunning to be the trading layer for crypto. Built as a purpose-built Layer 1, Hyperliquid powers two core products:

- HyperCore: a decentralized perpetuals exchange with on-chain order books

- HyperEVM: its own chain for faster, cross-margin trading

The pitch? Transparent, fast, and deep on-chain perps. And so far, it’s delivering.

Price trends

HYPE has been on a tear. After hovering in the $20–30 range in early May, it spiked to an all-time high of $39.68 by the end of the month.

It’s currently trading between $36–38, with a market cap above $12 billion. That makes it one of the largest DeFi-native assets in the market right now.

Growth drivers

Hyperliquid has captured a massive 80% of all on-chain perpetuals volume, beating out older players like dYdX.

Traders are loving the low fees, slick UI, and fast execution. Plus, staking incentives, active community engagement, and a recent influx of developers building on HyperEVM are keeping the momentum strong.

Challenges & risks

There’s real regulatory risk here. Perpetuals are often in the crosshairs of global regulators, especially in the US, where leverage and derivatives are heavily scrutinized.

Also, while the product is gaining traction, competition from Binance, Bybit, and other centralized exchanges is always looming. Token unlocks later this year could also introduce volatility.

Future outlook

If Hyperliquid keeps growing its volume and developer base, HYPE could become a core part of the DeFi landscape. But it needs to keep innovating and navigating regulatory waters carefully. For now, it’s one of the most promising DeFi projects of 2025.

Fartcoin ($FART): Solana’s funniest and foulest meme coin

Yes, it’s real. And yes, it makes a fart sound when you send it.

Fartcoin launched on Solana in October 2024 as a full-blown joke. It’s a meme coin that turns every transaction into a literal gas fee gag.

Its entire value proposition is built on absurdity, sound effects, and the unstoppable power of crypto humor.

And somehow, it worked.

Price trends

After quietly launching, $FART went viral in January 2025 (that felt really weird to write).

Nonetheless, it rocketed to an all-time high of $2.48. It has since cooled off but still trades between the $1.02 and $1.16 range , holding a spot in the top 100 by market cap. That’s impressive for a coin with zero utility and a total supply of 69,420,000. (Nice.)

Growth drivers

The coin’s rise was fueled by social media chaos, meme contests, and a surprisingly loyal community. The fart sound on Solana wallets became a running joke on crypto Twitter.

Even non-crypto accounts jumped on the trend, which gave $FART viral reach beyond the usual circles.

Challenges & risks

Let’s be honest, this is pure speculation. Fartcoin has no utility, no dev roadmap, and no long-term vision.

Its price is tied entirely to social engagement and meme momentum. The moment people get bored, this coin could vanish just as quickly as it appeared.

Future outlook

As long as people are laughing, $FART has room to pump. But without substance behind the scenes, it’s a risky hold. It’s a classic meme coin: potentially profitable, definitely ridiculous, and always one joke away from irrelevance.

Trump Coin ($TRUMP): Political meme machine with wild swings

Trump Coin exploded onto the scene in January 2025, launched just as Donald Trump returned to the Oval Office.

Enjoying the perks of political hype, the token dropped on Solana with full backing from Trump-affiliated entities and quickly became the most polarizing memecoin in the market.

Supporters saw it as a digital show of allegiance. Traders saw dollar signs.

Price trends

$TRUMP launched around $6.50, hit a jaw-dropping $75 within days, and then reality hit. It’s now trading near $11, with a market cap of $2.2 billion. The volatility has been brutal, with swings driven by media coverage, speculation, and political news cycles.

Growth drivers

Trump’s name alone is enough to cause massive hype.

His rallies, legal battles, and public statements all move the token’s price. A rumored wallet airdrop and NFT integration sent it pumping again in April — until it was publicly denied, which sent it tumbling. It’s built on Solana, it also benefits from fast, cheap transactions, perfect for meme coin momentum.

Challenges & risks

The token is wildly centralized, with insiders reportedly holding over 80% of the supply. That’s a red flag for manipulation risk.

Critics have called it a “cash grab,” and there are lingering questions about the ethics of monetizing a sitting president’s brand. If the Trump family distances itself further, confidence could tank.

Future outlook

$TRUMP lives and dies by the news cycle. If Trump stays in the headlines, the coin stays hot. If attention fades, so will the token. It’s a high-risk political memecoin—volatile, controversial, and completely driven by public perception.

Alchemist AI ($ALCH): No-code AI dev meets blockchain

Alchemist AI wants to turn crypto building into magic. Built on Solana, it’s a no-code development platform where users can describe what they want.

For example, “make me a DeFi app” — and the AI handles the rest. Smart contracts, UI, backend logic. No dev skills required.

At least, that’s the pitch.

Price trends

$ALCH has been steadily climbing. It’s currently priced around $0.14, up 25% in the past few weeks, with a market cap just over $120 million. It hasn’t had the kind of blowout pump we’ve seen from meme coins, but it’s quietly building momentum.

Growth drivers

Alchemist is tapping into two hot narratives: AI and Web3 accessibility.

Its early access platform has attracted curious developers, and the team’s application to NVIDIA’s Inception startup program gave it a credibility boost. Active community updates and Solana’s low fees have also helped.

Challenges & risks

The concept is ambitious, but unproven. Only 14% of the total token supply is circulating, which raises dilution concerns.

If the platform doesn’t deliver a smooth, working product soon, the hype could dry up fast. Competition in the “AI x crypto” space is fierce, too.

Future outlook

If Alchemist actually makes app-building as easy as it claims, $ALCH could become a breakout project. But until the tech is fully battle-tested and adopted, it remains a speculative bet.

One to watch, but not one to blindly ape into just yet.

zkSync ($ZK): Layer-2 hopeful battling back after breach

zkSync has been one of Ethereum’s most talked-about Layer-2 projects, but its path hasn’t exactly been smooth.

Built on zk-rollup tech, zkSync promises faster, cheaper Ethereum transactions without compromising security. The tech is solid, but its token debut got messy.

In April 2025, an exploit in the airdrop contract let an attacker mint millions of unclaimed tokens. Most were returned, but the damage to sentiment was done.

Price trends

After peaking at $0.32 post-airdrop in mid-2024, $ZK crashed to an all-time low of $0.041. It’s now trading around $0.059, with a market cap of roughly $218 million.

It’s made a modest recovery, but still sits far below its early highs.

Growth drivers

Despite the rocky rollout, zkSync is still a major player in Ethereum’s scaling race. The demand for faster, cheaper L2s hasn’t gone away.

The team continues to fund ecosystem growth through grants, and future governance plans are in motion. If adoption climbs, so could the token.

Challenges & risks

The April breach rattled investor confidence. Add in a heavy unlock schedule and competition from Arbitrum, Optimism, and others, and it’s an uphill battle.

Many also question whether zkSync has done enough to differentiate itself from other L2s.

Future outlook

$ZK remains a long-term bet on Ethereum scaling. The fundamentals are there, but the token faces short-term volatility and stiff competition.

If it can rebuild trust and keep attracting developers, it may find its second wind. Otherwise, it risks fading behind faster-moving rivals.

Centrifuge ($CFG): Serious DeFi play for real-world assets

Centrifuge isn’t here for memes or hype. It’s one of the few DeFi projects focused on something the industry’s been promising for years: bringing real-world assets (RWAs) on-chain.

Think Treasury bills, credit funds, and invoices — tokenized and traded like any other crypto asset.

It’s infrastructure, not flash. And that’s exactly the point.

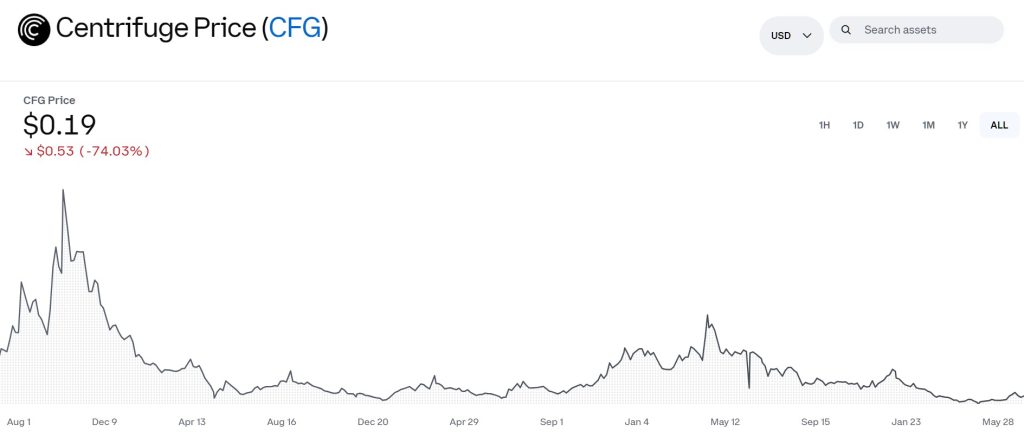

Price trends

$CFG has stayed relatively stable compared to the rest of this list. It’s currently trading around $0.18, with a market cap under $100 million.

No wild pumps or dumps here. Just slow, steady movement with occasional upticks tied to real-world news.

Growth drivers

In May, Centrifuge helped launch a $400 million tokenized US Treasury fund on Solana.

That’s not a typo. It’s a huge deal for DeFi’s push into traditional finance. The project also benefits from institutional partnerships and rising interest in tokenized securities across platforms like Polkadot and Solana.

Challenges & risks

RWAs are still a niche sector. Liquidity is low, regulatory complexity is high, and most retail investors don’t fully understand the use case.

CFG also flies under the radar compared to flashier DeFi names, which limits visibility and volume.

Future outlook

If RWAs take off, Centrifuge is well-positioned to be a key player. But that’s a big if.

This is a long-term infrastructure bet, not a quick flip. For now, it’s one of the most grounded projects in a very hype-heavy space.

Final thoughts: Hype vs. hope in June 2025

June 2025 has delivered a wild mix of projects, from flatulence-fueled memes to serious infrastructure bets.

On one side, we’ve got Fartcoin and Trump Coin, where attention is the asset and volatility is the product. These tokens thrive on jokes, politics, and viral momentum. They’re fun, unpredictable, and can be profitable for those who time it right.

On the other hand, you’ve got projects like Hyperliquid, Centrifuge, Alchemist AI, and Kaito, which are trying to build actual tools, protocols, and platforms. Some are already gaining traction, while others are still finding their footing. But all of them are chasing real utility, not just likes and retweets.

As always, volatility is the only constant in crypto. Always know what you’re holding and why.

Keep an eye on project updates, watch those unlock schedules, and double-check the tokenomics before you dive in.

And most importantly?

Do your own research.