OKX is a well-known name in the crypto world, offering a wide range of services like buying, staking, and trading numerous currencies. In this OKX review, we’ll dive into OKX’s security measures, fee structure, and key features — highlighting both its strong points and its limitations to help you decide if it’s the right platform for your needs.

Let’s get into the details and see if OKX checks all the boxes for your crypto strategy.

OKX exchange overview

OKX, launched in 2017, operates through entities based in Seychelles and the Bahamas. According to CoinMarketCap, it’s the third-largest crypto exchange globally by trading volume. The platform serves millions of users across more than 100 countries. If OKX is available in your region, you can sign up and trade from a selection of 317 spot currencies.

Beyond basic trading, OKX offers margin borrowing, staking, crypto-backed loans, and even advanced features like mining pools and its own blockchain, OKExChain. It can be a solid option to use alongside a third-party wallet or as your main hub for all things crypto.

| 👍Pros | 👎Cons |

| Wide range of crypto for trade: +320 | Not available in US |

| Comparatively low fees for spot and futures trades | Complicated fiat withdrawal procedure |

| Great staking opportunities | Low liquidity for some of the cryptocurrencies |

| Quick and simple crypto purchases with a card, bank account, or digital wallet | You’ll need to verify your identity to make crypto deposits |

OKX features & benefits

OKX offers a wide range of features for its global user base, spanning over 180 regions. It allows users to trade various tokens and trading pairs, manage decentralized assets by connecting a Web3 wallet, and engage with DeFi and blockchain applications.

Key features include:

- The ability to trade multiple tokens and pairs.

- Integration with Web3 wallets to manage DeFi portfolios in one place.

- Access to the NFT Marketplace for creating, buying, and selling NFTs.

- Discovery of DApps such as DeFi platforms and blockchain gaming.

- Trading bots: OKX offers a wide selection of free trading bots, with options ranging from dollar-cost averaging to futures trading on volatile cryptocurrencies.

- Seamless connection to the TradingView platform for crypto trading using advanced charting tools.

These features provide flexibility for users looking to engage with both traditional crypto trading and decentralized finance activities.

Trading experience

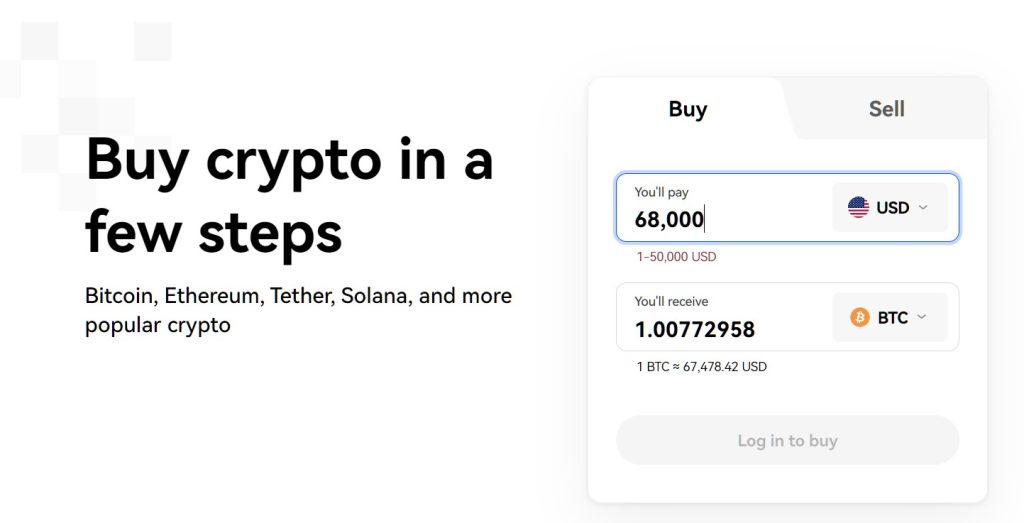

OKX offers a beginner-friendly trading interface, while also providing advanced tools for experienced traders. In addition, the process to buy and convert cryptocurrency is clear and easy to follow.

This makes it a good option, especially for those new to crypto, who are looking to buy their first Bitcoin, Ethereum, or other supported currencies.

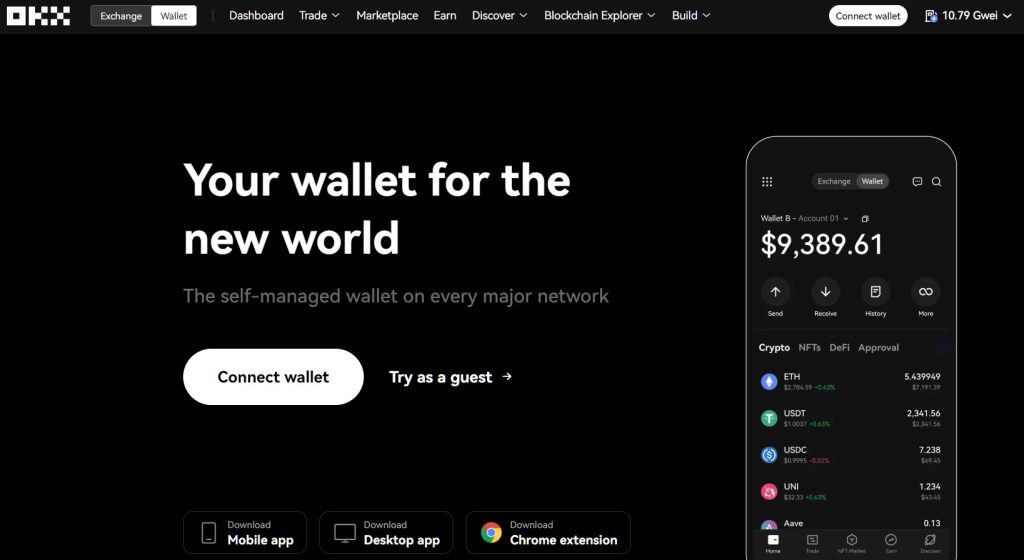

OKX Wallet

The OKX Wallet is a crypto wallet available across multiple platforms, including mobile apps, web, and browser extensions. It gives users access to over 3,000 cryptocurrencies across 80+ networks, as well as a wide range of DApps and the broader Web3 ecosystem.

With OKX Wallet, users have full control over their private keys and assets. The wallet supports multiple blockchains, including both EVM and non-EVM networks, allowing users to access DApps across different networks without needing to switch wallets.

OKX wallet also supports popular hardware wallets like Ledger.

Trading bots

OKX offers a wide selection of trading bots that cater to various strategies, from dollar-cost averaging to futures trading on volatile cryptocurrencies. Users can explore a marketplace of pre-built bots or create their own, with flexible functionality and settings to suit different trading approaches.

OKX trading bots are free to use as long as they don’t generate a profit. Once a bot starts making a profit, a 20% commission is applied, capped at $50 per month.

These bots can automate trading strategies, respond quickly to market changes, and operate 24/7, giving users a time advantage. However, using trading bots effectively requires a solid understanding of the market and the strategies being automated. They can execute strategies, but they don’t guarantee profits. It’s recommended to conduct thorough research and test strategies with a demo account before trading with real funds.

It’s important to note that trading bots on OKX are not available in the US, UK, and several other regions.

OKX learning opportunities

OKX provides several tools to help users learn about crypto trading. The platform offers a variety of guides and articles covering multiple topics: from spot trading to crypto options strategies.

Users can also access a demo account funded with virtual assets like BTC and ETH. This allows for practice in making spot trades, trading futures with leverage, or trying out trading bots that operate around the clock.

For those interested in learning from experienced traders, OKX includes a copy trading feature. This allows users to follow and replicate the trades of seasoned traders, gaining insights from their strategies and actions.

OKX On-Chain Earn

OKX On-Chain Earn offers a range of staking and DeFi options for users looking to earn rewards. These options include direct staking, staking through DeFi protocols, and lending opportunities.

Users can earn yields on over 100 different cryptocurrencies, with options to participate in structured products like Seagull, an options-based vehicle. The risks and potential returns differ depending on the product chosen.

Staking involves earning rewards by helping secure the blockchain network, while DeFi products offer returns through activities like providing liquidity, yield farming, or lending cryptocurrency.

The annual percentage rate (APR) for these products is based on interest earned from subscriptions, and some DeFi protocols provide additional bonus rewards. The APR can fluctuate in real time, influenced by the supply and demand of services and assets.

For proof-of-stake (PoS) staking products, the timing of interest distribution varies and could be daily, weekly, or upon redemption. With DeFi products, interest is usually distributed the day after redemption, while rewards are distributed daily around 12:00 UTC.

Fees

OKX has a tiered fee structure based on the assets you hold and your 30-day trading volume. These tiers are updated daily, and each level comes with different fee discounts. For example, if you’ve traded more than $50 million in the past 30 days (wow, that’s really impressive!), you’ll get a -0.010% maker fee and a 0.015% taker fee discount.

For beginners or those with assets below $20,000 and a monthly trading volume under $100,000, the maker/taker fees are 0.14% and 0.23%, respectively. In comparison, Kucoin charges a flat 0.1% maker/taker fee for those trading less than 50 BTC over 30 days, which can drop to 0.08% if you pay with the KCS token.

Withdrawal fees on OKX vary depending on the cryptocurrency and are tied to network costs. For instance, withdrawing Bitcoin requires a minimum of 0.00073 BTC, with a network fee of 0.00023 BTC. For Ethereum, the fees depend on the network you choose — on the Base network, the minimum withdrawal is 0.00204 ETH, and the fee is 0.00004 ETH.

Security

OKX ranks as the fourth largest crypto exchange by trading volume and liquidity, and it regularly publishes proof of reserves. However, it’s not registered in major markets like the U.S., UK, Canada, or Australia.

In terms of security, OKX follows industry standards, such as keeping the majority of customer assets in cold storage. Users can also set up extra security measures, like a withdrawal password and anti-phishing codes.

While users can deposit and trade on OKX without completing KYC (Know Your Customer) verification, unverified accounts are unable to withdraw funds. OKX also doesn’t support temporary or one-time withdrawal requests.

Some users have reported concerns about funds being frozen or withdrawals being disabled without prior notice, as well as changes to the terms of service without clear communication.

To protect your account, it’s essential to follow general security best practices, such as using strong, unique passwords for each platform and enabling multifactor authentication to safeguard your assets.

OKX payment methods

The payment options available on OKX depend on your location, with support for 84 fiat currencies, including USD, GBP, and EUR.

Supported payment methods on OKX include:

- Debit and credit cards

- Apple Pay and Google Pay (via debit cards)

- SEPA and iDEAL bank transfers

- Peer-to-peer (P2P) transactions with various payment options

- Third-party services like Banxa and Mercuryo