2026 is just a few weeks away, and it’s the perfect time to start thinking about a fresh batch of New Year’s resolutions and emerging crypto trends 2026. Because… you just have to stay two steps ahead in this game, right?

The past couple of years were messy to say the least, but they seem to have pushed the industry in a clearer direction: easier apps, fewer barriers, and features built for everyday users instead of hardcore traders.

A new wave of ideas is forming: AI helpers, smoother on-chain trading, safer wallets, better security, and even meme coins trying to be more than a lucky gamble. None of it requires deep technical knowledge. If anything, 2026 looks like the year crypto finally becomes more accessible.

This guide walks through the trends worth paying attention to:

- what they are

- why they’re useful

- how they can actually make your crypto experience simpler.

3, 2, 1… Starting the time machine!

1. AI-powered trading tools & on-chain agents

AI-powered trading tools are platforms or bots that use machine learning, big data, or natural-language processing to analyse crypto markets, spot patterns, make suggestions, and sometimes even execute trades automatically.

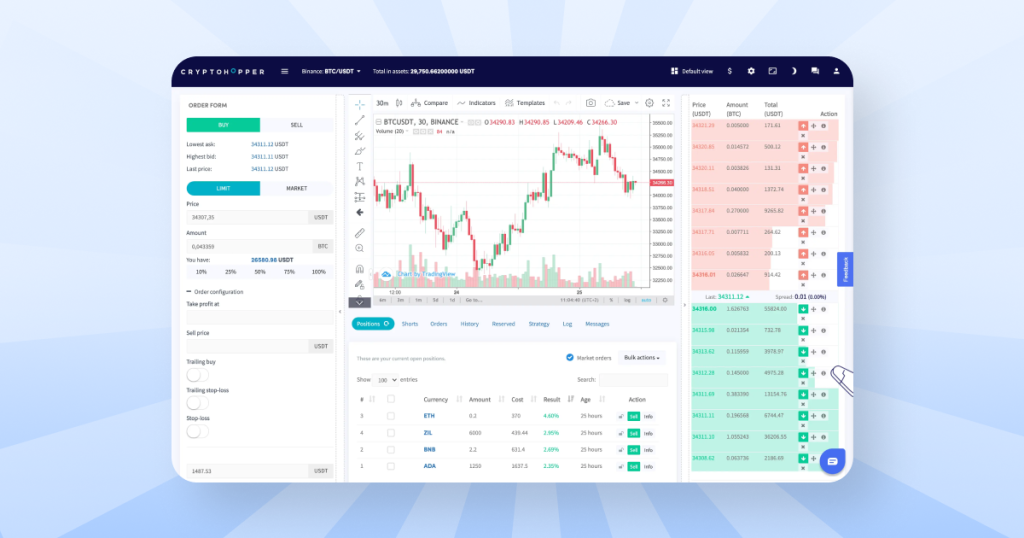

For example, Cryptohopper is a bot platform that supports multiple exchanges and offers “Algorithmic Intelligence” modules for users of all skill levels.

On the more advanced side: “on-chain agents” are AI systems built to operate directly on a blockchain – they may hold a private key, monitor on-chain events, and trigger executions (e.g., trades, liquidations, or lending actions) when certain conditions are met.

Why it’s worth attention

- Time saver & filter: As a beginner, you don’t need to watch dozens of charts or scan hundreds of news headlines manually. AI tools help narrow down what to focus on.

- Emotion reduction: Many mistakes in crypto come from panic or FOMO. A bot or agent sticks to rules, not feelings.

- More accessible: Platforms like Cryptohopper, 3Commas, or Pionex provide no-code or low-code setups, so you don’t need to be a coding wizard.

- Better signals: On-chain agents can go beyond just price charts. They can pull data from blockchain transactions, social sentiment, whale moves, and news feeds, giving richer insight.

Potential for 2026

- Expect more plug-and-play AI tools tailored for beginner-level traders, like “set your risk level, push a button, let the bot track and trade for you” tools, will become more common.

- On-chain agents will increasingly automate more than just buy/sell — they’ll monitor your portfolio, suggest portfolio rebalancing, track yield-farming opportunities, or protect you from big drawdowns.

- Also, add stronger integrations with major exchanges + wallet platforms, so you can move seamlessly between manual and automated control.

- Important caveat: These tools are helpful but not magical. They reduce friction, but they don’t guarantee profits. Always check what the bot/agent is actually doing, understand the rules it follows, and use risk management.

2. Restaking tools & “boosted” staking yields

Restaking is a way to earn extra rewards on top of the regular staking we were talking about in one of our previous articles.

Traditionally, if you staked ETH or SOL, you earned a fixed reward, and that was it.

Restaking takes your staked (or liquid-staked) tokens and lets them secure additional networks or services. In simple terms, your staked assets “work twice”, without you unstaking anything.

A few real examples:

- EigenLayer — the biggest restaking ecosystem on Ethereum.

- Ether.fi — lets users stake ETH and automatically restake it to earn boosted rewards.

- Kelp DAO, Renzo, Puffer Finance — LRT (Liquid Restaking Token) platforms that simplify the whole restaking process for beginners.

Why it’s worth attention

Because beginners finally have a way to earn more from assets they were already staking, without touching complicated DeFi strategies.

Real benefits:

- Higher yields: LRT platforms combine staking rewards + restaking rewards + points (EigenLayer, project-specific, etc.).

- Liquidity: You usually get a token (e.g., eETH, ezETH, rsETH) you can still use in trading or DeFi.

- Lower barrier: You don’t need to run validators or understand AVSs (Actively Validated Services). The platforms handle everything.

Potential for 2026

Restaking is expected to become one of the biggest yield categories in crypto next year. Here’s what we can realistically expect:

- More beginner-friendly dashboards

Platforms like Ether.fi and Renzo are already pushing clean, simple UIs focused on “deposit and chill.” This trend will continue. - More chains joining the trend

Restaking will expand beyond Ethereum. Early versions already exist on Solana, Avalanche, and modular chains. - Safer “default” strategies

Instead of users having to pick 20+ different restaking options, platforms will offer bundled strategies:

“Low risk,” “medium risk,” “max rewards,” etc. - Better utility for LRTs

LRT tokens (like eETH or ezETH) will be accepted in more DeFi protocols, making them easier to use and more liquid.

Overall, 2026 looks like the year restaking becomes “normal staking 2.0” — a default option rather than an advanced strategy.

3. DePIN: Earn by contributing real-world value

DePIN stands for Decentralized Physical Infrastructure Networks. A long phrase for a simple idea: you share something from the real world (WiFi, storage, GPU power, maps) and earn tokens for it.

Instead of giant companies building infrastructure, thousands of regular users contribute small pieces and get rewarded. That actually sounds familiar, doesn’t it?… Anyway.

Examples you can actually recognize:

- Helium: people run small hotspots that provide wireless coverage.

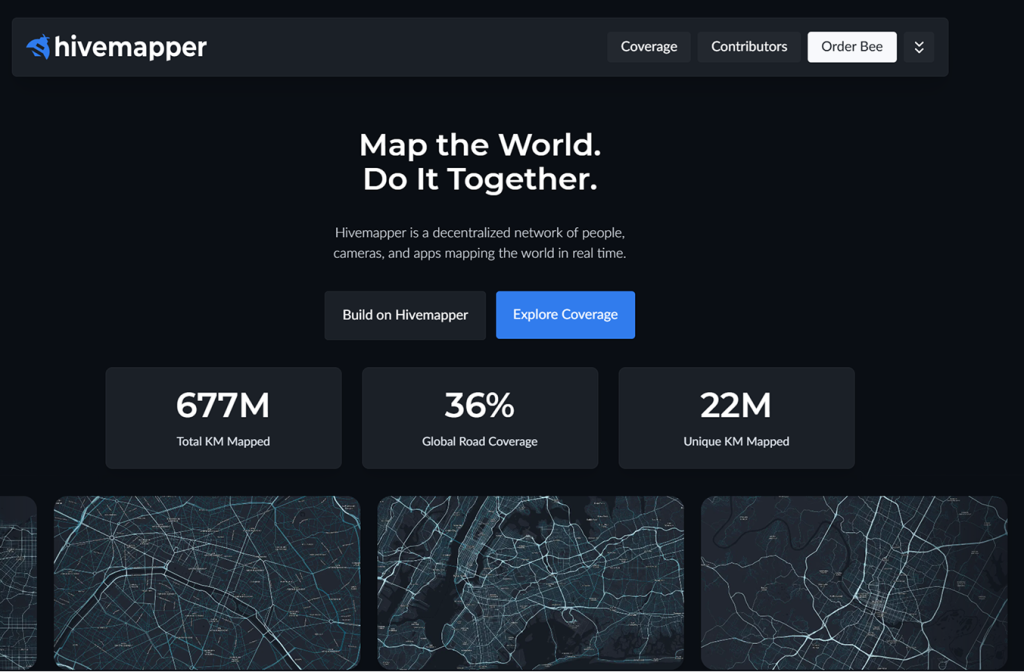

- Hivemapper: drivers use a dashcam to collect street imagery and earn tokens.

- Render & Akash: people rent out unused GPU/compute power.

- Grass & Nosana: users contribute data or small AI-related tasks.

Why it’s worth attention

Because it’s one of the few crypto trends where you can earn without trading, investing, or watching charts.

And it’s a great earning opportunity for beginners:

- Low entry barrier: many DePIN apps run on normal devices.

- Simple earning model: you provide a resource → you get rewarded.

- Real utility: these networks power maps, AI training, connectivity, storage, not speculation.

- Diversification: DePIN projects give beginners a way to participate in crypto without risking their portfolio.

If you ever wished crypto had more “real-world” use cases, this is exactly that.

Potential for 2026

DePIN is expected to grow fast next year, mostly because AI demand is exploding and these networks can supply cheap data, compute, or coverage.

Here’s what to realistically expect:

- More phone-based earning apps

DePIN will shift towards “download an app, contribute data/compute, earn tokens.” No hardware needed. - AI-focused micro-work networks

Apps like Grass are early examples: you earn by helping AI systems gather or verify data. - Cheaper, simpler hardware

Projects like Helium will release plug-and-play devices with easier onboarding and better coverage rewards. - More stable reward models

Early DePIN projects had unpredictable earnings. In 2026, expect clearer incentives, transparent dashboards, and less volatility in reward structures. - Bigger partnerships

Mapping, wireless, and GPU networks will start supplying data or compute to real companies, not just other crypto projects, which means more reliable demand for contributors.

4. Meme coins evolving into “MemeFi”

MemeFi is what happens when meme coins start adding real features: quests, staking, points, leaderboards, basic DeFi mechanics, and simple in-app experiences (not to be confused with the P2E Telegram game called MemeFi we reviewed earlier).

In short: meme coins + light DeFi + gamified community layers.

Examples already in the market:

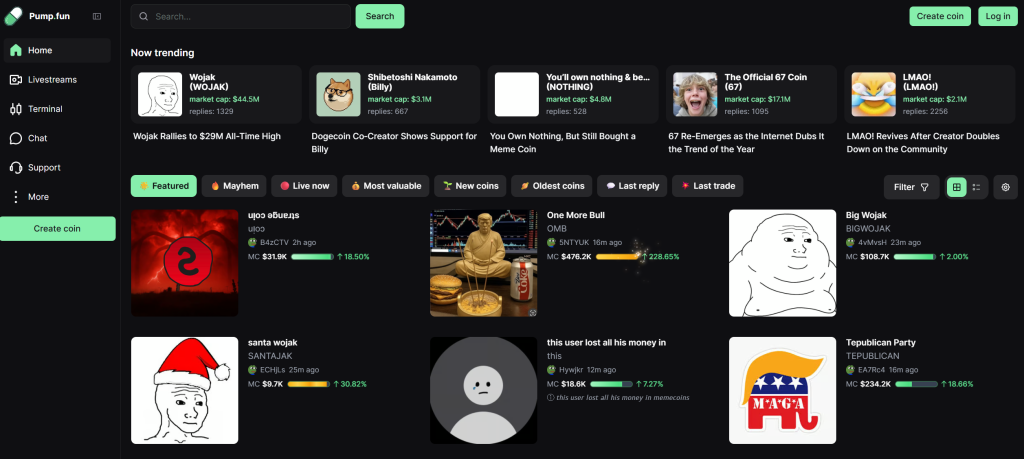

- Pump.fun on Solana made meme launches transparent and social. It sure has its problems, which we discussed in this piece.

- BONK built staking, apps, and widespread integrations.

- WIF (dogwifhat) turned from a meme into a full cultural ecosystem.

- MANEKI, SLERF, and MOTHER introduced quests, NFTs, missions, and community rewards.

Why it’s worth attention

Meme coins are often the first touchpoint in crypto for beginners. Memecoins are down-to-earth, fun, and easy to understand. MemeFi takes this starter energy and turns it into something more structured and a bit less chaotic.

Key reasons it matters:

- Safer than old-school meme launches: transparent bonding curves, locked liquidity, and anti-rug mechanics.

- More things to do: quests, staking, XP, collectibles — not just buying and hoping.

- More learning opportunities: MemeFi quietly introduces beginners to staking, liquidity, rewards, and on-chain activity without overwhelming them.

- Community-driven growth: projects reward engagement instead of pure speculation.

Potential for 2026

MemeFi is shaping up to be one of the most active “social crypto” trends next year.

Here’s what we can expect:

- Safer launch platforms

Pump.fun-like tools will add audits, creator reputation metrics, and built-in protections against rugs. - Daily engagement systems

Expect daily quests, XP ladders, activity streaks, community events, and rewards for participation. - Meme + NFT fusions

Tokens linked to avatars, skins, comics, collectibles, or simple game items with real utility inside apps. - Brand and creator partnerships

More meme projects will branch out into merchandise, collaborations, and cultural events. - No-code meme creation tools

AI-generated memes, on-chain image creators, simple launchpads — making meme coin creation a mainstream hobby.

Maybe we’re high on hopium, but it looks like 2026 will push meme coins toward structured, gamified ecosystems, keeping the fun but lowering the chaos.

5. Next-gen DEXs & perp trading platforms

These are decentralized trading platforms that feel almost as smooth as centralized exchanges: fast execution, clean UI, minimal delays, and lower fees, but with the transparency and self-custody of DeFi.

They’re basically the new generation of on-chain trading apps, built to remove the clunky UX that used to scare beginners away.

Real examples already leading the space:

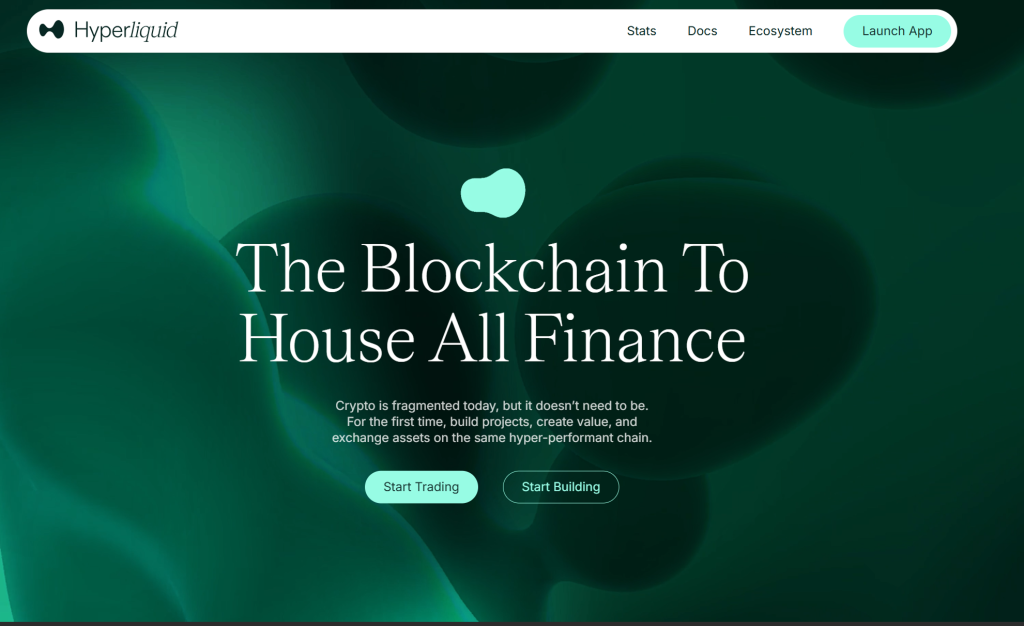

- Hyperliquid: fully on-chain order books, fast execution, and an experience close to a CEX.

- dYdX v4: a completely decentralized perps chain with strong liquidity.

- Drift Protocol (Solana): beginner-friendly perps with built-in risk controls.

- Vertex (Arbitrum): combines spot + perps + money markets in one interface.

- Zeta Markets (Solana): cleaner UX for perps and options trading.

Why it’s worth attention

Users can get the best of both worlds:

- CEX-like simplicity

- DeFi-level transparency

- Without trusting a centralized custodian

Actual value:

- Lower fees than many exchanges.

- Self-custody: your funds stay in your wallet.

- Smoother UX: fast charts, simple order placement, clearer risk management.

- Fewer surprises: no hidden withdrawal limits, random KYC popups, or frozen accounts.

- Safer learning curve: many platforms now show liquidation risks, funding rates, and PnL previews in plain language.

Potential for 2026

Next year will be big for on-chain trading, and beginners will benefit most.

Here’s what’s likely coming:

- AI-assisted trading interfaces

Tools that explain charts, suggest risk levels, highlight volatility, or notify you when your positions get dangerous. - More “all-in-one” trading dashboards

Spot, perps, lending, bridging, and portfolio tracking in a single interface (Hyperliquid and Vertex are already pushing this). - Simpler perps onboarding

Expect tutorials, guided trading modes, and built-in protection like auto-stop-loss features for new users. - Mobile-first DEX experiences

Fast mobile perps apps without clunky wallets or complicated setups. - Social trading features

Copy trading, leaderboard competitions, and beginner-friendly presets managed on-chain. - Safer trade execution

Transaction simulators, frontrunning protection, and on-chain risk engines that prevent accidental liquidation-level mistakes.

6. Payments 3.0: Stablecoins eat fintech

This trend is all about using stablecoins for everyday money transfers and payments, instead of banks, PayPal, or traditional fintech apps.

Stablecoins are digital dollars/euros that stay the same price and move instantly on a blockchain.

They’re already used for:

- sending money internationally

- paying freelancers

- moving savings out of unstable local currencies

- paying for online services

- shopping where crypto is accepted (Asia, LatAm, Africa growing fastest)

It’s like online banking but without the bank. It’s faster, cheaper, and often more reliable.

Examples already shaping the trend:

- USDC on Solana: near-instant transactions for fractions of a cent.

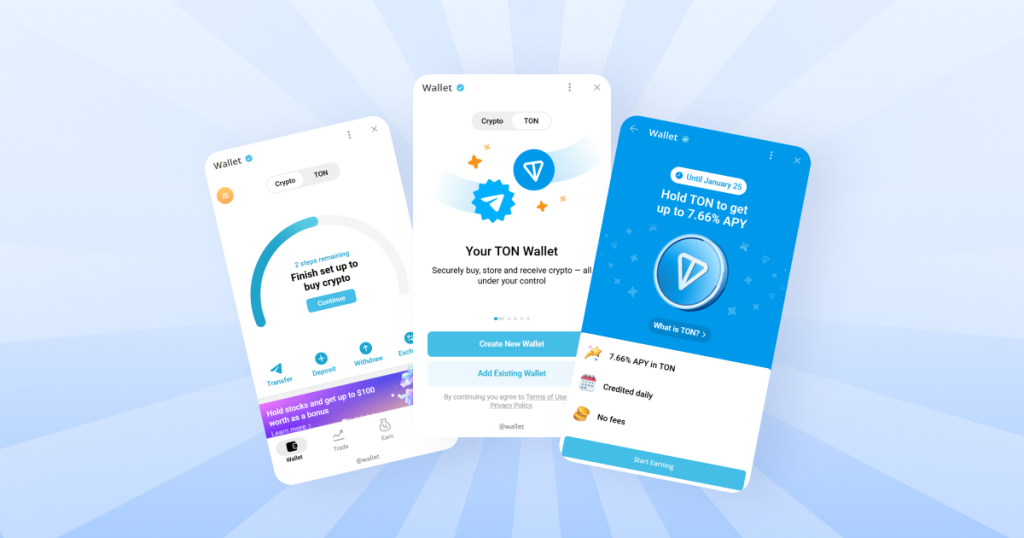

- Telegram Wallet: built-in USDT transfers inside chats.

- Binance Pay / Bybit Card / OKX Card: crypto-to-fiat spending without touching a bank.

- Strike (Lightning + USDT): popular in Argentina, El Salvador, Philippines.

- TON payments: growing fast due to Telegram’s massive user base.

Why it’s worth attention

Because this is the simplest real-world use case crypto has ever had. Check it.

Real benefits:

- Cheaper international payments: no wire fees, no SWIFT delays, no “3–5 business days.”

- Fewer barriers: no bank account needed, just a wallet.

- Protection from weak local currencies: many users in LatAm/Africa now store savings in USDT instead of local currency.

- Privacy & control: no random freezes, no surprise limits, no asking the bank for “permission.”

- Smooth UX: sending USDC is now as easy as sending a message, especially in Telegram or mobile wallets.

Potential for 2026

Crypto cards go mainstream

OKX, Bybit, Binance, Coinbase, and several regional platforms are rolling out more crypto cards that let you pay anywhere Visa or Mastercard works while your crypto converts automatically in the background. If you’re curious about how they stack up, we already did a full review of crypto cards — you can find it here.

Stablecoin payments spread to more regions

Usage is growing fast in Southeast Asia, Latin America, Africa, and Eastern Europe. These regions already lead in USDT adoption, and 2026 will likely push the trend further.

Stablecoins dominate remittances

Global remittances are an $860B+ market. Stablecoins beat banks and old-school providers like Western Union on both cost and speed, and that gap keeps widening.

More merchants start accepting USDT and USDC

Mainly online platforms, travel services, freelancers, digital marketplaces, and SaaS tools. It’s not mainstream retail yet, but it’s moving.

Wallets become more practical

Apps will add features people actually use: built-in swaps, cross-chain USDC transfers, sending money by username, recurring payments, bill splitting, and quick invoicing for freelancers.

Regulation finally adds some stability

Clearer rules → more trust → more adoption. That’s the direction stablecoins are heading in 2026.

7. Crypto security 2.0

Here we mean the shift from “you’re on your own” to real, consumer-grade protection inside wallets and apps.

Crypto security 2.0 includes things like transaction simulators, scam detection, risk scores, safer signing flows, and built-in recovery options.

Think of it as antivirus + fraud alerts + basic insurance, but for your wallet.

Real examples already available:

- Rabby Wallet: shows full transaction previews, risk warnings, and what will change in your wallet before you sign.

- Ledger, GridPlus Lattice, Trezor Safe 5: next-gen hardware wallets with clearer signing messages and better UX.

- Fireblocks / Coinbase WaaS: institutional-level MPC tech now being adapted for consumer wallets.

- Wallet Guard & Blowfish: protect users from malicious websites, fake approvals, and phishing.

- Metamask’s security alerts: improved scam-detection powered by Blockaid.

Why it’s worth attention

Crypto has always been risky, especially for beginners, with all the scams, fake tokens, malicious pop-ups, and confusing signing screens.

Security 2.0 tools might fix that by adding:

- real-time scam warnings

- automatic detection of malicious contracts

- clear transaction previews in plain English

- alerts when a website is suspicious

- safer wallet recovery options (MPC, social recovery, passkeys)

Traders finally get tools that catch mistakes before they become expensive.

Potential for 2026

Next year is shaping up to be a turning point for user protection.

Expect:

- AI-powered scam detection inside wallets that flags suspicious behavior instantly.

- Safe signing defaults, where risky contract interactions are blocked automatically.

- “Protected mode” wallets that limit what apps can do until you approve higher-risk actions.

- Simple recovery flows using passkeys or multi-device confirmation instead of seed phrases.

- Chain-wide reputation scores showing whether a contract or token is safe before you engage.

8. Gaming trends: on-chain loot, UGC worlds & fast L2s

Crypto gaming is shifting from giant AAA promises to lightweight, on-chain-first games built around assets, collectibles, and user-generated content.

In practice, this looks like:

- on-chain loot drops (weapons, skins, items)

- player-made worlds and quests

- marketplaces for in-game assets

- simple, mobile-friendly games powered by cheap L2s

Real-world examples that are already implementing it:

- Treasure / Arbitrum: an ecosystem of on-chain games with shared items and UGC mechanics.

- Parallel / Colony: games with deep lore and on-chain assets.

- Pixels (Ronin): farming + UGC loops with a strong token economy.

- Solana compressed NFTs: used by games to mint huge volumes of items cheaply.

- Loot Projects & MUD (Lattice): frameworks for fully on-chain game logic.

Why it’s worth attention

Because crypto gaming is finally doing what traditional games can’t:

- true ownership of items

- open marketplaces for skins and loot

- player-driven worlds that can’t be shut down

- creators earning from their in-game assets

- fast, cheap transactions thanks to modern L2s and Solana

These games are easy to join, earn from, and trade inside.

Potential for 2026

2026 will likely be the first real breakout year for on-chain gaming because the infrastructure is finally ready.

Expect:

- Mass adoption of compressed NFTs

Millions of items minted for cents → more loot, more collectibles. - UGC as a core mechanic

Players creating quests, maps, items, or mini-games that others can use — with rewards tied directly to usage. - Faster gaming-specific L2s

Chains optimized for real-time gameplay, cheap transactions, and large inventories. - Cross-game item liquidity

Skins and items that work across multiple games (Treasure’s ecosystem is leading here). - Simple, mobile-first experiences

Casual games with on-chain rewards built in.

Overall, crypto gaming in 2026 will be less about giant metaverse promises and more about small, fun, tradable worlds that grow through community contributions.

Final thoughts

Looking ahead to 2026, it’s clear the crypto space is shifting in a more practical direction. The industry feels less like a science experiment and more like a place where normal people can actually participate without feeling lost. Tools are getting easier to use, trends are becoming more grounded, and that is a good thing.

Still, none of this is guaranteed. The ideas covered here aren’t prophecies or insider leaks, just patterns that are hard to ignore after watching this market evolve for years. Some of these trends will grow faster than expected, others will fade, and a few new surprises will definitely show up along the way.

That’s how this industry works.

If 2025 taught us anything, it’s that crypto keeps reinventing itself, sometimes in ways nobody saw coming. And that’s exactly what makes 2026 worth paying attention to.