How to Earn Passive Income with Crypto: A Guide to DeFi Yield Farming

Vuk Martinovic

Imagine earning income from your crypto without having to trade or sell it. That’s the promise of DeFi yield farming — a method that allows you to put your crypto to work and earn passive income with crypto.

It doesn’t matter if you’re new to decentralized finance (DeFi) or you’re simply exploring ways to make your crypto more profitable. Yield farming can offer exciting opportunities. But how does it work, and what are the risks?

In this guide, I’ll explain the fundamentals of yield farming, how it helps you earn passive income from crypto, and what you need to know to get started. By the end, you’ll understand how to maximize your crypto earnings while keeping risks in check.

What is yield farming in DeFi?

The basics of DeFi

Before I dive into yield farming, let me quickly explain what decentralized finance, or DeFi, is all about. DeFi is a system of financial tools and services built on blockchain technology. Unlike centralized finance, i.e. CeFi (such as traditional banks), DeFi doesn’t rely on intermediaries. Instead, it uses smart contracts, which are automated programs that execute transactions securely and transparently.

So, why is DeFi such a big deal for passive income? Because it opens up opportunities for anyone, anywhere in the world, to make passive income with crypto without needing to trust a middleman.

Imagine you have $1,000 in actual dollars. How could you earn passive income from it? You’d have to go to a bank, deposit it, and earn a fraction of a percent on it.

With DeFi, you can lend, borrow, or stake your crypto and earn rewards, without needing a bank. Yield farming is one of the most popular ways to do this.

DeFi yield farming explained

DeFi yield farming is a way to earn rewards by lending or staking your crypto in liquidity pools. But what’s a liquidity pool? Think of it as a digital vault where users deposit their crypto to support trading on decentralized exchanges (DEXs). Each liquidity pool consists of two cryptocurrencies (because you’re always trading one crypto for another, for example BNB/USDC, or ETH/USDT).

Here’s how it works: When you add your crypto to a liquidity pool, you’re helping the exchange function smoothly by providing the assets needed for others to trade. In return, you earn rewards. These rewards can come in three forms:

- Interest from lending protocols: Some platforms, like Aave and Compound, let you lend your crypto to others and earn interest in return. The interest rate depends on supply and demand — when demand for borrowing is high, your earnings increase.

- Token rewards: Many yield farming platforms offer rewards in the form of native tokens. For example, PancakeSwap rewards you with CAKE, and Raydium rewards you with RAY. These tokens can be sold, reinvested, or held for potential long-term gains.

- Trading fees: As a liquidity provider, you earn a portion of the trading fees generated in the pool. For instance, if a platform charges a 0.3% fee per trade, a share of that fee is distributed to everyone who contributed liquidity. This income is typically stable and depends on the pool’s trading volume.

Each of these earning methods adds up, creating a steady stream of passive income from crypto.

Let me break it down further with an example.

Imagine a liquidity pool for a pair like ETH/USDT (Ethereum and Tether). For easier math, let’s assume Ethereum is priced at $1,000. You deposit an equal value in $ of both ETH and USDT into the pool. That means that, if you have $1,000, you will be depositing 0.5 ETH and 500 USDT.

When someone trades ETH for USDT (or vice versa) on the platform, a small fee is charged. Part of that fee goes to you as a reward for providing liquidity. Also, most platforms issue bonus tokens in addition to the fees, regardless of how much that crypto pair is traded.

Some popular platforms where you can start yield farming include:

- Uniswap: The biggest decentralized exchange for trading and liquidity provision.

- PancakeSwap: A Binance Smart Chain platform known for its low fees.

- Curve Finance: A DeFi protocol focused on stablecoin trading and liquidity.

- Raydium: A Solana-based platform offering high-speed and low-cost trading with yield farming opportunities.

Yield farming might sound simple, but it’s important to understand the risks and choose platforms carefully. I’ll cover those later in the guide.

Getting started with yield farming crypto

Choosing the right DeFi platform

The first step in yield farming crypto is picking the right platform. With so many options available, it’s important to choose wisely to maximize your earnings and minimize risks.

Here’s what the platforms mentioned earlier are best for:

- Uniswap: Ideal for Ethereum-based yield farming with a large variety of liquidity pools.

- PancakeSwap: Great for Binance-based yield farming (although it supports multiple chains), extra rewards through its Cake token.

- Curve Finance: Best for stablecoin farming, with low fees and reduced risk of impermanent loss.

- Raydium: A great choice for Solana users.

When choosing a platform, consider these factors:

- Security: Make sure the platform has been audited by a trusted third party. Check reviews, community feedback, and whether the platform has experienced any hacks.

- Fees: Different platforms charge varying transaction fees. Platforms like PancakeSwap (on Binance Smart Chain) tend to have lower fees than Ethereum-based platforms like Uniswap. Though, again, many platforms now offer multi-chain support, but they are still focused on one.

- APRs (Annual Percentage Return): Higher APRs mean greater earning potential, but they often come with higher risks. Look for a balance between a reasonable APR and stable platform performance.

All of the ones I mentioned above are trusted, reputable, and they’re a good place to start.

Step-by-step guide to yield farming

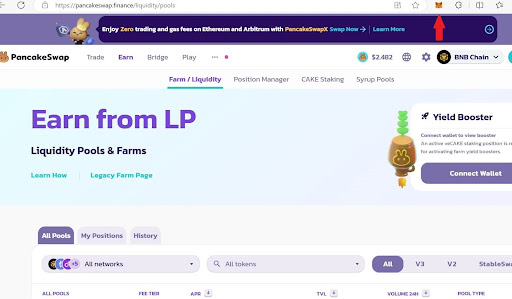

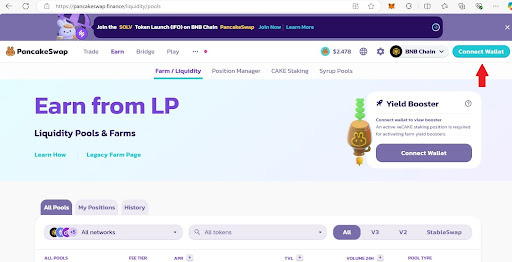

Once you’ve chosen a platform, you’re ready to start yield farming. I will be giving an example of using MetaMask on PancakeSwap, using the Binance network:

1. Set up a crypto wallet

- You’ll need a crypto wallet to interact with DeFi platforms. MetaMask is one of the most popular options for Ethereum-based platforms (but it can be used for others as well, such as Binance or Polygon), while Phantom is a great choice for Solana.

- Install the wallet as a browser extension or mobile app. Follow the setup instructions to secure your wallet with a strong password and save your recovery phrase somewhere safe.

2. Connect the wallet to the DeFi platform

- Click on Connect Wallet

- Confirm the connection

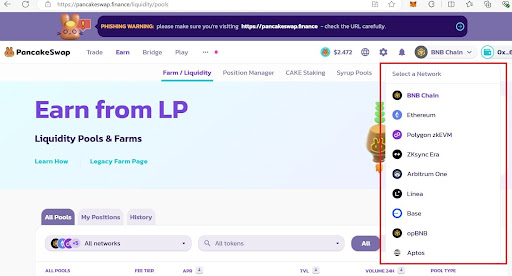

3. Select the right blockchain

- Yield farming is available on various blockchains, such as Ethereum, Binance Smart Chain (BSC), Solana, and others. Choose a blockchain based on its fees and compatibility with your chosen platform.

- Fund your wallet with the blockchain’s native token (e.g., ETH for Ethereum, BNB for BSC) to cover transaction fees. Yes, this basically means you will need to either send the needed token to your wallet from an exchange or a different wallet. Alternatively, wallets like MetaMask allow you to buy crypto directly inside with fiat, but this is still in its pilot phase and doesn’t always work.

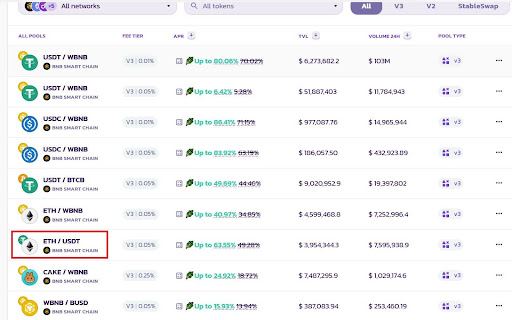

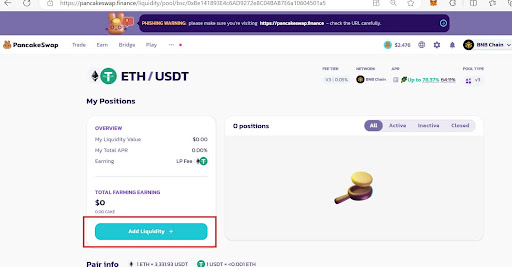

4. Provide liquidity to a pool

- Go to the liquidity section of your chosen platform. Pick a trading pair (e.g., ETH/USDT) and make sure you have an equal value of both tokens in your wallet. If you don’t you won’t be able to deposit that difference. For example, if you have $500 in ETH but only $400 in USDT, you will be able to deposit all of USDT but only $400 of ETH.

- Deposit your tokens into the liquidity pool. The platform will give you LP (liquidity provider) tokens as proof of your contribution. These tokens represent your share in the pool.

5. Harvest and reinvest rewards

- As your tokens generate rewards, regularly check the platform to harvest them. Rewards might be in the form of trading fees or native tokens (e.g., CAKE or RAY). Sometimes, it’ll be both.

- Reinvest your earnings by adding them back into the pool. This compounds your returns, letting you earn more over time.

6. Practical tips for success

- Start small. Use a small amount of crypto initially to get familiar with the process and understand the risks.

- Monitor gas fees. If you’re using Ethereum, high gas fees can eat into your profits. Time your transactions during off-peak hours for lower costs. Every time you deposit, every time you harvest, every time you re-deposit — all of it counts as a transaction with fees.

- Stay informed. Yield farming is constantly evolving, so keep an eye on updates and new opportunities from your chosen platform.

Risks and challenges in yield farming

Understanding the risks

Yield farming offers exciting earning opportunities, but it’s not without its risks. Understanding these challenges will help you make better decisions and protect your investments.

Impermanent loss

- This occurs when the value of the tokens you’ve deposited into a liquidity pool changes compared to simply holding them in your wallet.

- For example, if you add ETH and USDT to a pool and ETH’s price increases significantly, you may lose out on potential gains because your ETH is partially converted into USDT in the pool.

- While trading fees and rewards might offset this loss, impermanent loss can still significantly impact your profits.

Smart contract vulnerabilities

- Yield farming relies on smart contracts, which are susceptible to bugs or hacking. If a platform’s code is poorly written or not audited, your funds could be at risk.

- Once funds are deposited in a smart contract, you have limited control, and any exploit could result in total loss.

Regulatory and market risks

DeFi operates in a largely unregulated space, making it vulnerable to sudden legal changes. Governments may impose restrictions or taxes that could affect your earnings.

Market volatility is another concern. If crypto prices drop sharply, the value of your staked assets and rewards could plummet.

How to minimize risks

While risks are an inherent part of yield farming, there are strategies you can use to minimize their impact and safeguard your investments.

Diversification strategies

- Don’t put all your funds into a single pool or platform. Spread your assets across different liquidity pools and blockchains to reduce risk.

- For example, you might allocate some funds to a stablecoin pool (like USDT/DAI) to minimize price volatility while experimenting with riskier pairs for higher rewards.

Use audited and reputable platforms

- Stick to well-known platforms that have undergone third-party audits. Platforms like Uniswap, Curve Finance, and PancakeSwap are industry leaders with strong track records.

- Check for audits from trusted firms like CertiK or ConsenSys to ensure the platform’s smart contracts are secure.

Stay updated on market trends and project developments

- Regularly monitor the performance of your chosen pools and the broader crypto market. Changes in trading volume, platform updates, or external events can impact your earnings. Just because APR is high now, doesn’t mean it will stay the same a week from now.

- Join community forums and follow project announcements to stay informed about upgrades, new features, or potential risks.

Don’t chase high APR

- This is a big one, and something I always see people do. You might be looking over APRs offered for various liquidity pools, and you might see an obscenely high APR, such as this one:

- Don’t fall for it. 1,391% sounds very attractive, but as you can see on the right, liquidity is very low, less than $9,000. As soon as more people provide liquidity, the rewards will plummet. Also, a good rule of thumb to follow is — never yield farm using crypto that you wouldn’t invest in otherwise. In other words, don’t buy unknown tokens just because they offer high APR.

Yield farming vs. other crypto passive income methods

Staking vs. yield farming

Staking and yield farming are two of the most popular ways to earn passive income with crypto. While they may seem similar, they have distinct differences in terms of process, risk, and potential rewards.

How they work

- Staking: This involves locking up your cryptocurrency for a specified amount of time to help secure a blockchain network. In return, you earn rewards, usually in the form of additional tokens. Platforms like Ethereum (with ETH staking) or Cardano (ADA) make staking simple and low-maintenance.

- Yield farming: In yield farming, you provide liquidity to decentralized exchanges by depositing your crypto into liquidity pools. You earn rewards from trading fees, platform tokens, and other incentives. There is no specified period, meaning, you can withdraw your tokens whenever you wish.

Risk and reward differences

- Staking: Generally less risky because your funds are not exposed to impermanent loss or market fluctuations within a trading pool. Rewards are more predictable, but usually lower compared to yield farming.

- Yield farming: Offers higher earning potential due to trading fees and token rewards. However, it comes with risks like impermanent loss and smart contract vulnerabilities. It also requires a bit more technical know-how.

Practical insight: If you prefer a “set it and forget it” approach with low to moderate returns, staking might be the better option. If you’re comfortable with more complexity, hands-on approach and higher risk for potentially higher rewards, yield farming could be a good fit.

Lending and borrowing

Lending and borrowing offer another way to make passive income with crypto, and they differ significantly from liquidity mining.

How lending crypto works

Platforms like BlockFi, Aave, and Nexo let you lend your crypto to other users in exchange for interest. This is a straightforward process: you deposit your assets, and the platform manages the lending.

Borrowers pay interest to access your crypto, and you earn a share of that interest.

How it compares to yield farming

Advantages: Lending is less complex than yield farming and often has lower risks. Your earnings come from fixed or variable interest rates, which are typically stable.

Disadvantages: Returns from lending are usually lower compared to yield farming, especially if you’re not lending high-demand assets.

Borrowing for yield farming: Some advanced users borrow crypto to participate in yield farming, leveraging their positions to increase earnings. While this can amplify profits, it also significantly raises the risks.

Practical Tip: If you’re new to DeFi, it’s better to go either with lending or yield farming (but not both) as a starting point. You can always explore combining the two once you’re more familiar with the ecosystem.

Conclusion

Yield farming is a powerful way to generate passive income with crypto. By providing liquidity to DeFi platforms, you can earn rewards from trading fees, token incentives, and lending opportunities.

Yield farming offers a higher passive earning potential than any other passive income methods.

That said, yield farming isn’t without its challenges. Risks like impermanent loss, smart contract vulnerabilities, and market volatility mean you need to be cautious. Diversify your investments, choose reputable platforms and don’t chase high APRs. This will minimize risks and maximize your earnings in the long term.

If you’re new to DeFi, start small, get familiar with the process, and build your knowledge over time. Crypto offers endless opportunities to grow your wealth, and yield farming is just one of the many ways to do so.