ChatGPT Agent vs Trading Bots: Which is Best For Trading

Jane Savitskaya

As AI evolves, automated trading gets to new levels. Traders now have more than just classic bots to lean on — tools like the ChatGPT Agent promise to analyze markets, crunch numbers, and even suggest trades. But where does that leave dedicated trading bots like 3Commas and Cryptohopper?

In this post, we’ll break it down by answering the key questions:

- Can ChatGPT actually trade, or is it more like a research assistant?

- Is ChatGPT Agent better than purpose-built trading bots that run 24/7?

- Can ChatGPT replace bots, or is it more likely to complement them?

- What about the risks, limitations, and realistic use cases of each?

By the end, you’ll know whether ChatGPT, trading bots, or a mix of both makes the most sense for your setup.

What is ChatGPT Agent?

ChatGPT Agent is a new mode introduced together with ChatGPT’s new 5.0 version. This feature was released not so long ago, but it has already received a vivid response from the audience. So, what exactly is this “agent” and what can it do?

According to OpenAI’s CEO, Sam Altman:

Agent represents a new level of capability for AI systems and can accomplish some remarkable, complex tasks for you using its own computer. It combines the spirit of Deep Research and Operator, but is more powerful than that may sound — it can think for a long time, use some tools, think some more, take some actions, think some more, etc.

In practice, it means:

- Automated research and analysis. It pulls in market data, charts, on-chain metrics, and sentiment without you having to dig.

- Prompt-driven tasks. Just type what you want: “show me BTC/ETH hourly charts,” “calculate a 50-day moving average,” or “summarize whale activity.”

- Execution with guardrails. Connect your exchange API, and the agent can place or rebalance trades, but only with your explicit approval.

- Cleaner outputs and reports. Agent exports clean CSVs, ready-to-use charts, and digestible summaries.

Can ChatGPT Agent actually trade?

TL;DR: Kind of, but not on its own.

In Agent mode, ChatGPT can hook into exchange APIs like Binance or Coinbase. That means it’s capable of reading live market data, analyzing charts, and even sending trade instructions. But every move still requires your confirmation. It’s not going to start buying memecoins behind your back while you’re grabbing coffee.

What it can do really well:

- Scan the market and summarize trends in plain English.

- Run quick calculations (moving averages, RSI, whale activity).

- Flag possible entries or exits based on your prompts.

- Generate ready-to-use reports and charts.

Things it can’t do yet:

- Execute trades fully and automatically

- Guarantee accuracy: bad prompts or missing context can lead to questionable signals.

- Match the speed or reliability of bots built solely for execution.

What are trading bots?

Trading bots are automated programs that connect to your exchange account and execute trades based on pre-set rules or strategies. Instead of sitting at your screen 24/7, a bot can monitor price action, react to signals, and place trades faster than you ever could.

They come in different flavors:

- DCA bots that drip-feed you into positions.

- Grid bots that capitalize on volatility.

- Signal bots that follow technical triggers.

- Copy trading setups that let you mirror someone else’s strategy.

Some bots are beginner-friendly, while others are built for traders who want to fine-tune every parameter. Two of the more popular names in this space are 3Commas and Cryptohopper. Both have been around since 2017, both integrate with major exchanges, and both give traders a full stack of automation and risk management tools. We’ve already published detailed reviews of each, so here we’ll keep it short and focus on how they stack up against ChatGPT.

ChatGPT Agent vs. automated trading bots

Both ChatGPT Agent and trading bots sure can make your trading life easier. However, in the end, they’re built for different jobs.

ChatGPT Agent acts like a research assistant with some execution perks, while bots like 3Commas and Cryptohopper are designed to pull the trigger automatically, 24/7.

If you haven’t tried any of these bots before, here’s a quick overview:

3Commas

3Commas is a cloud-based trading platform launched in 2017 that connects to 20+ major exchanges, including Binance, Coinbase, and Kraken. It has over 1 million users and $400B+ in lifetime trading volume.

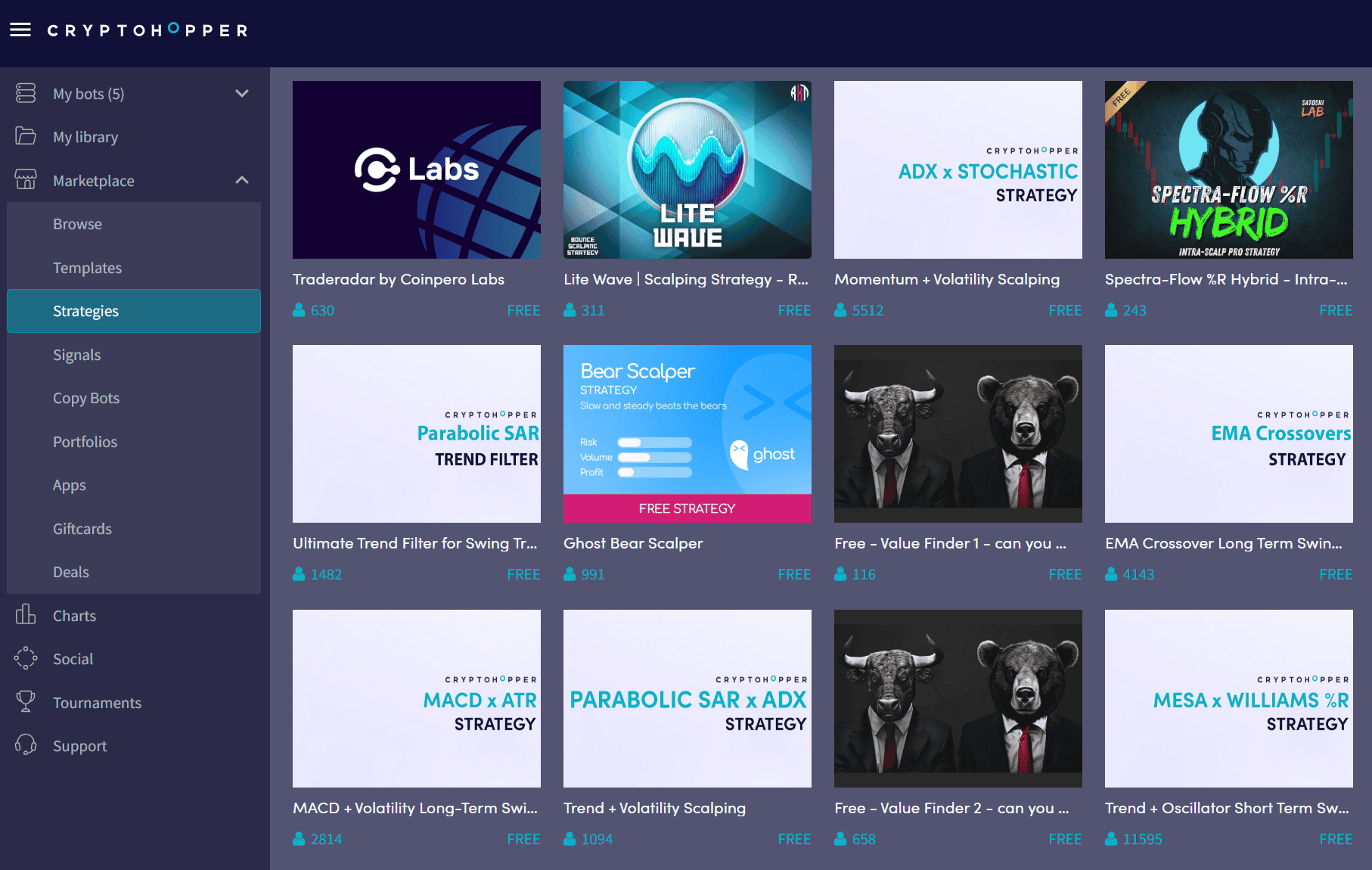

Cryptohopper

Cryptohopper is an automated crypto trading bot founded in 2017 in the Netherlands.

It operates 24/7 across 18+ major exchanges, including Binance, Coinbase, and Kraken, and is designed to be beginner-friendly while still offering advanced customization.

ChatGPT Agent vs 3Commas vs Cryptohopper comparison

Here’s how they stack up when you put them side by side with ChatGPT Agent:

| ChatGPT Agent | 3Commas | Cryptohopper | |

| Purpose |

|

|

Automated trading platform with pre‑built and custom strategies |

| Data sources |

|

|

|

| Customization |

|

|

|

| Execution |

|

|

|

| User skill level |

|

|

Beginner‑friendly interface with strong educational resources, but advanced features can become complex |

How to use ChatGPT Agent and trading bots together

ChatGPT Agent won’t pull the trigger on trades for you, but it’s excellent for designing and refining strategies.

Bots like Cryptohopper and 3Commas are where those strategies actually run. The idea is simple: use ChatGPT to plan and analyze, then plug the results into the bot that fits your style.

Here’s how to get the best of two worlds.

Drafting a strategy with ChatGPT Agent

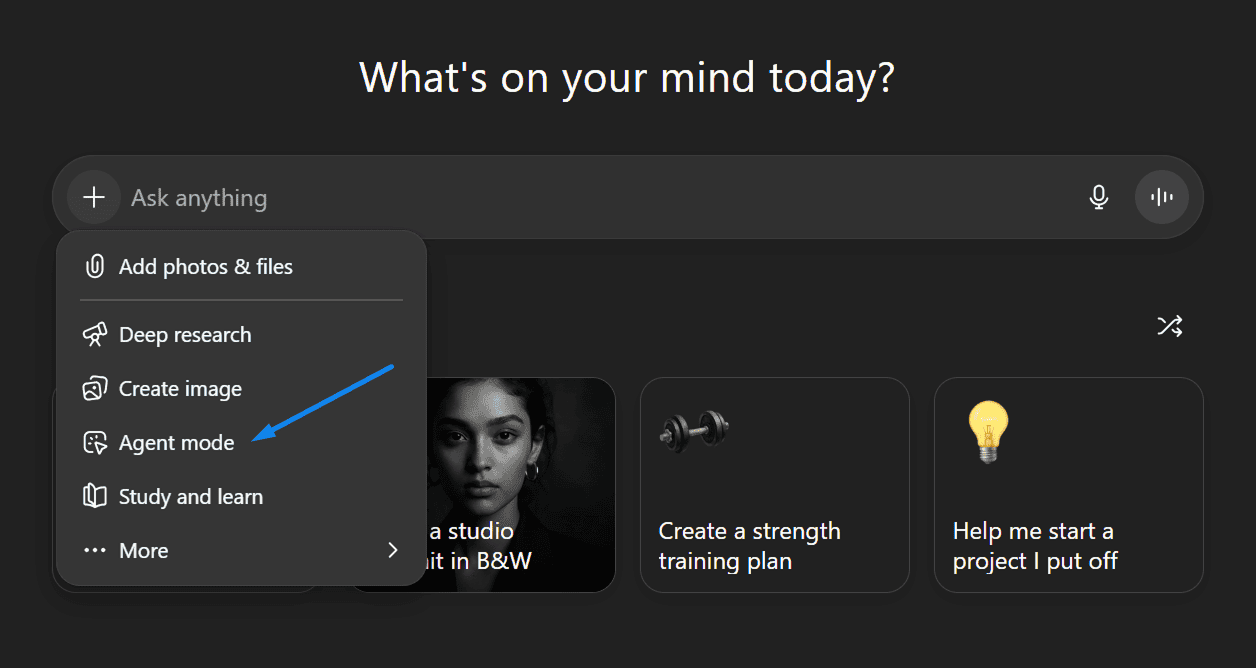

Step 1: Enable Agent mode in ChatGPT

Available for Plus, Pro, and Team users. This mode lets you request structured tasks like “draft me a trading strategy.”

Step 2: Write a prompt

What you ask is what you get. With ChatGPT Agent, a well-crafted prompt is 50% of the strategy’s success. Be specific about:

- The coin and timeframe (ETH on 1h, BTC on 4h, etc.)

- The indicators you want used (RSI, Bollinger Bands, MACD, etc.)

- Exact entry and exit conditions

- Any risk management rules (stop-loss, take-profit, DCA levels)

Step 3: Apply the draft

In Cryptohopper: Start with a template (either a built-in one or from the Marketplace). Pick one that already uses RSI or Bollinger Bands, then adjust the settings to match the rules ChatGPT drafted.

In 3Commas: Choose the right bot for the setup:

- DCA Bot, if you want to scale into ETH over time.

- GRID Bot, if you expect sideways volatility.

- Signal Bot if you’d rather feed in TradingView signals (e.g., from ChatGPT-generated Pine Script).

Tweaking & improving a strategy

Step 1: Test first

- Cryptohopper: Run your template in Paper Trading mode or backtest.

- 3Commas: Use backtesting inside the bot dashboard to see how the setup performs historically.

Step 2: Share results with ChatGPT Agent

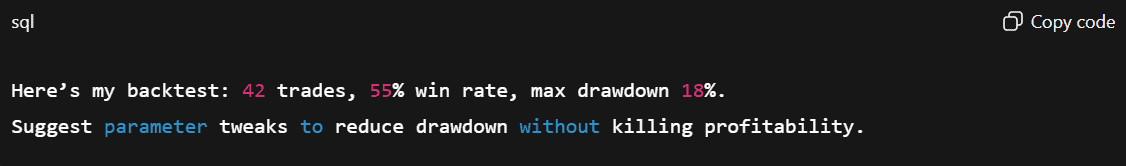

Backtesting and paper trading are only useful if you actually learn from the results. This is where ChatGPT Agent shines — it can take raw performance data and turn it into actionable optimization tips.

When you paste your results into ChatGPT, you’re basically giving it a performance report card. With the right details, it can highlight weaknesses and suggest parameter tweaks you might overlook.

Key parameters to include:

- Number of trades → tells whether the strategy is overfitting on a tiny sample or working across many setups.

- Win rate (%) → shows how often trades succeed. High win rate isn’t always best if profits are tiny.

- Max drawdown (%) → the deepest loss from a peak. Crucial for understanding risk.

- Average profit per trade (%) → shows if wins outweigh losses.

- Risk/reward ratio (if available) → balance between how much you risk and how much you aim to gain.

Why do this? Because instead of manually guessing which settings to tweak, you let ChatGPT analyze the results and suggest focused changes — like tightening RSI thresholds, adjusting Bollinger Band periods, or modifying stop-loss levels. That saves time and reduces the risk of blindly overfitting your strategy.

Step 3: Apply suggestions

- Tighten RSI thresholds, adjust Bollinger Band periods, or change stop-loss settings per ChatGPT’s feedback.

- Update your template in Cryptohopper or tweak bot parameters in 3Commas, then re-test.

Other practical scenarios

Beyond drafting and tweaking strategies, there are plenty of ways to make ChatGPT Agent, Cryptohopper, and 3Commas work together.

Template & bot selection help

Use ChatGPT to clarify which type of strategy or bot fits your trading style. For example, it can help you decide whether a DCA bot in 3Commas, a GRID bot for sideways markets, or a Cryptohopper volatility template makes the most sense. This saves time wandering through endless options.

Market context briefings

Before turning on a bot, ask ChatGPT to summarize the broader market picture — sentiment, whale moves, or on-chain signals. Then activate or pause strategies accordingly (e.g., a cautious DCA approach in trending markets vs. a volatility-based template when swings are wild).

Risk management coaching

Feed ChatGPT your bot or template settings and let it highlight red flags: oversized positions, no stop-loss, too much correlation between assets. From there, you can fine-tune your Cryptohopper templates or adjust 3Commas bot rules.

Portfolio rebalancing

If you use Cryptohopper’s Auto Rebalancer or multiple bots in 3Commas, ChatGPT can help shape allocations. It’s not financial advice, but it can highlight when your portfolio is skewed too heavily toward one asset class.

Strategy iteration loop

Don’t set and forget. Use ChatGPT to analyze backtest results, suggest refinements, and then apply them in your bot or template. Repeat the cycle regularly for steady improvements.

Scenario planning

Stress test your strategies by asking ChatGPT how they’d behave under specific conditions (e.g., sharp drops, sudden pumps, long sideways markets). This helps you prepare instead of panicking.

Pricing comparison

TL;DR: ChatGPT Agent is the cheapest way to get research and strategy drafts, 3Commas offers strong automation at a mid-range price, and Cryptohopper is the most expensive but built for scale and advanced features.

| Tool | Plans | Price Range |

| ChatGPT Agent | Plus / Pro / Team | From $20/month |

| 3Commas | Free / Pro / Expert |

|

| Cryptohopper | Pioneer / Explorer / Adventurer / Hero |

|

Setting the right expectations

Let’s make this one thing very clear: neither ChatGPT Agent nor any trading bot is a money-printing machine.

ChatGPT Agent is great at analysis, breaking down complex notions, and drafting strategies, but it can also spit out nonsense (lots of it) if the prompt is weak or the data is off. It doesn’t “see” the future — it just organizes information in a way that helps you make decisions.

Trading bots like 3Commas and Cryptohopper are automation engines. They follow the rules you set, nothing more. With that said, bad rules = bad results. Only faster and 24/7.

The risks are real:

- Overfitting strategies to past data that collapse in live markets.

- Bots running wild in volatile conditions without proper stop-losses.

- ChatGPT outputs that look smart but ignore hidden risks.

Bottom line: If you treat ChatGPT Agent and bots as co-pilots, not autopilots, you’ll get the most value. Also, your own judgment, risk management, and discipline matter more than the tech itself.