When you’re just starting with crypto, it’s not easy to find the right exchange. Between all the options, flashy features, and unfamiliar terms, it’s hard to know who to trust and what actually works for beginners. Here’s where our KuCoin review 2025 comes up.

Known for listing hundreds of cryptocurrencies (many before they appear somewhere else), offering built-in trading bots, and keeping fees low, KuCoin has grown into one of the most widely used exchanges in the world. It now serves over 40 million users in 200+ countries. It’s a serious number.

But is bigger always better? And more importantly, is it the right platform for you?

In this review, we’ll give you a full, honest breakdown of KuCoin:

- What it does well

- Where it falls short

- How it compares to other major platforms

What is KuCoin? A quick overview

KuCoin is a global cryptocurrency exchange that officially launched in September 2017. It was founded by Michael Gan and Eric Don, two blockchain enthusiasts who wanted to create a user-friendly platform accessible to everyone.

The idea was born in 2013 when they recognized the complexities and barriers in existing crypto trading platforms. Their goal was to build “The People’s Exchange,” which would make crypto trading simpler worldwide.

Where is KuCoin based? KuCoin is headquartered in Mahe, Seychelles, although it operates internationally across 200+ countries and regions.

As of early 2025, the platform boasts over 40 million registered users across more than 200 countries and regions.

KuCoin is a comprehensive crypto ecosystem. It offers various services such as:

- Spot trading

- Margin trading

- Futures trading

- Staking

- Lending

And much more. It’s popular among both beginners and experienced traders.

Image from Kucoin

However, KuCoin has faced regulation challenges, particularly in the United States. In January 2025, the exchange pleaded guilty to operating as an unlicensed money-transmitting business in the US and agreed to pay nearly $300 million in fines and forfeitures. As part of the settlement, KuCoin will cease operations in the US market for at least two years.

Despite these setbacks, KuCoin continues to operate globally. It’s focusing on compliance and aiming to re-enter the US market in the future with proper licensing.

Core features: What KuCoin brings to the table

KuCoin isn’t just a place to buy and sell crypto. Here’s what you’ll find inside the KuCoin platform:

1. Huge variety of cryptocurrencies

One of KuCoin’s biggest strengths is the sheer number of coins it supports. As of 2025, KuCoin lists over 1,000 cryptocurrencies and 1,200+ trading pairs.

That includes major coins like Bitcoin and Ethereum, but also many new and smaller altcoins that aren’t yet available on bigger exchanges like Coinbase or Kraken. This makes KuCoin popular with users looking to invest in early-stage projects or explore beyond the usual top 20 tokens.

Bottom line: If you want access to a wide range of coins (especially new or trending ones), KuCoin gives you more choices than most platforms.

2. Spot, margin & futures trading

KuCoin supports multiple types of trading, which you can choose based on your experience level and goals:

- Spot trading: Buy and sell crypto at current market prices. This is the most basic and beginner-friendly option.

- Margin trading: Trade with borrowed funds to potentially increase your profits, but also your risks. KuCoin offers up to 10x leverage on select trading pairs.

- Futures trading: For advanced users, KuCoin offers up to 100x leverage on futures contracts. These are bets on whether a coin’s price will go up or down. This is often used by day traders and professionals.

There’s also a “Lite Futures” mode that simplifies the interface for newer users.

3. Free built-in trading bots

One of KuCoin’s standout features is its free trading bots. Unlike many other platforms, you don’t need to download anything or pay extra.

You can use crypto trading bots like:

- Grid trading bot: Buy low and sell high in a price range.

- DCA bot (Dollar-Cost Averaging): Invest small amounts over time.

- Martingale bot: A riskier strategy that increases trade size after losses.

- AI smart bot: Uses KuCoin’s market data to automate trades.

Each bot includes pre-set templates, so even beginners can start experimenting without needing coding or strategy-building skills.

4. KuCoin Earn: Make passive income on your crypto

Don’t want to trade all day? KuCoin offers several ways for passive income with crypto. You can earn rewards just by holding assets:

- Flexible savings: Earn daily interest on select coins. Withdraw anytime.

- Staking: Lock your crypto to support the network and earn rewards.

- Crypto lending: Lend your crypto to margin traders and earn interest (often 8–12% APY).

- Dual investment & shark fin: More advanced products offering higher returns but with more risk.

KuCoin also lets you stake its native token KCS to get daily bonus rewards.

5. A platform that works anywhere

KuCoin has both a desktop site and a mobile app (iOS & Android). You can do almost everything from your phone, from trading and earning to using bots and setting up alerts.

Highlights:

- Clean, modern interface (with beginner-friendly modes like “Fast Buy”)

- Supports 20+ languages, including Spanish, Chinese, Russian, and Turkish

- TradingView charts with technical tools for experienced users

6. Buy crypto with fiat

Even though KuCoin doesn’t support direct bank transfers, you can still buy crypto with your local currency using:

- Credit/debit cards

- Apple Pay

- Third-party services like Simplex or Banxa

- Peer-to-peer (P2P) trading with other users in 60+ currencies

However, KuCoin doesn’t offer direct fiat withdrawals. If you want to cash out your crypto into real money, you’ll need to:

- Use the P2P market, or…

- Transfer to another exchange (like Binance or Coinbase) that supports bank withdrawals

KuCoin fees: Low-cost trading or hidden charges?

KuCoin is often praised for having some of the lowest trading fees in the industry. But how cheap is it really? And are there any hidden costs to watch for?

Let’s break KuCoin fees down so you know exactly what you’re paying for.

Trading fees

At the most basic level, KuCoin charges 0.1% per trade for both makers and takers on the spot market.

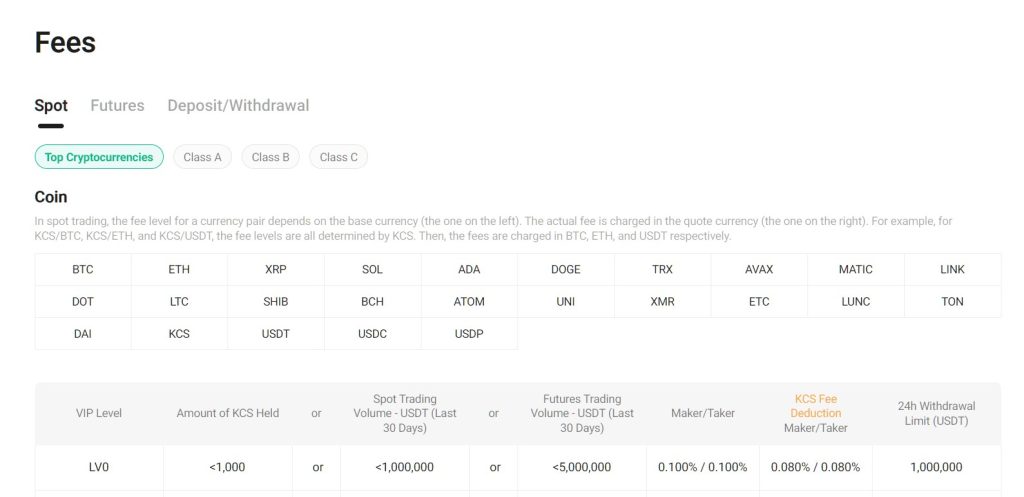

Image from Kucoin

That means if you trade $100 worth of crypto, you’ll pay just $0.10 in fees. It’s much cheaper than beginner platforms like Coinbase, which can charge up to 0.5%–1.5% per trade.

You can reduce KuCoin’s fees even further by:

- Paying with KCS (KuCoin’s own token): saves 20% on trading fees.

- Trading more: KuCoin offers VIP levels that give you discounted fees the more you trade.

On the futures market, fees are:

- Maker: 0.02%

- Taker: 0.06%

These are competitive with other major exchanges like Binance and Bybit.

What does maker/taker mean?

- Maker = you place a limit order that doesn’t fill right away.

- Taker = your order fills instantly at market price.

KuCoin deposit and withdrawal fees

- Crypto deposits: Free. No KuCoin fee, only network fee if applicable.

- Crypto withdrawals: Fee depends on the coin. For example:

- BTC: ~0.0002 BTC

- ETH: ~0.005 ETH

KuCoin doesn’t charge extra here, these are just the network fees required to send the transaction.

However, KuCoin doesn’t support direct fiat withdrawals, which is a limitation.

Buying with a card or a third-party provider

Buying crypto with a debit or credit card is convenient, but the fees vary depending on the payment provider. These are typically:

- 2%–5% of the total amount

- Charged by services like Simplex, Banxa, or Mercuryo (not KuCoin directly)

KuCoin shows you the provider and the exact fee before you confirm a purchase, so you’re not caught off guard.

Any hidden fees?

Not really. KuCoin is transparent about most fees. The main “hidden” costs are really just extra steps or third-party charges, like:

- High fees from card processors

- No direct cash-out option

- Potential spread on P2P or Convert trades (price difference between buy and sell)

How KuCoin compares to other exchanges

| Exchange | Spot trading fee | Crypto deposit | Crypto withdrawal | Fiat withdrawal |

| KuCoin | 0.1% | Free | Varies by coin | Not available |

| Binance | 0.1% | Free | Varies by coin | Available in many regions |

| Coinbase | 0.5% – 1.5%+ | Free | High | Easy cash-out |

| Bybit | 0.1% | Free | Varies | Not available in most countries |

Safety & regulation: How secure (and legal) is it?

With any crypto platform, security and regulation matter just as much as features and fees, if not more.

So, is KuCoin safe? And how does it hold up when it comes to playing by the rules?

Security: What’s in place to protect you?

KuCoin has stepped up its security game significantly since suffering a major hack in 2020, where roughly $280 million in crypto was stolen. Thankfully, the exchange recovered over 80% of the stolen funds and covered all user losses, earning some respect for how it handled the crisis.

Since then, KuCoin has implemented:

- Two-factor authentication (2FA)

- Withdrawal passwords

- Anti-phishing codes

- Cold wallet storage for most funds

- Proof of Reserves audits (so users can verify the exchange actually holds the crypto it claims to)

It also runs bug bounty programs and has achieved SOC 2 Type II certification, a respected industry audit for data protection.

Bottom line: KuCoin’s security today is strong, though it had to learn the hard way. Use all available security features to protect your account.

KYC: Identity verification is now required

Until recently, KuCoin was known for allowing users to trade without verifying their identity. It was very attractive for privacy-focused users.

That changed in 2023. KuCoin now requires KYC (Know Your Customer) verification to use most of its features.

You’ll need to submit:

- A government-issued ID

- A selfie or video verification

- Possibly proof of address

Regulation: Where KuCoin stands globally

Here’s where things get more complicated.

KuCoin is not licensed in the United States. If you’ve been wondering things like “Is KuCoin available in the USA?” or “Can I use KuCoin in the US?” — the short answer is no.

In early 2025, KuCoin pleaded guilty to operating as an unlicensed crypto business in the US and agreed to pay nearly $300 million in fines and must stop serving US customers for at least two years.

When will KuCoin be available in the US? No sooner than 2027 at the earliest.

It’s also faced scrutiny or bans in:

- Canada (banned in Ontario)

- Netherlands (warning from regulators)

- UK (on the Financial Conduct Authority’s warning list)

However, KuCoin is starting to pursue regulation in some areas:

- It recently registered with India’s FIU (Financial Intelligence Unit)

- It’s seeking a MiCA license in the EU (Austria)

KuCoin operates legally in many countries, but its offshore status means it’s not as strictly regulated as exchanges like Coinbase or Kraken. This gives it more freedom, but it also adds more risk.

KuCoin customer support: Helpful or frustrating?

No matter how smooth a platform seems, the real test comes when something goes wrong. So, how does KuCoin’s support team hold up?

Support channels available

KuCoin offers a few ways to get help:

- Live chat (available 24/7, starts with a chatbot but can connect to a human)

- Email ticket system (for more complex issues)

- Help Center with guides and FAQs

- Community support via Telegram, Discord, and X (Twitter)

You can also find step-by-step tutorials and a searchable knowledge base on their website.

User reputation: What the community says

What do real users think of KuCoin? The feedback is mixed. And that’s important to understand if you’re deciding whether to trust the platform.

What people like

Many users praise KuCoin for:

- Low trading fees

- Massive variety of coins

- Access to early altcoin listings

- Built-in trading bots

- User-friendly mobile app

On Google Play, the KuCoin app holds a solid 4.4-star rating, with users noting its smooth experience and wide functionality.

Reddit threads and YouTube reviews often highlight how KuCoin strikes a balance between beginner access and advanced features.

Common user complaints

This is where KuCoin has some work to do.

On Trustpilot, KuCoin has a low rating (around 1.3 out of 5 stars), and many complaints are about support delays or generic replies.

The biggest user complaints include:

- Poor customer support response times

- Withdrawal delays or limits

- Difficulties during identity verification (KYC)

- Lack of fiat cash-out options

To be fair, most large crypto exchanges, including Binance and Bybit, also have low Trustpilot scores (though not quite as low as Kucoin). It’s likely because people are more likely to post reviews when something goes wrong.

KuCoin pros and cons: A balanced summary

Every exchange has its strengths and weaknesses. Here’s a clear look at where KuCoin is great and where it still needs to improve.

Kucoin pros: What it does well

- Low trading fees: Just 0.1%, with discounts if you use KCS

- Huge coin selection: 1,000+ cryptocurrencies, including rare and trending tokens

- Advanced trading tools: Margin, futures, bots, copy trading (all in one platform)

- Passive income options: Staking, savings, lending, and structured products

- KuCoin app and language support: Beginner-friendly, with 20+ interface languages

- Proof of Reserves + 2FA: Transparent and layered security features

- Fast altcoin listings: One of the best exchanges to catch new coins early

KuCoin cons: Where it falls short

- No direct fiat withdrawals: You can buy crypto easily, but cashing out takes extra steps

- Not licensed in the US: Recently settled a major case and currently blocks US users

- Customer support can be slow: Many users report delayed or unhelpful responses

- Past security breach: Big hack in 2020 (though user funds were recovered and systems upgraded)

- KYC now required: No longer usable without ID verification

- Too complex for total beginners: So many features can feel overwhelming at first

Summary: KuCoin is great for users who want deep crypto access and low fees. But it’s not the best pick if you need simple cash-outs, fast support, or tight regulatory protection.

Final verdict: Should you use KuCoin?

KuCoin is one of the biggest names in crypto for a reason. It offers an impressive mix of low fees, wide coin selection, and advanced features like trading bots, staking, and futures. And it’s all packed into a platform that works across both desktop and mobile.

But it’s not perfect.

If you’re a beginner looking for the simplest way to buy crypto and cash out to your bank, KuCoin might feel a bit too complex. And if you live in the US or want a platform with strong regulatory oversight and fast customer service, you’ll likely be better off elsewhere.

On the other hand, if you’re outside the US, want access to smaller coins, and are comfortable taking a few extra steps to manage your funds, KuCoin delivers strong value. Especially if you’re ready to move beyond entry-level exchanges.

Final thoughts: Start small. Use two-factor authentication. Take time to explore features like KuCoin Earn or bots before diving in. The platform has a lot to offer, but only if you use it wisely.