According to Statcounter, in India, nearly 80% of all web traffic comes from mobile, while desktops barely scrape past 20%. Well, no surprises here — nobody’s firing up a bulky PC when you can check your trading portfolio in a few taps while waiting for chai.

This guide breaks down the best apps for crypto trading in India, what makes them stand out, and what their pros and cons are. I’ll also make a general overview of the crypto trading status in India: is crypto trading legal in India, what there is to know about crypto taxes in India, and how to start crypto trading in India without headaches.

Crypto trading situation in India

Legal landscape and regulations

Today, the status of crypto trading in India is somewhat twofold: it’s neither banned nor free-for-all. India hasn’t outlawed crypto, but it also hasn’t given it a clear regulatory green light. The current regime treats cryptocurrencies as digital assets, not legal tender, and allows buying, selling, and holding under regulated conditions.

In 2025, cryptocurrencies are officially classified as Virtual Digital Assets (VDAs) under the Income Tax Act (Section 2(47A)). You can trade them, but you can’t use them to pay for your groceries or rent (meaning that they’re not currency).

Markets are regulated patchily. India leans toward a partial oversight model — exchanges must comply with rules, taxes, reporting, KYC/AML but there’s no sweeping law that fully governs all aspects of crypto yet.

Because rules evolve fast, some offshore exchanges have faced blocking orders or fines when they didn’t register locally or comply.

Key tax rules, reporting & TDS

Taxes are heavy and strict (yes, you heard that). Here are the essentials:

- Crypto gains (from selling, swapping, trading) are taxed at 30% flat, with no deduction allowed except the cost of acquisition.

- On top of that, there’s a 1% TDS (Tax Deducted at Source) on each transfer or transaction above a threshold (₹10,000 or ₹50,000, depending on the rule in force)

- Losses from crypto cannot be set off against other income (like salary) or carried forward in most cases.

- Gifts of crypto are taxable in the hands of the receiver.

The takeaway: the tax rules are rigid. If you trade, expect the government to take its cut automatically (via TDS) and demand your full records come tax time.

FIU registration, KYC / AML, and reporting

The government has pushed hard to bring exchanges under serious compliance. Here’s how:

- Every crypto platform operating in India, whether domestic or serving Indian users internationally, is required to register with FIU-IND (Financial Intelligence Unit of India) as a “reporting entity.

- Platforms must follow KYC/AML norms akin to traditional financial institutions: verify identity, address, monitor transactions, flag suspicious activity.

- All transfers (even small ones) may require remitter + beneficiary data (FATF travel rule applied).

- Exchanges must file periodic reports (suspicious transaction reports, etc.) under PMLA (Prevention of Money Laundering Act).

- Non-compliance has consequences: show-cause notices, URL blocking, fines.

Because of this, any app you pick should clearly state that it is FIU-registered and follows KYC/AML rules. If it’s vague or silent, that’s a red flag.

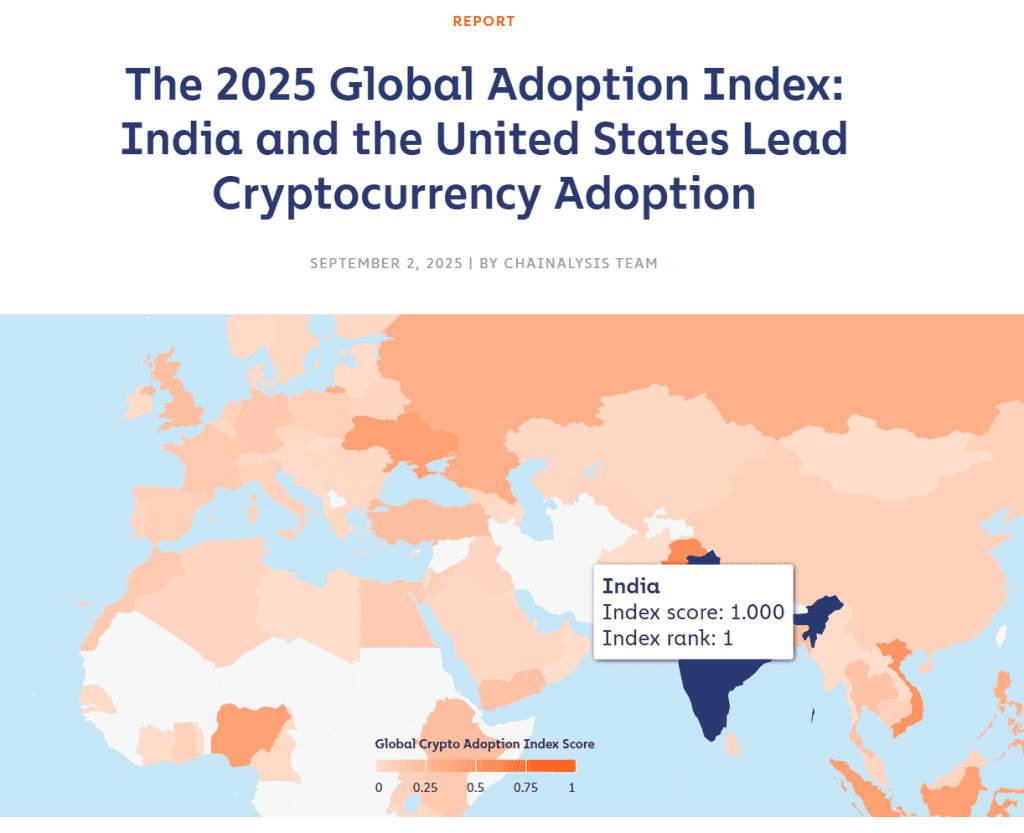

Market & adoption

The appetite for crypto in India is massive and growing. India now ranks #1 globally in the Chainalysis 2025 Global Crypto Adoption Index, with strength across retail, institutional, and DeFi metrics. In the 12 months to June 2025, crypto transaction volume across APAC jumped 69% year-on-year, with India being the driving force of that surge.

As per a 2025 estimate, India has ≈ 107 million crypto users, placing its penetration rate somewhere near 7% of the population. Earlier data from 2024 put the number of crypto owners at about 93 million.

Where adoption is happening

- Most crypto users are retail — small trades, speculation, asset play.

- Non-metro cities are seeing surprising growth. Reuters reports trading volumes doubling in smaller Indian cities like Jaipur, Lucknow, and Nagpur.

- Stablecoins and cross-border remittances are common use cases, especially when the rupee fluctuates.

- DeFi and yield strategies are still niche but growing, as more users chase passive returns rather than pure speculation.

Challenges & friction

- Banking & fiat rails: Some exchanges have faced trouble with banks refusing to process INR deposits/withdrawals due to compliance concerns.

- Trust & security: Big hacks (e.g. the 2024 WazirX hack, ~USD 234.9 million) hurt confidence.

- Tax burden & reporting complexity push some to stay underground or off-platform.

- UI and user education: Many first-time users find wallets, gas fees, and chain switching confusing.

- Regulatory opacity: Lack of clarity keeps many from going “all in.”

Best apps for crypto trading in India

Serious about getting into trading? Let’s pick a nice app for you.

With dozens of platforms fighting for attention, figuring out the best app for crypto trading in India isn’t just about flashy ads or sign-up bonuses. It’s about reliability, security, fees, and how smoothly you can trade INR against your favorite coins.

So, which app is best for crypto trading in India right now? Below, we review the most popular options actually used in the country. Each one has a working mobile app, solid adoption, and offers a different balance of features. Let’s check them out together.

CoinDCX

CoinDCX is one of the biggest names in crypto trading India. Founded in 2018 and backed by major investors, it’s built a reputation as a reliable and compliant platform. The app itself is clean, simple, and well-rated on both Android and iOS.

Key features

- Supports 500+ cryptos for spot trading.

- Futures trading with up to 20x leverage.

- INR deposits and withdrawals via UPI, bank transfer, and IMPS.

- Strong security setup with 2FA, withdrawal whitelisting, and cold storage.

- FIU-registered and KYC mandatory.

Pros

- One of the most trusted and liquid exchanges in India.

- Easy onboarding and simple INR deposits (big plus for beginners).

- Regular promotions, referrals, and staking options.

- Transparent fee structure (around 0.1%–0.2%).

Cons

- Futures leverage is capped at 20x, lower than some global apps.

- Limited advanced order types compared to Binance.

- Customer support response times can vary during high-volume periods.

CoinSwitch

CoinSwitch is one of India’s better-known crypto apps — part exchange, part aggregator. If you’re hunting for the best app for crypto trading in India, it often comes up.

Key features & highlights

- You can start trading with just ₹100.

- Supports 350+ cryptos across spot, futures, and now options.

- Futures maker/taker fees sit around 0.1% / 0.2% respectively.

- Options trading launched with ultra-low fees (starting ~0.015%) and multiple expiry cycles.

- INR deposits/withdrawals via UPI / bank transfers.

- FIU-IND registered; full KYC / AML.

Pros

- Very beginner-friendly and low barrier to entry (₹100 minimum)

- A wide variety of assets and now options make it more versatile

- Competitive futures / options fees, especially when trading volume grows

- Good liquidity since it connects you to multiple exchanges (aggregation helps)

- Transparent about compliance and security

Cons

- Spot trading fees can go up depending on your tiers — not always rock bottom.

- UX for advanced trading can feel a bit clunky compared to global apps

- Support can lag in peak times — many users report delays

- As with any app that aggregates, price slippage or latency might creep in

Mudrex

Mudrex is less “exchange only” and more “investment + automation + trading” hybrid. It leans toward users who want some hands-off exposure along with active trades.

Key features & highlights

- Supports 650+ cryptos (spot, futures, options) on its mobile app.

- INR deposits/withdrawals via UPI and bank transfers.

- Automated strategies: “buy the dip,” stop-loss / take-profit orders, recurring investments (crypto SIPs) via “Coin Sets.”

- Zero trading fees (in certain cases) on Coin Sets.

- Strong security: AES-256 encryption, 2FA, insurance on deposited funds.

- FIU-IND compliant KYC/AML practices.

- “Alpha” loyalty / tier program that lowers fees, offers perks.

Pros

- Great for semi-passive investors — you don’t need to trade every time, thanks to Coin Sets and automated tools.

- Competitive fees, especially with the new Alpha system (you can drop to ~0.03% on futures in favorable tiers)

- Broad asset support gives flexibility.

- Strong regulatory compliance and security posture.

- Tax reporting is easier: integration with ClearTax helps you generate crypto tax reports.

Cons

- Because of automation and “bundle” tools, you might lose control or incur slippage versus manual trades.

- Not every advanced order type or exotic derivative is as polished as in pure exchanges.

- Customer support and execution delays can surface under heavy network stress.

- The Alpha program is good if you trade a lot; if you’re low-volume, benefits are limited.

ZebPay

ZebPay is a long-standing player in the Indian crypto space. It offers a full mobile app and is still widely used — though it comes with its quirks. Here’s how it stacks up.

Key features & highlights

- Over 300 crypto coins available for trading.

- “Quick Trade” feature: instant buy/sell at visible rates, no waiting on order books.

- Perpetual futures with up to 50× leverage on INR pairs.

- Tiered maker/taker fees (from 0.45% down for higher volume users) for spot trading.

- Zero fees on fiat deposits.

- Fiat withdrawals carry a flat ₹15 fee.

- Monthly “membership fee” for inactive accounts (0.0001 BTC + 18% GST) unless you trade or use “Earn” features.

- Strong security claims: ~98% of funds held in cold storage, multi-sig, insurance, ISO-certified protocols.

Pros

- Good range of features for both casual and more active users (spot + futures)

- The mobile app is polished and supports standard trading tools (stop-loss, limit orders)

- Tiered fee structure gives incentives for volume traders (you can reduce fees with volume)

- Low fiat deposit fee is a plus for INR inflow

Cons

- That membership fee is a red flag: if you go a month without trading or using “Earn,” ZebPay may charge you.

- Some users complain about fee surprises or feeling nickel-and-dimed via these “inactive account” charges.

- The fee floor is relatively high for small traders: Quick Trade starts ~0.5%.

- Customer support delays have been flagged in user reviews.

Unocoin

Unocoin has been around since 2013, making it one of the earliest crypto platforms in India. It’s not the flashiest app, but it’s survived multiple market cycles and regulatory shake-ups.

Key features & highlights

- Supports 80+ cryptos, including BTC, ETH, and major altcoins.

- INR deposits via UPI, IMPS, and bank transfers.

- Recurring Buy Plan (RBP): lets you automate crypto purchases like a SIP.

- OTC desk for high-volume traders.

- Mobile app available on both iOS and Android with basic charts and order types.

- KYC and PAN card verification required.

- FIU-IND registered and compliant.

Pros

- Long track record — one of the oldest exchanges still running in India.

- Simple app interface, easy for beginners.

- Automated SIP-style plan is good for disciplined investing.

- OTC desk is helpful for big trades without slippage.

Cons

- Far fewer coins compared to CoinDCX or CoinSwitch.

- App design feels dated compared to newer platforms.

- Trading fees are higher (around 0.5%) than the market average.

- Limited advanced features — no futures, no options.

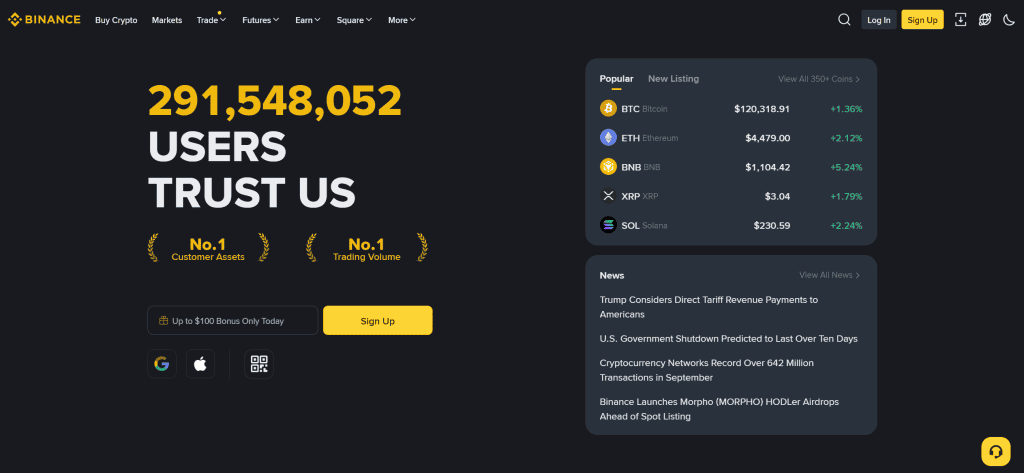

Binance

Binance is a heavyweight globally — the question is: how well does it play in India, and at what cost?

Key features & highlights

- The Binance app supports 350+ crypto assets, with advanced charts, alerts, recurring buys (DCA), staking, etc.

- For Indian users, direct INR deposits/withdrawals are disabled (due to regulatory issues), but you can use P2P trading in INR to bridge the gap.

- Binance has registered with India’s FIU (Financial Intelligence Unit) to comply with local regulations.

- They were fined ~ ₹188 million (~USD 2.25 million) for past non-compliance before registration.

- KYC / AML is enforced, as with any major exchange.

- The app is polished, high-quality, with global liquidity and features that many local apps don’t match.

Pros

- Access to a vast selection of cryptos, deep liquidity, and global markets.

- The app’s features are top-tier — from staking to margin products (where allowed) to cross-chain swaps.

- As a global player, Binance often innovates faster (new listings, features).

- Using P2P INR bridges makes it usable even when direct fiat access is blocked.

Cons

- The biggest drawback: you can’t deposit or withdraw INR directly through Binance in India. You must rely on P2P or route via stablecoins, which adds friction and risk.

- That regulatory history and fine are red flags. Just because they’re FIU-registered now doesn’t erase the past.

- Fees and spreads on P2P trades can vary and sometimes be higher (especially in less liquid pairs).

- Some advanced features (like futures or derivatives) might be restricted or limited for Indian accounts depending on local compliance rules.

- Customer support and responsiveness in India may lag behind local exchanges.

Comparison of top crypto trading apps in India

Choosing the best crypto trading app in India depends on more than hype. Fees, coin variety, ease of use, and how smooth the KYC process is all matter.

Here’s a side-by-side look at the leading platforms to help you decide which one fits your needs.

| Platform | Fees* | KYC / Identity Verification | Coin Support | Mobile app | Ease of use for beginners |

| CoinDCX |

|

KYC required | 100+ (some sources report 500+) | Android & iOS | High — clean UI, simple flows |

| CoinSwitch |

Varies: 0% to ~0.49% depending on pair and volume |

KYC required | 300+ | Android & iOS | Very beginner-friendly |

| Mudrex |

|

KYC required | 650+ | Android & iOS | Good for semi-passive investors |

| ZebPay |

|

KYC required | 100+ | Android & iOS | Decent — “Quick Trade” helps beginners |

| Unocoin |

|

KYC required | 50+ | Android & iOS | Simple — better for buy & hold |

| Binance |

|

KYC required | 500+ | Android & iOS | Medium — powerful but harder for INR beginners |

*Fees are typical for spot/futures trades. Extra charges (withdrawals, spreads, slippage) may apply.

Safety tips for using crypto apps in India

Trading on mobile is convenient, but don’t forget the risks. A solid app helps, but how you use it matters just as much. Here are some non-negotiables if you want to trade smart in India:

- Stick to FIU-registered apps

Exchanges registered with India’s Financial Intelligence Unit (FIU-IND) are far safer choices. CoinDCX, Mudrex, CoinSwitch, ZebPay, Unocoin, and even Binance (after regulatory pressure) are all FIU-registered. If an app isn’t on that list, skip it.

- Always complete KYC yourself

Never outsource this step to “agents” or shady intermediaries. If an app doesn’t ask for proper ID, that’s a red flag.

- Enable two-factor authentication (2FA)

A password alone isn’t enough. Use app-based 2FA (like Google Authenticator), not just SMS.

- Don’t keep all your funds on exchanges

Mobile apps are for trading, not long-term storage. For larger amounts, move your crypto to a hardware or non-custodial wallet.

- Test with small deposits first

Before moving serious money, send a small amount to check how deposits and withdrawals work.

- Watch out for fake apps

Download only from official app stores and verify developer details. Scam clones exist.

- Keep tax records

With crypto taxes in India at 30% plus TDS, every transaction counts. Export statements regularly — don’t wait until filing season.

- Stay alert to phishing

Don’t click on links promising “bonus tokens” or giveaways. Support will never DM you first.

Bottomline

Crypto trading in India is alive and growing rapidly on mobile. Although the rules are strict and the taxes are heavy, millions of new traders keep diving in.

If you’re looking for the best app for crypto trading in India, stick with registered, transparent platforms that take security seriously. CoinDCX, CoinSwitch, and Mudrex cover most needs for everyday traders. ZebPay and Unocoin work well for simpler buy-and-hold setups, while Binance is still unbeatable for global access.

In short: Pick an app that fits your style and never skip the basics like 2FA, KYC, and tax records.