Crypto cards are what happen when banks finally admit that crypto isn’t going anywhere. And the best crypto is free crypto, so why not earn some every time you spend?

Whether it’s cashback in BTC, staking rewards, or spending straight from your exchange balance — crypto credit and debit cards make it all seamless. In 2025, big names like Gemini, Nexo, Binance, Crypto.com, and Coinbase are battling to make your everyday purchases more profitable.

Let’s see which ones are actually worth swiping.

What is a crypto card?

A crypto card works just like any regular Visa or Mastercard, except it’s powered by your digital assets. When you tap or swipe, your crypto gets automatically converted into fiat, so you can pay anywhere cards are accepted.

There are two types:

- Crypto debit cards — you spend what you already have in your exchange wallet.

- Crypto credit cards — you borrow or earn crypto rewards for everyday purchases.

The idea is simple: instead of letting your crypto sit idle, you use it and get those sweet rewards.

Crypto credit cards

Crypto credit cards work like traditional ones; it’s just that instead of airline miles or cash back, you earn crypto every time you spend. Some even let you borrow against your crypto balance without selling it.

The perks sound great: up to 3% rewards, automatic conversions, and integrations with major exchanges. But keep an eye on fees, reward limits, and regional restrictions.

Top picks in 2025

- Gemini credit card: You can earn up to 3% back in crypto instantly, with rewards deposited straight to your Gemini account.

- Nexo credit card: Lets you spend without selling your crypto; your assets act as collateral. You get up to 2% back in BTC or NEXO tokens.

Crypto credit cards are best for active spenders who want to grow their portfolio with everyday purchases and not for those who carry balances or chase short-term hype.

Crypto debit cards

The main difference between crypto debit cards and regular debit cards is that you don’t pull money from your bank account, instead, you draw it from your crypto balance. When you pay, the card instantly converts your crypto into fiat at the current rate.

You simply spend what you already own. The best part? Many of these cards offer cashback in crypto, usually between 1–8%, depending on the platform and staking level.

Top options in 2025:

- Binance debit card: You can earn up to 8% cashback in BNB, depending on how much you stake. Accepted anywhere Visa works.

- Crypto.com debit card: Has multiple tiers with different perks: up to 5% back in CRO, free Spotify and Netflix on higher tiers.

- Coinbase card: Lets you spend crypto or fiat from your Coinbase balance and earn up to 4% in rewards. Simple setup, but limited availability outside the US.

Crypto debit cards are ideal for anyone who wants to actually use their crypto and not just trade it. They’re practical and easy to manage.

Best crypto credit cards in 2025

So, if you’re after the best crypto credit card, one that doesn’t just sound good but actually gives meaningful rewards without insane strings, here are three strong contenders that you should consider:

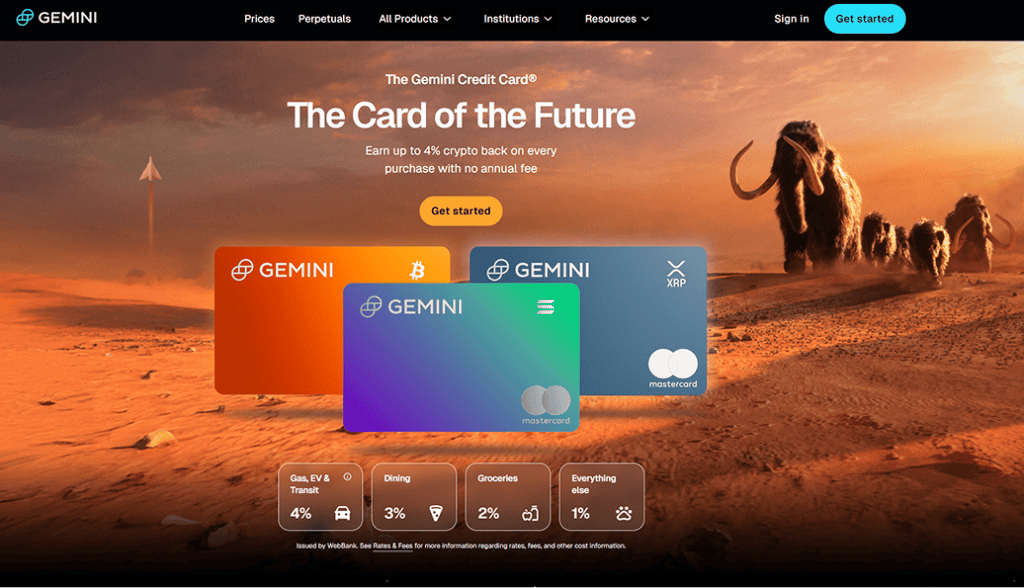

Gemini Credit Card

- Rewards: Up to 4% back on gas/EV charge/transit/ride-share; 3% on dining; 2% on groceries; 1% on everything else.

- Fee: No annual fee, no foreign transaction fee on rewards.

- Why it’s interesting: You earn crypto rewards immediately, with no heavy staking or collateral required.

- Catch: The highest reward (4%) is limited to certain categories; other purchases drop to 1%.

- Best for: U.S.-based spenders who want crypto back for everyday purchases and already use Gemini.

Nexo Credit Card

- Rewards: Up to 2% back in NEXO tokens (0.5% in BTC) for Platinum loyalty tier users.

- Fees: No annual or inactivity fee. Free ATM withdrawals up to a monthly limit, then ~2% per withdrawal. FX fees vary by region — as low as 0.2% within EEA/UK/CH, up to 2% elsewhere on weekdays, and +0.7% on weekends.

- Why it’s interesting: Dual-mode setup — use it as a credit card (borrow against crypto) or debit (spend your holdings). No need to sell your assets.

- Catch: Top rewards require Platinum Tier status, which means holding a lot of NEXO tokens. Some perks vary by region.

- Best for: European and UK users with significant crypto holdings who want to spend flexibly without liquidation.

Coinbase One Card

- Rewards: Up to 4% back in BTC for U.S. users, depending on membership and assets.

- Fees: No annual fee or foreign transaction fee. Crypto-to-fiat conversions carry a spread (around 2.49%) if spending non-USD coins.

- Why it’s interesting: Simple, trusted, and backed by one of the biggest exchanges. Integrates directly with your Coinbase balance.

- Catch: Primarily U.S.-only, and some benefits (like 4% rewards) are tied to the Coinbase One subscription.

- Best for: Coinbase regulars who want an easy, no-frills way to earn crypto on everyday purchases.

Best crypto debit cards in 2025

Crypto debit cards are for people who want to actually use their crypto, not just stare at it in a wallet. Spend what you have, earn something back, and skip the bank-conversion headache. Below are three solid options.

Binance debit card

- Rewards: Up to ~8% cashback in BNB (depending on how much you stake and your tier).

- Fees & other details: Accepted anywhere Visa works. However, there are user reports of weak protection in case of fraud.

- Why it’s interesting: If you already hold BNB and use Binance a lot, this gives you a high-ceiling reward.

- Catch: To get top rewards, you’ll likely need to stake, and the platform’s customer protection has been questioned.

- Best for: Active Binance users comfortable with staking and who spend often.

Crypto.com debit card

- Rewards: Varies by tier — cashback in CRO token, plus perks like free Netflix/Spotify for higher tiers.

- Fees & other details: Very feature-rich ecosystem; but unlocking best perks often means staking CRO tokens for a period.

- Why it’s interesting: Great if you want a feature-packed card with real benefits beyond just spending (streaming perks, lounge access, etc.)

- Catch: If you’re not going to hit the staking requirement or you don’t spend enough, you’ll get less value.

- Best for: Crypto power-users who want perks and are willing to commit assets.

Coinbase card

- Rewards & fees: Offers cashback in crypto, zero annual fee, or a monthly fee for many users.

- Fees & other details: In many regions, spending crypto = conversion to fiat automatically; “zero transaction and maintenance fees” is mentioned in some reviews.

- Why it’s interesting: Simple, no-frills, solid for everyday spending if you’re already a Coinbase user.

- Catch: Some rewards might be modest; might have lower spending limits; availability may vary by country.

- Best for: Beginners or users who already use Coinbase and want a straightforward crypto-spend card.

Drawbacks of crypto cards

Crypto cards sound great on paper: cashback, perks, sleek apps, but there’s plenty to watch out for once you start using them. Here are some things you should watch out for.

Crypto credit cards: What to watch out for

You know how credit cards work: you borrow now and repay later. If you don’t pay the full balance by the due date, usually within 21 to 25 days after the billing cycle closes, you’ll start paying interest on the entire remaining balance.

And that interest can be brutal. APRs often sit between 20% and 26%, while most crypto rewards top out at 2–4%. That means one late payment can erase months of earned rewards. So if you’re not paying your balance in full every month, the math just doesn’t add up.

Other drawbacks include:

- Category traps: The “up to 4% back” you see in ads usually applies to a narrow set of purchases (like gas or dining). Everything else may earn just 1%.

- Tax headaches: In many countries, crypto rewards are treated as taxable income the moment they hit your wallet. You’ll need to track values at the time of receipt — messy if you earn small bits daily.

- Limited availability: Most credit cards with decent crypto rewards (Gemini, Coinbase) are U.S.-only, with long waitlists elsewhere.

- Overhyped “instant rewards”: Some users report on Reddit that rewards don’t always post instantly or fluctuate in value by the time they claim them.

- Temptation to overspend: Credit card psychology doesn’t change just because rewards are in BTC. As one Redditor put it:

“It’s easy to justify dumb purchases when you tell yourself ‘I’m earning crypto back.’ Spoiler: you’re not — you’re just paying more later.”

Crypto debit cards: What to watch out for

Debit-style crypto cards remove the credit risk because you’re spending your own money, but they also come with a different set of pain points.

- Conversion and volatility costs: Every time you spend, your crypto converts to fiat at the current rate. If the market dips right before that, you’ll effectively lose value. And if your card uses a wide exchange spread, you’ll pay even more.

- Hidden fees: Many cards quietly charge for ATM withdrawals, inactivity, or currency conversions. For instance, Crypto.com users on Reddit often complain that withdrawal limits shrink without warning and higher tiers require hefty CRO staking.

- Declined transactions and support delays: Reddit threads are full of users saying their cards get rejected at random merchants or ATMs.

- Custodial risk: You don’t fully control the crypto you load onto most debit cards. If the issuer freezes accounts or runs into regulatory trouble (like Binance in some regions), your funds are stuck.

- Perk inflation: Streaming and travel perks on premium tiers sound great — until you realize they require locking up thousands of dollars’ worth of tokens for six months or more.

- Tax again: Spending crypto counts as a taxable disposal in many jurisdictions. Even a $3 coffee might technically trigger a capital gain or loss event.

Choosing the right crypto card for you

If you have no problem paying your balance in full every month, a crypto credit card is a solid pick. You’ll get up to 3–4% back in crypto without locking tokens or paying conversion fees.

Gemini is best for U.S. users who want instant rewards. Nexo works better in Europe or the U.K. if you already hold crypto and want to borrow against it rather than sell.

If you don’t want credit or interest risk, use a crypto debit card. It’s safer and simpler. Crypto.com and Binance give the highest cashback but require staking. Coinbase is the most straightforward option: minimal setup, low fees, fewer surprises.

| Use case | Best option | Key reason |

| Earn rewards, pay monthly balance | Gemini Credit Card | Up to 4% crypto rewards, no staking |

| Spend crypto without selling | Nexo Credit Card | Uses crypto as collateral |

| Everyday spending with perks | Crypto.com Debit Card | Cashback + streaming benefits |

| High-spending Binance user | Binance Debit Card | Up to 8% BNB cashback |

| Simple, low-maintenance setup | Coinbase Debit Card | No staking, clean interface |

Quick tip: Always check your region. Most credit cards are U.S.-only; most debit cards work in the EU and U.K. but not everywhere else.

Final thoughts

Crypto cards are not magic money printers. If you treat your finances responsibly and pay your credit card in full every month, rewards can stack up nicely. If you get sloppy or forget about payments, interest will eat them alive.

For most people, debit cards make more sense. You avoid debt, still earn cashback, and keep control over your crypto. Just check the fees, conversion rates, and regional availability before applying.

Bottom line: pick the card that adds value to your everyday spending, not the one with the loudest marketing.