There are over 800 different decentralized exchanges (DEXs) operating today, and that’s a rough estimate. If you tried to monitor them all in real time, you’d probably need a full-blown “flight-control” PC setup at home: multiple screens, dashboards, alerts going off every few seconds.

Dexscreener was built to solve that problem by aggregating live on-chain data from multiple networks.

Let’s see how it performs in practice.

What is Dexscreener?

Dexscreener is a real-time analytics and charting platform for decentralized exchanges. It tracks token pairs, prices, volume, and liquidity directly from smart contracts, meaning you get on-chain data straight from the source, not through intermediaries.

The tool supports hundreds of DEXs across dozens of blockchains, including Ethereum, BNB Chain, Solana, Base, Arbitrum, Avalanche, and many more. Whatever token you’re on, Dexscreener pulls needed data into a single, easy-to-browse interface.

Basically, it’s the DeFi equivalent of a trading dashboard: it’s built for speed, transparency, and token discovery.

You can use it to:

- Track live prices and charts for any token pair

- Monitor liquidity and trading volume across chains

- Discover trending or newly launched tokens

- Create custom watchlists and alerts

How does Dexscreener work?

Dexscreener acts as a real-time data bridge between decentralized exchanges and your browser.

You don’t need to rely on exchange-submitted price feeds, because Dexscreener reads transaction data directly from the blockchain.

Here’s the simplified flow:

1. Listening to smart contracts

Every DEX runs on smart contracts that handle swaps, liquidity provision, and token creation.

Dexscreener connects to those contracts through blockchain nodes and listens for each event — every trade, liquidity update, or new pair created.

2. Aggregating multi-chain data

It doesn’t stop at one network. Dexscreener constantly pulls data from dozens of blockchains (Ethereum, BNB Chain, Solana, Base, Avalanche, Arbitrum, etc.) and standardizes it, so you can view all pairs on a single dashboard.

3. Indexing and sorting in real time

As new transactions come in, Dexscreener’s backend updates prices, volumes, and liquidity values every few seconds.

That’s why you can see newly deployed tokens appear on the site almost instantly — often faster than CoinMarketCap or CoinGecko listings.

4. Front-end visualization

The frontend turns that on-chain chaos into TradingView-style charts, complete with candles, volume indicators, and order feeds.

It also powers features like trending pairs, top gainers/losers, and custom watchlists.

5. Optional API access

Developers and data-savvy traders can access the same live feeds via Dexscreener’s public API, useful for bots, alerts, or dashboards.

Why this is cool

Because Dexscreener reads data as it happens on-chain, there’s no centralized source that can censor or delay information.

You see trades and liquidity changes the moment they’re recorded on the blockchain, giving traders an edge in early discovery or exit timing.

Dexscreener vs. CoinMarketCap & TradingView

At first glance, all three platforms show crypto charts and prices, but they operate in completely different ecosystems.

Here are the major differences.

Source of data

- CoinMarketCap and TradingView rely mostly on centralized exchange (CEX) data. Prices are aggregated from platforms like Binance, Coinbase, or Kraken, where trades happen off-chain.

- Dexscreener, on the other hand, pulls data directly from blockchain smart contracts. It listens to what’s happening on decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and Raydium in real time, on-chain, with no middleman.

✅Dexscreener shows trades the moment they happen on the blockchain.

✅CoinMarketCap and TradingView usually show averaged or delayed data from CEXs.

Market coverage

- CoinMarketCap tracks thousands of tokens, but only those listed on major exchanges. You won’t find a brand-new memecoin or microcap token there until it’s already gained traction.

- TradingView focuses more on charting and technical analysis, mostly for assets with stable price feeds.

- Dexscreener is for everything that trades on-chain, from new token launches to liquidity pool pairs that appeared 5 minutes ago.

Think of it like this:

✅CoinMarketCap = Wall Street tickers

✅TradingView = professional chart terminal

✅Dexscreener = DeFi radar scanning every new pair before anyone else notices

Transparency

- Dexscreener shows live on-chain transactions, wallet movements, and liquidity pool info. You can literally watch whales buy and dump in real time.

- CoinMarketCap and TradingView depend on data reported by exchanges, meaning there’s a layer of trust and potential delay.

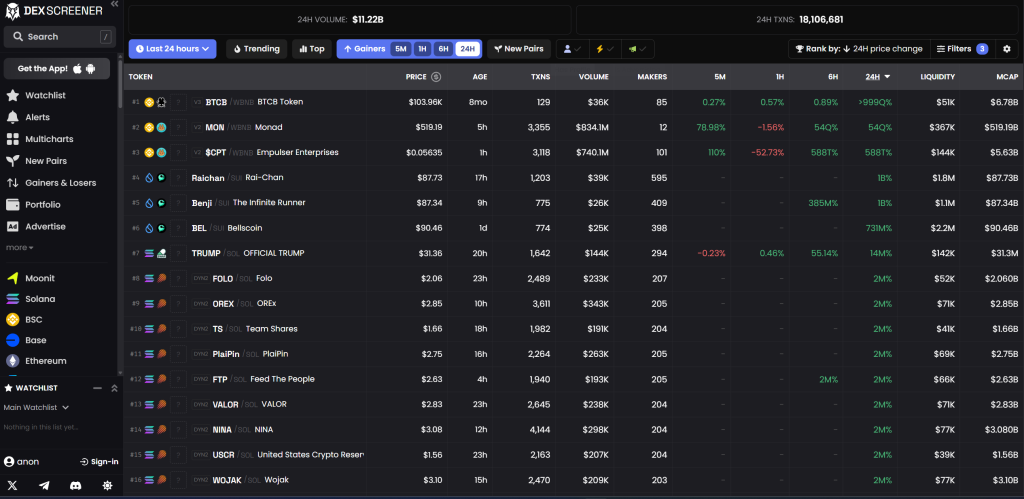

Dexscreener core features overview

Dexscreener is built around one idea: real-time visibility into DEX trading activity.

Here’s a breakdown of its key features and what they actually do for traders.

1. Real-time charts & token pairs

Every token pair listed on supported DEXs gets its own live chart with price, volume, and liquidity data.

You can view:

- Standard candlestick and line charts

- 24h, 7d, and 30d performance

- Transaction feed showing who’s buying and selling

Compared to CEX dashboards, this feels raw and immediate: no delay, no API smoothing, just unfiltered on-chain action.

2. Multi-chain coverage

Dexscreener supports dozens of networks, including:

- Ethereum

- BNB Chain

- Polygon

- Solana

- Arbitrum

- Base

- Avalanche

- Optimism

…and many others.

You can filter by chain or view aggregated data. For multi-chain traders, that’s huge — it saves time hopping between different explorers or DEXs.

3. Trending & hot pairs

The Trending and Hot Pairs sections are where many users spend most of their time.

They highlight:

- Tokens with sudden volume or liquidity spikes

- Newly deployed contracts gaining traction

- On-chain “hype” indicators — perfect for early entries (or exits)

- While these features don’t guarantee profitability, they’re excellent for market scouting.

4. Watchlists and price alerts

Dexscreener lets you create custom watchlists to track specific tokens or pairs.

You can also set alerts for price movements: either via browser notifications or external bots using the Dexscreener API.

It’s a simple but powerful feature for traders who monitor multiple assets across chains.

5. Liquidity & volume insights

Each pair page includes detailed liquidity info:

- Pool size and token ratios

- 24-hour volume and transaction count

- Liquidity changes over time

This helps spot potential rug pulls or low-liquidity traps, since you can see when LPs (liquidity providers) suddenly pull funds.

6. Dexscreener API

For developers and data analysts, Dexscreener provides a public API with real-time access to the same data displayed on the site.

Use cases:

- Building alert bots

- Automating pair discovery

- Integrating DeFi data into dashboards or trading models

It’s one of the most reliable free APIs in the on-chain analytics space.

7. Pair explorer

Each token pair has a dedicated analytics page, including:

- Live chart

- Transaction list with wallet addresses

- LP and router info

- Quick links to block explorers and DEXs

This section is where Dexscreener feels closest to a mini block explorer + trading terminal combo — ideal for checking a token’s legitimacy before aping in.

Drawbacks and limitations

While it’s one of the most popular DEX analytics platforms, it does come with a few trade-offs worth knowing.

1. No trading or portfolio tools

You can analyze pairs, but you can’t trade or track your holdings.

For PnL or wallet management, you’ll need tools like DeBank or Zerion.

2. Limited historical data

Charts show only the data Dexscreener has indexed, not the full token history.

That’s fine for new tokens, less ideal for long-term analysis.

3. Overloaded for beginners

The interface throws a lot at you: charts, pairs, pools, and chains.

So, it’s great for pros, and overwhelming for newcomers.

4. Occasional data gaps

If a DEX uses a nonstandard smart contract, data might display incorrectly until Dexscreener re-syncs.

5. No token safety checks

Dexscreener lists everything on-chain, including scams.

It’s transparent but risky if you don’t verify tokens elsewhere.

6. Web-only

There’s no mobile app yet. The browser version works fine, but lacks native notifications or app-level comfort.

Dexscreener alternatives

Dexscreener isn’t the only tool trying to make sense of decentralized markets.

Several other dashboards like DEXTools, GeckoTerminal, and Birdeye compete for the same space, each with its own strengths and quirks.

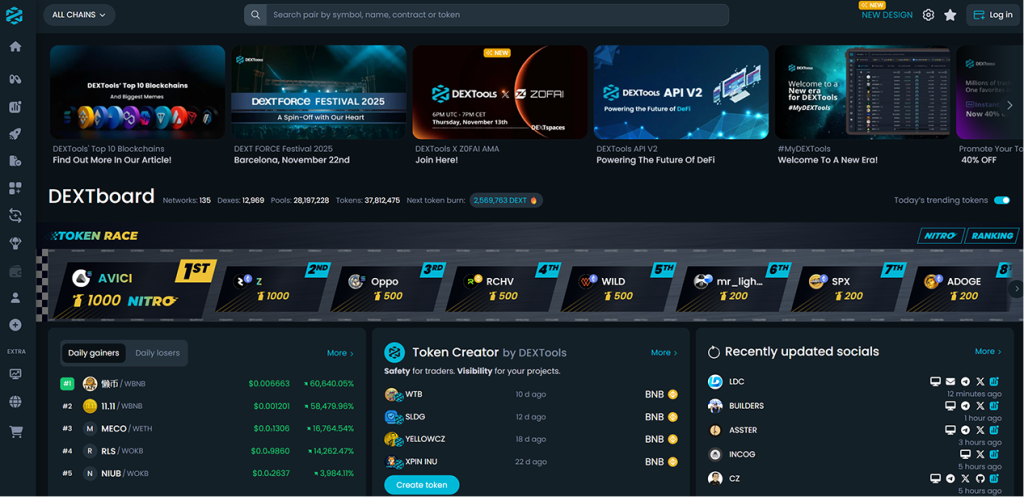

DEXTools

DEXTools has been around since 2020 and remains one of the most feature-packed DEX analytics platforms.

Strengths:

- Deep historical charts and technical indicators

- Token scoring system (“DEXTscore”) for quick quality checks

- Wallet connection for limited portfolio tracking

- VIP tier with extra analytics and ad-free interface

Weaknesses:

- Slower data updates than Dexscreener

- Paywall for some features

- UI feels cluttered and outdated

🟢 Verdict: Better for advanced traders who want deep analysis and don’t mind paying.

🔵 Dexscreener advantage: Faster, simpler, and free.

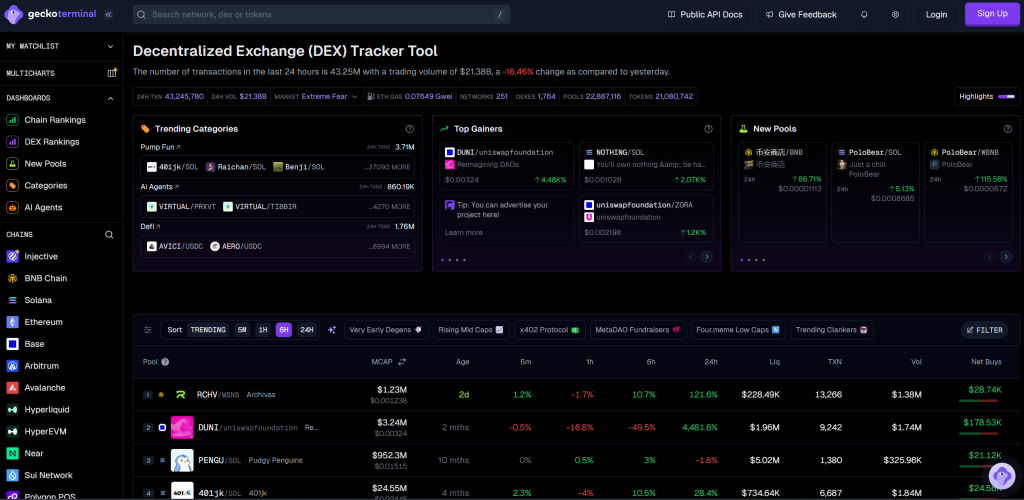

GeckoTerminal

Created by CoinGecko, GeckoTerminal is a clean, user-friendly alternative that integrates nicely with CoinGecko’s ecosystem.

Strengths:

- Familiar layout for CoinGecko users

- Excellent token discovery and trending data

- Reliable multi-chain coverage

Weaknesses:

- Fewer charting features

- Slower refresh rates

- No alerts or watchlists

🟢 Verdict: Ideal for casual traders or token researchers.

🔵 Dexscreener advantage: Real-time performance and customizable watchlists.

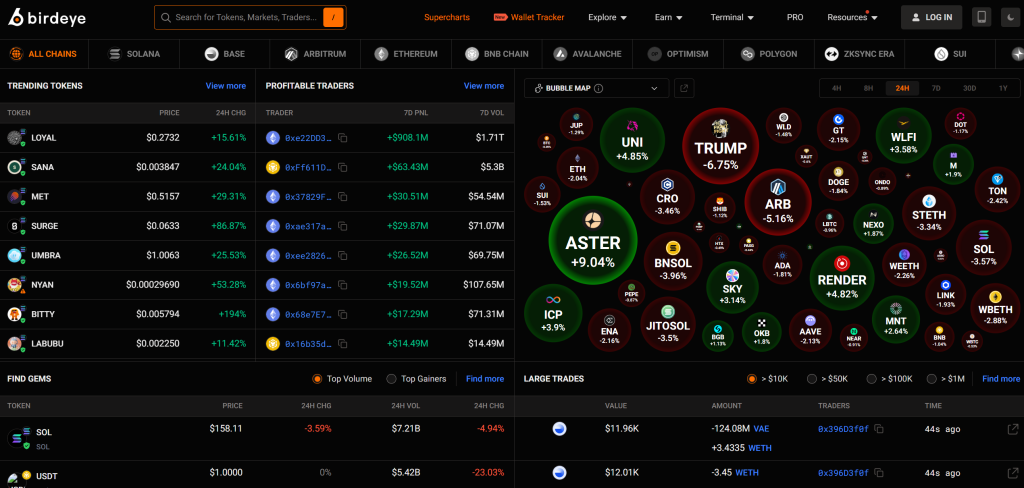

Birdeye

Birdeye started as a Solana-focused analytics tool but has since expanded to more chains.

Strengths:

- Extremely fast Solana data

- Built-in token safety checks

- API for developers and traders

Weaknesses:

- Limited non-Solana coverage

- Occasional bugs and downtime

🟢 Verdict: Best choice for Solana-native traders.

🔵 Dexscreener advantage: Broader multi-chain coverage and a more stable interface.

Comparison snapshot

| Tool | Strengths | Best For | Limitations |

| Dexscreener | Fast, real-time, multi-chain, free | DeFi traders, airdrop hunters | No trading or portfolio tools |

| DEXTools | Deep analytics, historical data | Power users | Paywall, slower updates |

| GeckoTerminal | Simple, beginner-friendly | Token researchers | Limited charts, slower refresh |

| Birdeye | Great Solana coverage | Solana traders | Limited to few chains |

Verdict: Who’s Dexscreener for?

Dexscreener shows what’s happening on-chain, right now, without filters or delays, and it’s exactly what most DEX traders need.

It’s fast and refreshingly straightforward in a space filled with over-engineered dashboards. And to the top of that, it’s free.

Best suited for:

- Active DeFi traders who monitor multiple pairs and chains daily.

- Airdrop hunters and yield farmers tracking new tokens and liquidity pools.

- Developers and data tinkerers who use its free API to power bots or dashboards.

- Anyone tired of refreshing five different tabs just to see what’s pumping on Uniswap, PancakeSwap, or Base.

Not ideal for:

- Beginners who prefer a guided experience or built-in safety checks.

- Portfolio managers wanting PnL tracking or order execution.

- Charting purists who need extensive TA tools like in TradingView.

Final thoughts

Dexscreener is not here to replace CoinMarketCap, TradingView, or DEXTools. It’s carving its own niche — a real-time DeFi radar for on-chain traders.

If you live and breathe decentralized markets, Dexscreener deserves a browser tab of its own.

If you just check prices occasionally, you’ll probably be happier sticking with CoinGecko.