Centralized vs Decentralized Crypto Exchanges: Benefits and Risks of Each

Vuk Martinovic

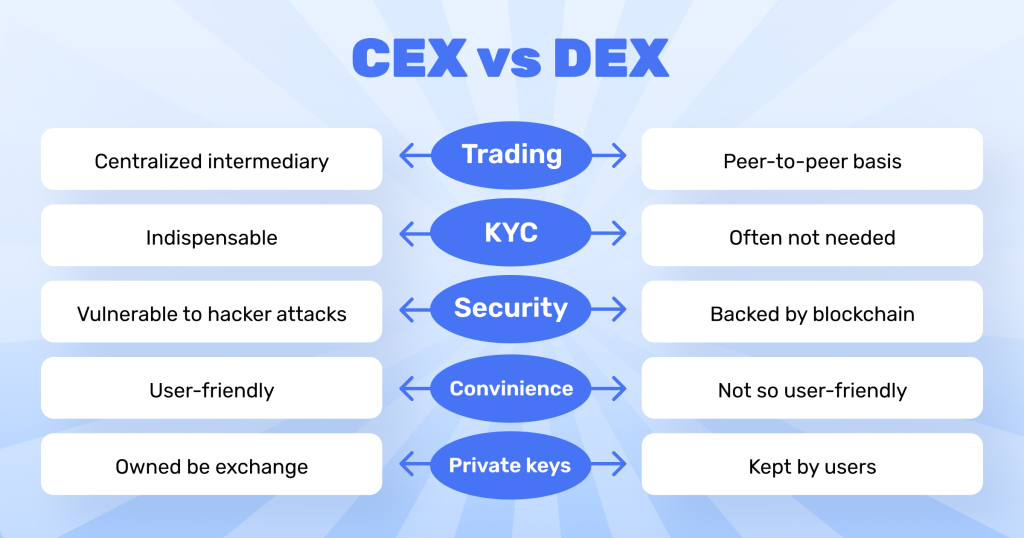

When starting with crypto, you’re faced with a huge decision: choosing between centralized and decentralized exchanges.

Centralized exchanges, like Coinbase and Kraken, offer a user-friendly experience with high liquidity as well as customer support. However, they also come with security risks and privacy concerns due to their custodial management of your assets.

On the other hand, decentralized exchanges, such as Uniswap and Pancake Swap, provide improved security and privacy. They let you control your private keys and enable anonymous trading. But, they have their own set of challenges, such as lower liquidity and potential smart contract vulnerabilities. Which path will you choose?

Key takeaways

- Control and security: Centralized exchanges (CEXs) manage users’ private keys and funds, making them susceptible to large-scale hacks. Decentralized exchanges (DEXs) let users retain control, reducing large-scale risks.

- Liquidity and usability: CEXs offer higher liquidity and user-friendly interfaces, making them ideal for beginners. DEXs often have lower liquidity and more complex interfaces, and they require more technical expertise.

- Regulatory compliance: CEXs adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, providing security but potentially compromising privacy. DEXs typically operate without these requirements.

- Fees and autonomy: DEXs often have lower transaction fees and provide greater autonomy in transactions, while CEXs have higher fees but offer customer support.

- Operational risks: CEXs are vulnerable to single points of failure and regulatory restrictions, while DEXs face risks from smart contract vulnerabilities and individual security responsibilities.

Centralized crypto exchanges explained

Centralized crypto exchanges act as intermediaries in cryptocurrency transactions, bridging buyers and sellers while managing user funds. They’re online platforms that typically offer high liquidity and fast transaction speeds, which is what makes them attractive to traders.

To use a CEX, you’ll need to deposit your cryptocurrency into a custodial wallet, which means the platform controls the private keys to your assets. This setup allows for user-friendly interfaces and services like customer support and regulatory compliance through Know Your Customer procedures. All of this can provide a sense of legitimacy, as the platforms are in charge of security.

However, there are risks involved with CEXs. Their custodial nature makes them vulnerable to hacking incidents and issues with regulators, which can lead to you losing your funds or hacking.

Also, the fee structures of CEXs often include trading fees, withdrawal fees, and may have tiered rates depending on trading volume. This can negatively affect your profits.

Despite these risks, centralized crypto exchanges remain popular due to their convenience, liquidity, and accessibility.

Main benefits of centralized crypto exchanges

- Easy to use: CEXs have simple interfaces with clear dashboards and one-click buy or sell options. This makes them user-friendly, even for beginners.

- High liquidity: Because many people trade on CEXs, you can buy or sell quickly without changing the asset’s price too much, even when the market is volatile.

- Variety of cryptocurrencies: Many CEXs offer a wide range of cryptocurrencies, so you can easily diversify your investment portfolio. For example, Kraken has over 200 cryptocurrencies for trade.

- Advanced trading options: Features like margin trading and futures contracts allow you to use more complex trading strategies that are usually not available on decentralized exchanges.

- Regulatory compliance: CEXs often follow Know Your Customer and Anti-Money Laundering regulations. This can make the platform seem more secure and trustworthy to users.

- Customer support: Centralized exchanges usually have customer service teams that can help you solve problems quickly, improving your overall trading experience.

Risks of centralized exchanges

- Security risks: Since CEXs hold your funds in their own wallets, they can be targets for hackers. This means there’s a risk you could lose your assets if the exchange is hacked, even though you did nothing wrong.

- Lack of control: You don’t have control over your private keys. You have to trust the exchange to keep your assets safe and manage them ethically and properly.

- Privacy issues: CEXs often require you to provide personal information for KYC procedures. This information could be at risk if there’s a data breach.

- Single point of failure: Because they rely on central servers, technical problems or heavy user traffic can cause the exchange to go down or stop working temporarily.

- Regulatory limitations: Compliance with regulations might limit how freely you can trade. There could be restrictions on certain activities and limits on how much you can withdraw.

Decentralized crypto exchanges explained

Decentralized exchanges offer a fundamentally different approach to cryptocurrency trading. They prioritize user autonomy and security over convenience and high liquidity. When you trade on a DEX, you’re dealing directly with another user, so there’s no need for intermediaries.

This peer-to-peer model guarantees that you keep full control over your private keys. This enhances your security but also makes you responsible for safeguarding your assets. Essentially, your security is in your hands.

Trading on DEXs is facilitated by smart contracts on blockchain platforms, which automate the trading process to guarantee transparency and security in transactions. However, this exposes you to risks associated with unverified smart contracts.

Also, DEXs don’t require a KYC process. This makes trading anonymous and provides greater privacy compared to centralized exchanges. While DEXs provide these benefits, they often suffer from lower liquidity, which can impact trade execution speed and efficiency.

You need to consider this trade-off between autonomy and liquidity when choosing a DEX over a centralized exchange.

Main benefits of decentralized crypto exchanges

- Control over your assets: You keep your private keys, so your funds aren’t held by an exchange. This makes you responsible for your own funds and security.

- Privacy and anonymity: DEXs don’t require personal information, so you can trade without sharing your identity.

- Access to more niche cryptocurrencies: DEXs often list new or less common tokens that might not be available on centralized exchanges.

- Global accessibility: Anyone with internet access can use a DEX, without worrying about regional restrictions or regulations.

- Transparency: All transactions are recorded on the blockchain, so you can verify trades and trust that they are carried out fairly.

Risks of decentralized exchanges

- Responsibility for security: You’re in charge of keeping your private keys safe. If you lose them or they get stolen, your funds could be gone permanently.

- Smart contract vulnerabilities: If there are bugs or security issues in the smart contracts, you could lose funds.

- Lower liquidity: Fewer users may result in slower trades and possible price changes while your trade is being processed.

- Complex user interfaces: DEXs can be more complicated to use, which might be confusing for beginners.

- Regulatory uncertainty: Future government regulations could affect how DEXs operate, possibly leading to changes in the services they offer.

Choosing the right exchange

To choose the right exchange for your crypto trading needs, you need to keep in mind several critical factors.

When considering centralized vs decentralized exchanges, think about your need for ease of use versus control over your private keys.

Centralized exchanges offer user-friendly interfaces, but they hold your private keys, making you reliant on their security measures. In contrast, decentralized exchanges require more technical knowledge but give you full control over your private keys and funds.

Assess the importance of liquidity in your trading strategy. CEXs generally provide higher liquidity, resulting in faster order execution. DEXs may have lower liquidity levels, which can impact the speed and pricing of your trades.

Consider the regulatory environment and fee structures. CEXs are subject to compliance requirements and often charge transaction and withdrawal fees. DEXs operate with less regulatory oversight but may charge gas fees that vary depending on network congestion.

Ultimately, weigh the risks of security. CEXs are more vulnerable to hacks due to centralized control. DEXs typically have lower risk of large-scale breaches, but they expose users to smart contract vulnerabilities.

Carefully evaluate these factors and determine what is most important to you. This will help you choose the right exchange for your needs.

The bottom line

Centralized vs decentralized exchanges has long been debated in crypto. Both offer different things, and, unfortunately, it’s just not easy to say that one is clearly better than the other.

When choosing between centralized and decentralized crypto exchanges, weigh the benefits and risks of each.

Centralized exchanges offer high liquidity and user-friendly interfaces but expose you to security threats and privacy concerns. Decentralized exchanges provide enhanced security and control over private keys but face challenges like lower liquidity and smart contract vulnerabilities.

Your decision depends on your priorities: convenience, control, liquidity, and security. Evaluate these factors to select the exchange that best fits your needs.