Paper Trading Simulator: 6 Tools to Practice Stocks, Forex & Crypto

Jane Savitskaya

Paper trading, also known as demo trading, is trading without real money. You buy, sell, and test strategies in a simulated market where losses are painless and profits don’t count.

It started with stock traders tracking imaginary trades on paper. Now it’s built into most modern platforms: stock brokers like Webull & charting tools like TradingView, and even gamified apps like Cryptomania.

The idea is simple: practice first, risk later. You can test a new strategy, learn market basics, or just see how your “I knew it would go up” instincts hold up against real data —paper trading lets you do it safely.

In this guide, we’ll break down how paper trading works, how to start, and which simulators actually help you learn instead of wasting your time.

How does paper trading work?

At its core, paper trading is just simulated investing. The platform gives you a virtual balance — usually something like $100,000 in play money, and lets you trade real market data in real time. You can buy stocks, short crypto, test forex pairs, or play with options, all without touching your actual funds.

The mechanics are the same as real trading:

- You choose an asset

- Decide how much to invest

- Set entry and exit points

- Track your performance

The difference is that there’s no real gain or loss. It’s your safe zone for trial and error.

Most paper trading simulators mirror live market conditions closely enough to give you a realistic experience: price movements, volatility, and even order types are often identical to what you’d see on a real exchange. Some platforms, like 3Commas, even let you test automated bots or strategies in a sandbox environment before going live.

It’s not a video game, though. Paper trading works best when you treat it like the real thing. That means tracking results, reviewing mistakes, and learning discipline.

Is paper trading free?

In most cases, yes, paper trading is completely free. The whole point is to let you practice before committing real funds, so charging for that wouldn’t make much sense.

Platforms like Webull, TradingView, MetaTrader, and Cryptomania all offer free access to simulated trading. You can open an account, get a virtual balance, and start placing trades within minutes.

Some brokers might lock advanced tools, real-time market data, or premium features behind a paywall, but the basic paper trading functionality almost always costs nothing.

Best paper trading simulators and platforms in 2025

There’s plenty of paper trading tools out there, but not all of them make sense for beginners. Each platform offers a different kind of experience: on one, you get professional setups like thinkorswim; on another, relaxed, game-style learning like Cryptomania.

Here’s a quick overview of the best simulators across different markets and how beginner-friendly they are.

| Platform | Best For | Markets | Beginner-Friendly |

| Webull | Stock & options traders | Stocks, ETFs, Options, Futures | ⭐⭐⭐⭐☆ |

| TradingView | Chart-driven strategy testing | Stocks, Forex, Crypto, Indices | ⭐⭐⭐⭐☆ |

| Charles Schwab | Experienced traders | Stocks, Options, Futures, ETFs | ⭐⭐☆☆☆ |

| E*TRADE | Options & advanced strategies | Stocks, Options | ⭐⭐☆☆☆ |

| MetaTrader (MT4/MT5) | Forex traders | Forex, CFDs, Commodities, Indices | ⭐⭐⭐☆☆ |

| Cryptomania | New crypto traders & learners | Crypto only | ⭐⭐⭐⭐⭐ |

Webull paper trading simulator

Webull offers a free paper trading mode with unlimited virtual cash and access to real-time market data. You can practice trading stocks, ETFs, options, and even futures (depending on your region) using the same interface and tools as in a live account.

Features

- Available on both desktop and mobile.

- Supports market and limit orders, chart analysis, and portfolio tracking.

- Provides over 60 technical indicators and multiple charting tools.

- Real-time quotes mirror live market conditions.

- Lets users test strategies across different asset classes with zero risk.

Limitations

- Execution in paper mode isn’t always identical to real trading conditions — orders may fill more easily than they would in reality.

- Some features (like specific order types or asset categories) may vary depending on your region.

- Like any simulator, it can’t reproduce the emotional pressure of real money trading.

Webull’s simulator is ideal for beginners learning order types or traders testing new strategies in a realistic environment.

For a deeper look into Webull’s tools, fees, and live trading experience, check out our detailed Webull review.

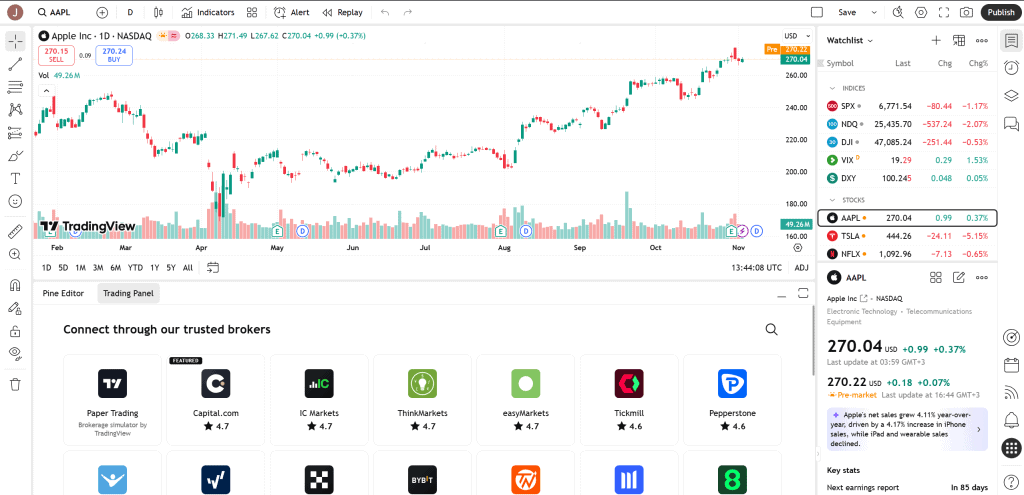

TradingView paper trading

TradingView’s paper trading mode is free and works with your existing account. You get a virtual balance of $100,000 by default, which you can reset anytime. It uses live market data from TradingView’s charting engine, so trades look and feel very real.

Features

- Fully integrated with TradingView’s charts: you can place simulated trades directly from the chart.

- Supports all major asset classes: stocks, forex, crypto, and indices.

- Real-time price tracking with advanced charting tools and technical indicators.

- Lets you test strategies manually or with scripts using Pine Script.

- Available on web, desktop, and mobile apps.

Limitations

- Doesn’t support order routing to real brokers since it’s a standalone simulator.

- Execution may differ slightly from live conditions, especially for high-volatility assets.

- Data access depends on your plan — free accounts have delayed data for some exchanges.

TradingView is perfect for traders focused on technical analysis. You can test setups, fine-tune entry points, or backtest indicators before applying them in real trading.

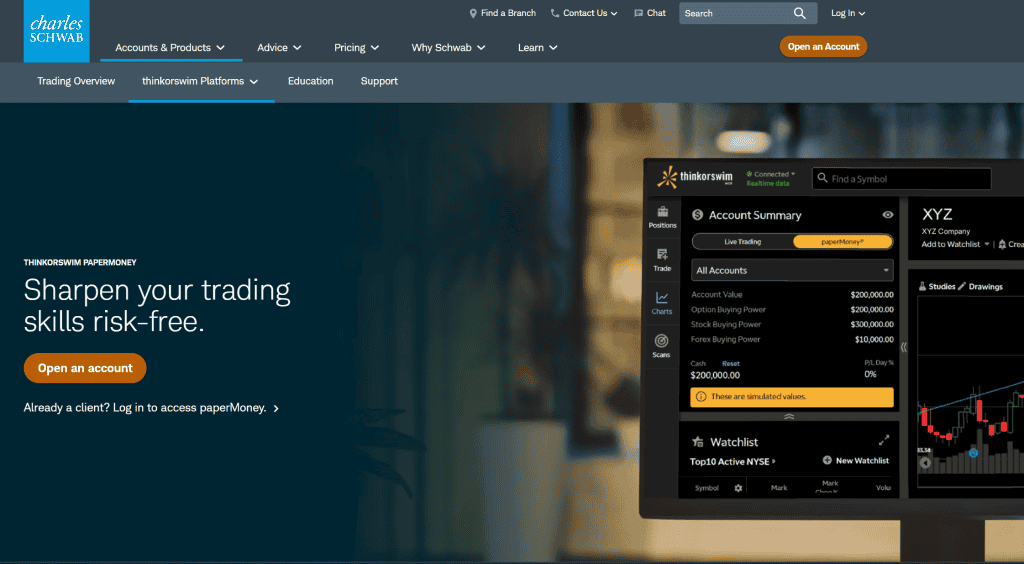

Charles Schwab paper trading

Does Charles Schwab have paper trading? Yes. It’s one of the most powerful simulators available, designed for serious traders who want to test complex strategies.

Features

- Free access for all Schwab clients through the thinkorswim desktop, web, and mobile platforms.

- Comes with a fully functional paperMoney® mode that replicates live market conditions using virtual funds.

- Supports trading in stocks, options, ETFs, and futures.

- Includes advanced charting, real-time data, and professional-level analysis tools.

- Perfect for testing multi-leg options trades, automated strategies, and conditional orders.

Limitations

- Available only to users with a Charles Schwab account.

- Interface can feel overwhelming for beginners because it’s built for active traders.

- Some users report occasional data delays during peak market hours.

Schwab’s thinkorswim simulator is ideal for traders who want a realistic environment with deep analytical tools. It’s less about “learning the basics” and more about refining execution, strategy, and timing in a professional setup.

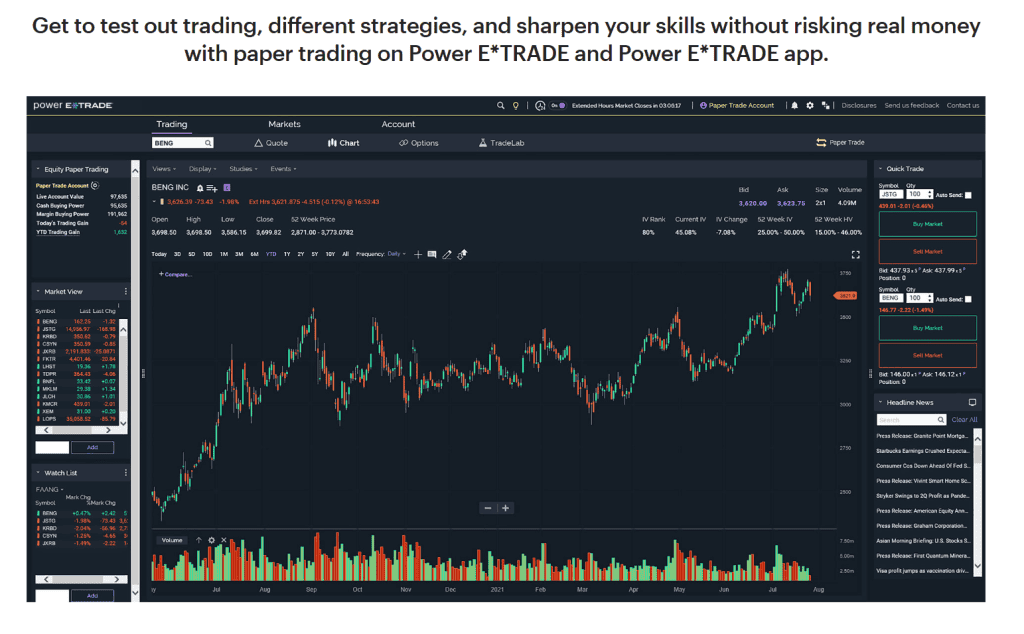

Does E*TRADE have paper trading?

Not exactly. At least not in the way Webull or TradingView do. E*TRADE doesn’t offer a full built-in simulator for regular users, but its Power ETRADE platform includes a limited paper trading mode for testing options and complex strategies.

Features

- Available through Power E*TRADE for active traders.

- Lets users simulate options and multi-leg strategies without using real funds.

- Includes live market data, customizable charts, and risk analysis tools.

- Uses the same interface as real trading, making the transition smooth.

Limitations

- Paper trading isn’t available on E*TRADE’s standard web or mobile platforms.

- The feature is meant for experienced traders, not beginners looking for a practice account.

- Requires a funded E*TRADE account to access all features.

So while E*TRADE technically offers paper trading, it’s not as beginner-friendly or accessible as Webull or TradingView. It’s better suited for traders who already use E*TRADE and want to test specific strategies before execution.

MetaTrader paper trading

MetaTrader 4 and 5 (MT4/MT5) are the industry standards for practicing forex and CFD trading. Almost every broker that supports MetaTrader offers a free demo account, giving traders a realistic environment with live market data and zero risk.

Features

- Free demo accounts with instant setup — no deposit required.

- Real-time forex and CFD price data.

- Supports manual trading and automated strategies through Expert Advisors (EAs).

- Includes advanced charting, indicators, and performance tracking.

- Works on desktop, web, and mobile.

Limitations

- Interface looks dated and can be overwhelming for beginners.

- Limited asset selection: mostly forex, CFDs, and metals.

- Execution may not perfectly match real trading conditions.

MetaTrader is best for traders learning or testing forex strategies. It’s powerful, flexible, and widely supported. It’s ideal for those who prefer technical control over visual flair.

Cryptomania crypto trading simulator

If traditional simulators feel too serious or intimidating, Cryptomania offers a lighter way to practice.

It’s a free crypto trading simulator that turns learning market dynamics into a game: complete with virtual money, tournaments, challenges, and a global leaderboard.

Features

- 100% free to play with a virtual balance you can use to trade Bitcoin, Ethereum, and other major crypto assets.

- Real-time crypto price data for realistic market conditions.

- Tournaments, challenges, and achievements keep things competitive and engaging.

- Includes educational tips and mini-lessons that explain trading terms, strategies, and indicators as you play.

- No registration hoops or deposits, just start trading right after downloading the app.

Limitations

- Focused solely on crypto markets. You won’t find stocks or forex here.

- Designed for education and fun, not professional-grade backtesting.

- Some advanced tools (like custom indicators or bots) aren’t available to keep it beginner-friendly.

Cryptomania is a perfect match for anyone who wants to learn crypto trading mechanics in a relaxed environment. It’s less about complex charting and more about understanding market moves, testing intuition, and building trading habits that actually stick.

How to start paper trading

Getting started is simple. All you need is a suitable platform and a few minutes.

Here’s how it usually goes:

1. Pick your market

Decide what you want to practice: stocks, forex, crypto, or options. The tools and platforms differ slightly for each.

2. Choose a paper trading simulator

Webull, TradingView, and MetaTrader are solid for traditional markets. For crypto, you can use something more relaxed and gamified, like Cryptomania.

3. Set up your account

Most simulators only need a quick sign-up. You’ll get a virtual balance, often around $100,000, to start trading right away.

4. Make your first trades

Try buying a few assets, setting stop-losses, or testing a strategy you’ve read about. The goal isn’t to win every trade, it’s to understand how markets move.

5. Track your results

Keep a simple trading journal. Note what worked, what didn’t, and how you reacted to price changes. That’s how you turn random trades into actual experience.

You’ll quickly see that paper trading isn’t just about pretending to trade. It’s about training your brain to make better, calmer decisions when real money is on the line.

Final thoughts

Paper trading is good for you, and it’s not just for beginners. It’s for anyone who wants to test new ideas and tools, sharpen instincts, and feel the pulse of the market before putting real money on the line.

The logic is simple: if a strategy doesn’t work with fake cash, it won’t magically start working when the stakes are higher.

So before you fund that first account, take the time to practice. Learn how orders behave, how fast markets move, and how it feels to win or lose, even if it’s only virtual.

Once you’re consistent in a simulator, you’ll trade with more confidence, less emotion, and a much better shot at keeping your real profits real.