What Is Liquidation in Crypto? A Beginner’s Guide to Triggers, Risks, and How to Avoid It

Vuk Martinovic

If you trade crypto long enough, you will hear the word liquidation again and again. It usually shows up when the market moves fast, funding rates spike, and traders with high leverage suddenly lose their entire position.

Why does it happen? How does an exchange decide when to close your trade? And more importantly, how can you avoid it?

In this guide, I’ll explain:

- What liquidation in crypto means

- How it works

- What triggers it

- How to avoid it

I’ll also look at crypto liquidation heatmaps, which highlight price levels where large groups of traders could be liquidated. These tools help you spot risk zones before the market reaches them.

Let’s get started!

Key takeaways

- Liquidation happens when your collateral can no longer cover your losses

- High leverage and sudden volatility are the most common triggers

- Tools like crypto liquidation heatmaps help you spot danger zones

- Good risk management prevents most liquidations

How liquidation works on crypto exchanges

When you trade with leverage, the exchange gives you borrowed capital. To protect itself, the exchange constantly checks whether your collateral is strong enough to support your position.

Collateral is the money you deposit to open the trade. It acts as a safety buffer, a guarantee that you can return the borrowed funds. And the exchange uses it to cover potential losses.

If that buffer becomes too small, the position is no longer safe to keep open. This real-time check is what determines your liquidation price.

The core mechanics

Every exchange follows the same basic steps:

- You open a leveraged position. Your collateral becomes the margin that supports your trade.

- The exchange calculates your liquidation price. This is the price where your margin becomes too small to keep the trade open.

- If the market moves toward your liquidation price, your margin drops. The higher the leverage, the faster this happens.

- Once your margin falls below the maintenance requirement, liquidation is triggered. The exchange closes your position automatically at the best available price.

This entire process happens instantly. You don’t need to confirm anything. The system protects itself by exiting your trade before your balance goes negative.

Exchange differences

Platforms like Binance, Bybit, and OKX use slightly different formulas for calculating the liquidation price. However, all of them rely on the same elements:

- Your entry price

- Your leverage

- Your collateral amount

- Your maintenance margin requirement

Even small price moves can trigger liquidation when leverage is high, which is why you need to understand these mechanics.

A real-life liquidation example

Liquidation becomes much easier to understand with a simple example. Let’s follow a beginner trader from the moment they open a position to the moment they get liquidated.

Step 1: Opening the trade

Anna has $100 in her futures account. She opens a long position on Bitcoin with 10x leverage.

- Her money: $100

- Total position size: $1,000 ($100 x 10)

- Entry price: $60,000

She now controls about 0.0166 BTC.

Step 2: Calculating the liquidation price

With 10x leverage, a drop of around 10% can wipe out her margin. That means her liquidation price is roughly around $54,000.

If the price of Bitcoin falls to this level, her $100 collateral is gone.

Step 3: Price moves against her

Let’s say Bitcoin drops to $57,000. Here’s what that means for Anna:

- Loss: about $50

- Margin remaining: $50

She is already halfway to liquidation.

Step 4: The drop continues

Bitcoin falls to $55,000.

- Loss: about $83

- Margin left: $17

She could add more margin here but chooses not to.

Step 5: Bitcoin hits $54,000

Her loss reaches roughly $100, which is her full margin. The exchange immediately liquidates her position.

Step 6: What liquidation means

Her entire $100 is lost. The exchange closes the position automatically because there is no collateral left to cover further losses.

Why Anna was liquidated

Anna was liquidated because:

- She used high leverage, which placed her liquidation price very close.

- She didn’t add extra margin when the trade moved against her.

- The market kept falling, leaving her position no room to recover.

This shows how even normal price swings can liquidate a leveraged trade when the margin is small.

Now, imagine the same scenario, but on a much higher scale. And instead of just one person, it’s many people getting liquidated, causing losses in millions.

Common triggers for liquidation

Liquidations usually happen when the market moves faster or farther than a trader expects. Beginners often think liquidation is caused only by “bad luck,” but in reality, several predictable factors increase the risk.

If you understand these triggers, it makes it much easier to stay safe when using leverage.

High leverage

High leverage reduces the distance between your entry price and your liquidation price. Even a small move against you can wipe out your collateral.

For example, a 20x leveraged position can be liquidated by a price swing of only a few percent.

Sudden volatility

Crypto markets often move in sharp spikes or drops, especially during news events, funding rate changes, or major liquidations on other exchanges. When volatility increases, liquidation levels get hit much faster.

Thin liquidity or rapid price gaps

During low-liquidity periods, prices can jump from one level to another without trading much in between. These gaps can skip over stop-loss orders and push positions straight into liquidation.

Insufficient margin

If a trader does not add extra collateral when the market moves against them, their margin can fall below the maintenance requirement.

At that point, the exchange has no choice but to close the trade.

Risks of liquidation in crypto

Liquidation is not just a small setback. For beginners, it can completely wipe out an account if they don’t understand how fast leveraged trades can move.

Before using margin or futures, you need to be aware of the main risks involved.

Losing your entire margin

When a position is liquidated, the exchange uses your collateral to cover the loss. In most cases, this means you lose all the money you put into the trade. Even if the market later recovers, the position is already closed and cannot be reopened.

Price slippage during fast moves

During sharp market swings, the price at which the exchange closes your position might be worse than expected. This slippage can increase the loss and speed up how quickly your margin disappears.

Cascading liquidations

Liquidations often trigger more liquidations. When many leveraged traders have similar liquidation prices, a quick drop can set off a chain reaction. This can push prices even lower and cause additional forced exits across different exchanges.

Emotional pressure and poor decisions

After a liquidation, many traders try to “win it back” immediately. This can lead to emotional trading, even higher leverage, and more losses. Once a trader becomes emotional, it gets much harder to stay disciplined.

Strategies to avoid liquidation

Liquidation is not random. Most forced exits happen because traders take on too much risk. With a few simple habits, beginners can protect their balances and reduce the chances of losing their entire margin.

Use lower leverage

Leverage looks attractive because it increases the size of your position. But high leverage also pushes your liquidation price dangerously close.

Using low or moderate leverage gives your trade more room to move without getting liquidated.

Add extra margin when needed

If the market starts moving against you, adding a bit more collateral can increase your buffer.

This lowers the chance of hitting the maintenance margin level. It also gives your trade more flexibility during temporary volatility.

Use stop-loss orders

A stop-loss closes your trade before the liquidation price is reached. It allows you to control how much you want to lose instead of letting the exchange decide.

If you’re a beginner, stop losses are one of the strongest tools to prevent big wipeouts.

Avoid trading during extreme volatility

Major news events, sudden funding spikes, and unexpected announcements can trigger large candles on the chart. During these moments, liquidation prices get hit more often. Beginners should avoid entering new trades when the market feels unstable.

Keep position sizes reasonable

A large position requires more margin and carries more risk. Smaller positions are easier to manage and less likely to hit the liquidation price quickly. Beginners often do better by trading small until they gain more experience.

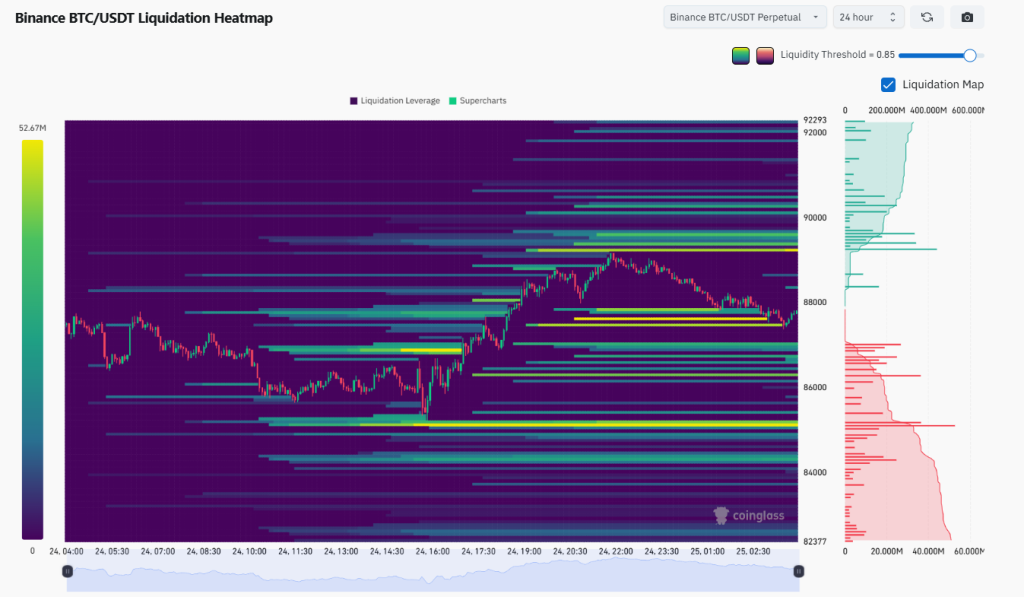

What is a crypto liquidation heatmap?

A crypto liquidation heatmap is a visual tool that shows where large groups of traders have their potential liquidation prices.

It highlights the price levels where forced liquidations could happen if the market moves into those zones. For beginners, it’s one of the easiest ways to see where the market might become unstable.

Most heatmaps use colors to show how dense these liquidation levels are:

- Cool colors (blue or green) mean fewer liquidation orders

- Warm colors (yellow, orange, red) mean many positions could be wiped out there

When you look at a heatmap, think of it as a “map of risk.” The brighter the area, the more leveraged traders are sitting at that price.

Why heatmaps matter

Liquidation heatmaps help traders understand:

- Where the market might move next. Prices often gravitate toward large clusters because they represent areas with high trading activity.

- Where liquidation cascades can occur. If a bright zone is hit, many positions close at once, which can accelerate the price movement.

- Where squeezes are likely. A large cluster above the current price can lead to a short squeeze. A cluster below can cause a long squeeze.

These insights help beginners avoid entering trades near dangerous price zones.

How to use liquidation heatmaps as a beginner

Identify large liquidation clusters

Look for bright areas on the heatmap. These zones show where many positions would be wiped out if the market reached that level. When you see a strong cluster above or below the current price, treat it as an area of interest.

Avoid entering trades near heavy clusters

Entering a position right in front of a large cluster is risky. If the market touches that area, liquidations can push the price further and faster than you expect.

Beginners should place entries and stop-losses away from these dense regions.

Watch for squeeze zones

If a huge cluster sits above the price, short positions become vulnerable. If the price climbs into that area, a short squeeze can happen, forcing shorts to close and pushing price higher. The same idea applies to long squeezes when a big cluster sits below the price.

Use heatmaps with simple indicators

You don’t need a full strategy to use heatmaps. Combine them with basic tools like support and resistance. If a strong resistance level lines up with a bright liquidation zone, that area may act like a magnet for price.

Look for sudden changes

Heatmaps update in real time. If a new bright zone appears, it often means a large number of traders opened fresh leveraged positions. This can signal increased volatility ahead.

The biggest liquidation events in crypto history

March 2020: The COVID crash

During the global market panic in March 2020, Bitcoin dropped more than 40 percent in a single day. Futures markets saw billions of dollars in long positions wiped out as prices fell sharply. This event is often remembered as one of the earliest examples of how dangerous high leverage can be in crypto.

May 2021: The over-leveraged bull market

In May 2021, the crypto bull run turned suddenly. Bitcoin fell from above 50,000 dollars to under 32,000 dollars within days. At the time, many traders were using extremely high leverage. This led to one of the largest liquidation waves the market had ever seen, with billions lost in hours.

2022: Terra (LUNA) collapse

When the Terra ecosystem collapsed, both LUNA and UST went into freefall. The speed of the crash triggered huge liquidations across exchanges, wiping out long positions on multiple assets. This event showed how quickly leverage can break down when a major project fails.

2022: FTX failure

FTX’s collapse shocked the entire market. Liquidity disappeared, volatility exploded, and many futures traders were caught in sudden price gaps. This created a massive liquidation spike, especially in altcoins that depended heavily on FTX for trading volume.

Final thoughts

Liquidation is one of the biggest risks in crypto trading, especially for beginners who are still learning how leverage works. The market can move quickly, and even small price swings can push a leveraged position toward its liquidation price.

Traders can avoid many common mistakes by:

- Understanding how liquidations happen

- What triggers them

- How to read tools like liquidation heatmaps

The key is to stay patient, keep position sizes reasonable, and never risk more than you can afford to lose.

Next read: Spot, Leverage, and Futures Trading in Crypto: A Comprehensive Guide to Types, Benefits, and Risks