What Is USOR Crypto? The “Oil-Backed” Token Everyone’s Talking About

Jane Savitskaya

USOR crypto is now trending with a bold statement: it’s a tokenized U.S. oil coin. You might see it called USOR coin, U.S. Oil (USOR), or even oil-backed crypto. With all the events around Venezuela, oil talk got louder than usual. And the message of the USOR token is simple and tempting: buy USOR and get exposure to U.S. oil on the blockchain.

That alone is enough to grab attention. Especially if you’re new to crypto or if you’re trying to make money fast.

But once you slow down, the questions start stacking up.

- What does “tokenized U.S. oil” actually mean in crypto terms?

- Is USOR really backed by real oil, or just linked to oil by name?

- Who created USOR crypto, and why did it appear now?

- Is USOR legit, or just another Solana token with a strong narrative?

- And most importantly: what are you really buying when you buy USOR?

We break down what USOR crypto is, where it came from, and how to think about its legitimacy without hype or complicated language. Some answers are simple. Others are… less comfortable. Let’s unpack it step by step.

What does “tokenized U.S. oil” actually mean?

In crypto, “tokenized” just means something is represented by a token on a blockchain. That something can be real assets like gold, real estate, or commodities, but only if there’s a clear legal structure behind it.

For oil, true tokenization would normally require:

- real barrels of oil held somewhere,

- legal ownership or claims tied to those barrels,

- regular audits proving the oil exists,

- clear rules on who can redeem or benefit from it.

With USOR crypto, there is no public proof that any of this exists: no audits, no custody details.

So in practice, “tokenized U.S. oil” here appears to mean an oil-themed crypto token, not actual oil being put on-chain.

Is USOR really backed by real U.S. oil?

Actually, there is no verified evidence that USOR is backed by real oil.

There is also no connection to the U.S. government, the Strategic Petroleum Reserve, or any official oil authority. Those are tightly controlled state assets. They are not quietly tokenized on Solana.

If a token were truly backed by U.S. oil, it would be one of the biggest financial stories in the world. Not a rumor spreading on crypto Twitter and Telegram.

Right now, USOR should be treated as unbacked unless proven otherwise, not “maybe backed,” not “kind of backed,” just unproven.

Who created USOR crypto?

Creators of USOR crypto are a part of another blurry area.

There is no well-known company, regulated entity, or public institution clearly standing behind USOR. The project does not have the kind of transparent team disclosure you’d expect from something claiming real-world asset backing.

In crypto, this matters a lot:

- anonymous teams are common,

- but anonymous teams + big real-world claims = higher risk.

This doesn’t automatically mean USOR is a scam. It does mean you’re trusting a narrative more than a structure.

Why did USOR appear now?

Timing matters in crypto, and USOR didn’t show up randomly.

Right now, real-world asset tokenization is a hot topic. Big finance talks about it. Crypto amplifies it. Oil, inflation, geopolitics — all emotionally charged, all easy to sell as “the next big thing.”

That’s where the narrative kicks in.

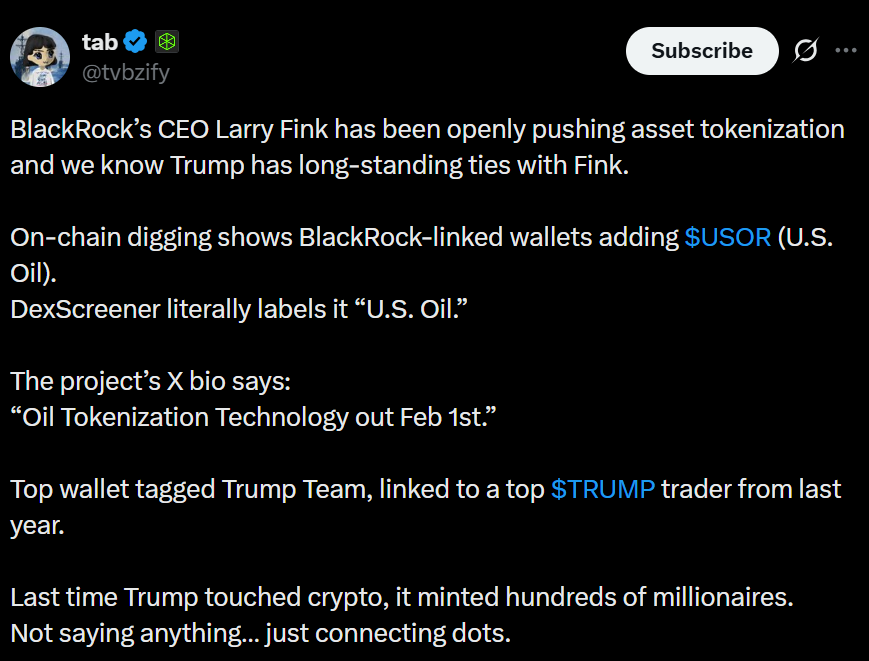

On X, posts started connecting dots:

- Larry Fink has publicly pushed asset tokenization.

- BlackRock gets mentioned by name.

- Donald Trump is pulled into the story through past ties and wallet labels.

- Some wallets holding USOR are tagged with names like “Trump Team.”

- DexScreener labels the token as “U.S. Oil.”

- The project hints at upcoming “oil tokenization technology.”

Individually, none of this proves anything. Together, it creates a hype-infused story. And that’s the point.

Wallet labels are not endorsements and holding a token is not the same as backing it. Platform labels describe what a token claims to be, which is not what it legally represents.

Is USOR really backed by real U.S. oil?

At the moment, there is no public, verifiable proof that USOR is backed by real oil.

If a crypto token were truly backed by oil, you would normally expect to see a few things:

- clear legal documents explaining how the backing works,

- an entity that actually controls the oil,

- independent audits confirming the oil exists,

- and rules explaining what the token holder can realistically claim.

None of that is publicly available for USOR.

There is also no link to any U.S. government body or official oil reserve. Those assets are tightly regulated and politically sensitive. They are not something that quietly becomes a Solana token without global headlines.

So when USOR is described as “tokenized U.S. oil,” it’s best be read as a narrative, not a confirmed structure. Until there is transparent, third-party proof of real oil backing, USOR should be treated as unbacked by physical oil, regardless of how often the phrase is repeated.

Is USOR legit or not?

Well, it depends on how you define LEGIT.

USOR is legit in the narrow, technical sense:

- The token exists

- It lives on Solana

- It can be bought, sold, transferred, and tracked on-chain

- Liquidity is real

- Transactions settle

Nothing about that part is fake.

But legitimacy in crypto has another layer: credibility.

When you strip away the oil narrative, USOR behaves like:

- a standard Solana SPL token,

- with no verified real-world asset backing,

- no disclosed operator structure,

- and no enforceable link between the token and oil prices or oil ownership.

That doesn’t make it a scam by default. But! It does place it firmly in the category of speculative tokens driven by belief and momentum like any other memecoin.

Wrapping up

USOR is a real token with real trading activity. That part is not in question.

What is in question is the claim behind it. There is no public proof that USOR is backed by U.S. oil, tied to real reserves, or connected to any official institution. The “tokenized oil” angle works as a narrative, not as a legit structure.

That doesn’t mean USOR can’t move in price. It means its value depends far more on hype, timing, and belief than on oil itself.

If you look at USOR as a speculative crypto token with an oil-themed story, the picture makes sense. If you look at it as digital ownership of U.S. oil, it doesn’t. With that said, tread carefully and stay safe.