If you’ve been anywhere near crypto Twitter lately, you’ve probably seen the words perp DEX thrown around like confetti. But what’s the actual perp DEX meaning?

Simply put, perp DEXs are decentralized exchanges where you can trade perpetuals — basically crypto futures contracts with no expiry date. Perpetuals trading lets you go long, short, and use leverage without worrying about contracts expiring. And this is exactly why perpetuals crypto markets have exploded.

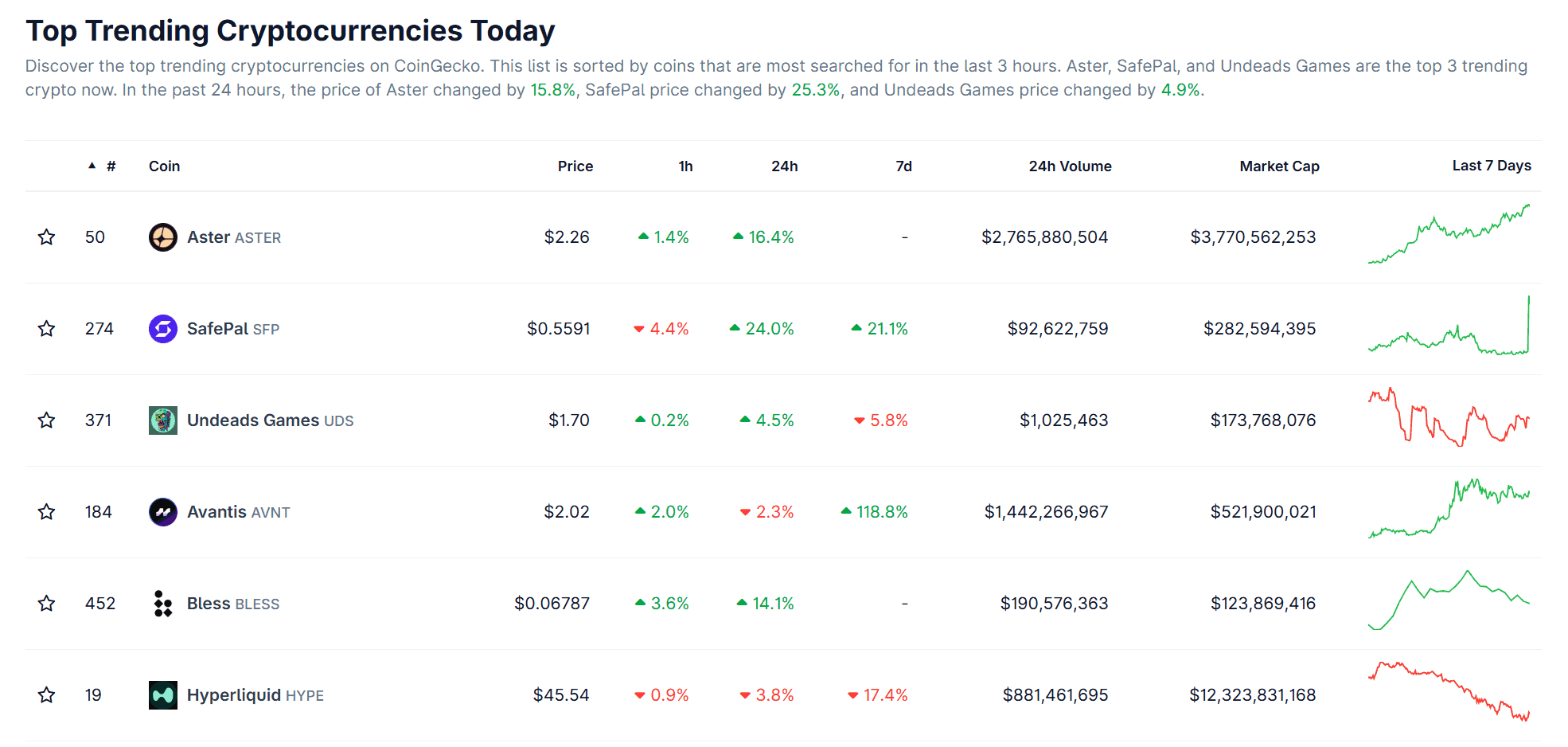

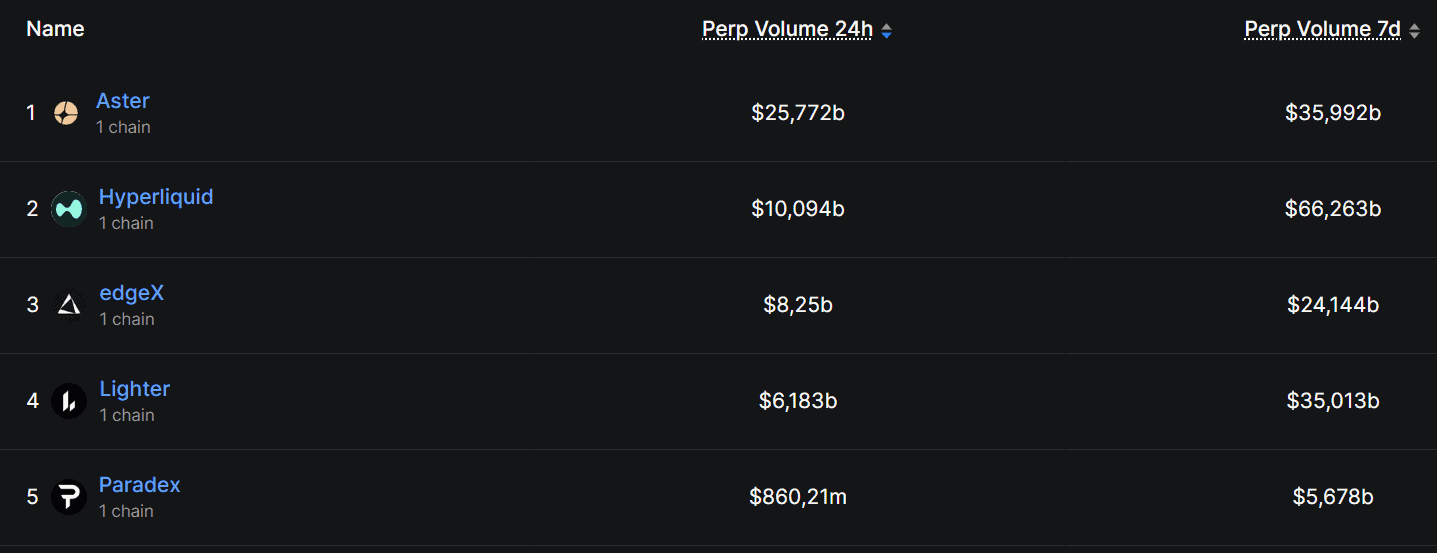

Right now, the king of the hill is the Hyperliquid exchange. It’s the largest on-chain perp DEX, and if you’ve ever checked the Hyperliquid price charts, you know it’s absolutely printing money. But no monopoly lasts forever. And just in the past week, three new challengers have stepped up, ready to test Hyperliquid’s grip on the market.

So, if you want to know more about what’s next in the race for the top perp DEX, here’s a look at three fresh projects: Aster, Avantis, and Lighter.

Key takeaways

- Perp DEX meaning: decentralized exchanges for perpetuals trading.

- Hyperliquid exchange is still the biggest, with the Hyperliquid price printing cash.

- New rivals are here: Aster crypto (CZ-backed, token already pumping), Avantis crypto (500x leverage + equities), and Lighter DEX crypto (no token yet, but flipped Aster in volume).

- These projects could become the next top perp DEX contenders — but remember, new doesn’t always mean safer.

What are perpetuals in crypto?

They’re a type of futures contract in crypto, but unlike traditional futures, they never expire. In other words, you can hold the position as long as your margin lasts.

Most of this action still happens on centralized exchanges like Binance or Bybit, where liquidity is deep and execution is lightning fast. But a growing share is moving to decentralized platforms aka perp DEXs. These let you trade perpetuals directly on-chain, keeping custody of your funds while still accessing leverage and a wide range of markets.

The trade-off is clear: decentralized exchanges often struggle with liquidity depth, higher fees, and slower execution compared to their centralized cousins. But for many, the appeal of not trusting a middleman outweighs those drawbacks.

That’s what Hyperliquid exchange did — it brought CEX-like speed and liquidity to an on-chain world. And now, with new players like Aster, Avantis, and Lighter, the race for the top perp DEX is heating up. Each brings its own perks: from higher leverage to broader asset coverage, showing there’s still plenty of room for innovation.

Aster ($ASTER)

Aster crypto is all over X (ex-Twitter) now. It launched its token just last Thursday, Sept 18th, and has already forced its way into the conversation by becoming a top 10 revenue generator in under a week. Not bad for the new kid, huh?

The Aster crypto price has ~3.5x’d since launch, and the hype machine shows no signs of slowing.

Part of that buzz comes from its backer: CZ, the founder of Binance. Combine that with the fact that $ASTER isn’t even listed on the Binance CEX yet — a listing that would almost certainly bring another wave of liquidity and retail interest — and you’ve got traders circling like sharks.

In terms of activity, Aster is already flexing serious muscle. It hit #1 in perp DEX trading volume over the past 24 hours, racking up more than $11 billion in trades. On top of that, Trust Wallet has partnered with Aster to add perps — over 100 markets with up to 100x leverage.

Pros

- Backed by CZ, with Binance listing potential

- Already a top 10 revenue generator

- Over $11B in daily trading volume shortly after launch

- 100+ markets, up to 100x leverage

Cons

- Hype-driven price action (3.5x in days can cut both ways)

- Still untested beyond the early frenzy

- Heavy reliance on the eventual Binance listing narrative

Avantis ($AVNT)

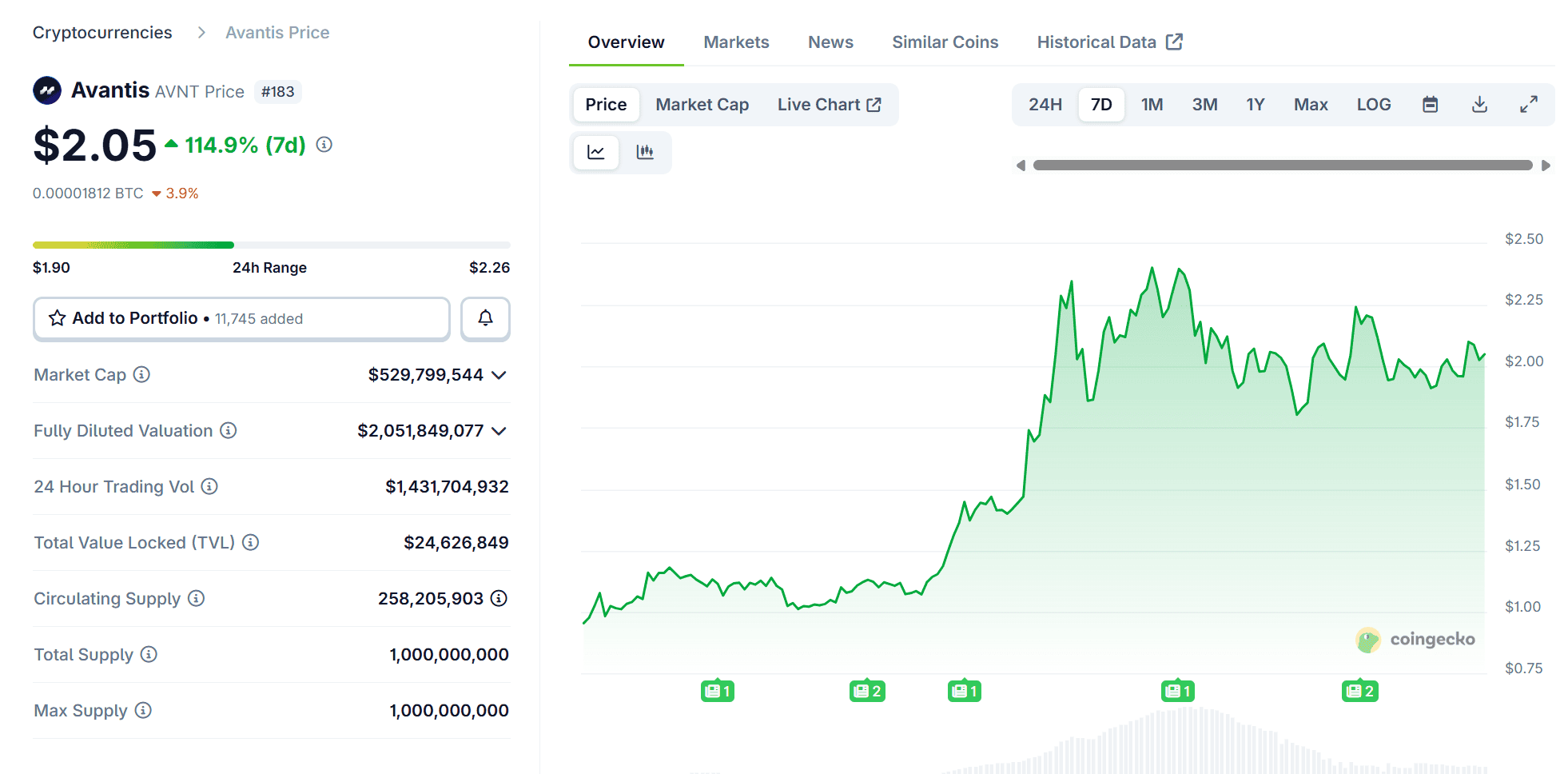

Avantis crypto isn’t just another perp DEX — it’s trying to widen the playground. While most platforms stick to crypto assets, Avantis lets traders use up to 500x leverage across both crypto and equities (yes, you can long or short Tesla on-chain). That’s an aggressive pitch, and so far, traders seem to like it.

The token has already 5x’d since its launch two weeks ago. More recently, the Avantis crypto token price pumped 66% in a week and 641% over the past month, while its TVL climbed 27%. Not bad for a brand-new project.

It doesn’t hurt that Avantis is backed by Coinbase, giving it a layer of legitimacy that most perp DEX startups can only dream about.

Trading activity is heating up too: the most popular market is on Binance, where AVNT/USDT has pulled in nearly $300M in 24h volume.

Pros

- 500x leverage, including equities like Tesla

- Backed by Coinbase

- Token up 5x in two weeks, strong momentum

- Growing TVL (+27%) and rising volumes

Cons

- Extremely high leverage is a double-edged sword

- Still very new — real-world stress test pending

- Reliance on centralized exchange liquidity (Binance)

Lighter

Lighter DEX crypto came out swinging. On September 22, it not only flipped Aster in 24-hour trading volume, but also took a direct shot at Hyperliquid — and actually beat it, if only briefly. For a project with no token yet, that’s a bold entrance.

Although no token, Lighter is running a Points Program that looks a lot like pre-airdrop farming. Users can earn points mainly by trading perpetuals, inviting new users, and joining competitions, with leaderboards tracking weekly rewards.

The common expectation is that these points will convert into a future token allocation, though no launch date or tokenomics have been confirmed. Community chatter points to a possible Q4 token generation event, but that’s still speculation.

The absence of a token is a double-edged sword. On one hand, there’s no lighter crypto airdrop yet, which keeps speculators in suspense. On the other, it creates a powerful narrative: when (or if) the token finally drops, the hype could be explosive.

For now, Lighter’s main claim to fame is raw volume. It’s already proven it can go toe-to-toe with the biggest names, at least in short bursts. Whether it can keep that momentum without a token incentive remains to be seen.

Pros

- Already flipped Aster and challenged Hyperliquid in 24h volume

- No token yet — potential for a big narrative when launched

- Proven ability to generate hype quickly

Cons

- No token = no direct way for traders to capture upside

- Sustainability of volume without incentives is unclear

- Extremely early, with little info on long-term plans

Things to keep in mind

The Hyperliquid exchange is still the biggest dog in the yard, with deep liquidity and strong traction. But the sudden rise of Aster crypto, Avantis crypto, and Lighter DEX crypto proves the perp DEX market isn’t locked up. Each new player brings its own twist, whether it’s insane early volume, equities with 500x leverage, or the dangling carrot of a possible lighter crypto airdrop.

That said, don’t mistake “new” for “safe.” Most of these projects are only weeks old. Liquidity can vanish, aster crypto price swings can cut both ways, and decentralization doesn’t automatically equal protection. Perpetuals are powerful trading instruments, but they’re also risky.

Bottom line: if you’re hunting for the next top perp DEX, these three are worth watching. Just keep your guard up, size positions responsibly, and remember: in perpetuals trading, the house edge is volatility itself.