Cryptocurrency is booming, and so are the platforms that support it. Among the many crypto exchanges available, Bybit stands out for its wide range of trading pairs, advanced strategies like leveraged trading and shorting, user-focused features, and reliable customer support. With over 10 million registered users since its launch in 2018, Bybit is growing fast.

However, it has its drawbacks, including limited availability in the U.S.

In this review, we’ll break down Bybit’s strengths, weaknesses, and features. Whether you’re a beginner or a seasoned trader, you’ll get a clear picture of whether Bybit fits your needs — or if you should look elsewhere.

What is Bybit?

Bybit is a global centralized cryptocurrency exchange that aims to provide a transparent, secure, and user-friendly trading experience. Established in 2018 and headquartered in the British Virgin Islands, Bybit has quickly grown to over 10 million users — a remarkable feat for its relatively short time in the market.

The platform focuses on offering intuitive features and tools for both novice and experienced traders. However, its accessibility is limited in certain regions, including the United States, Quebec and Ontario (Canada), Singapore, Cuba, Crimea, Donetsk, Luhansk, Iran, Syria, North Korea, Sudan, and Mainland China.

| 👍Pros | 👎Cons |

| Leverage up to 100x | Limited spot trading options |

| Extensive educational resources | High-risk derivatives trading |

| Low fees | Unavailable in the U.S. and some other countries listed above |

| Helpful customer support | Geared towards advanced traders |

Bybit features & benefits

Bybit stands out with a range of advanced features designed to enhance the trading experience for both investors and traders. Here’s a closer look at what it offers:

Mobile app

Bybit’s mobile app, available for Android and iOS, mirrors the functionality of the desktop platform, offering a seamless and feature-rich trading experience on the go.

NFT marketplace

Bybit features its own NFT marketplace, allowing users to invest in non-fungible tokens, digital assets, and DeFi projects without incurring extra fees.

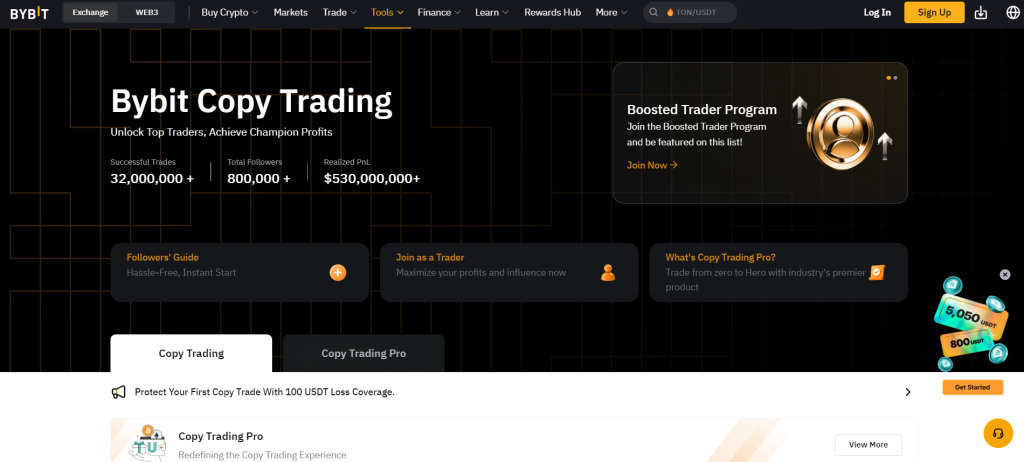

Copy trading

This feature lets users replicate the strategies of top-performing traders. It’s an excellent tool for beginners looking to learn or for those who prefer a hands-off approach to trading.

Trading bots

Bybit provides a variety of AI-powered trading bots for automated trading solutions. Users can also create their own bots, making it possible to profit from custom strategies or even share them with others.

Bybit Earn

Bybit Earn is a versatile asset management platform designed to help crypto investors grow their holdings. It offers a range of products tailored to different risk levels — some focus on stability, while others target higher yields. Here’s a concise overview:

| Product | Description | Best for |

| Bybit Savings | Grow your earnings with flexible- or fixed-term products offering guaranteed APRs. | Risk-averse HODLers, stable-yield seekers, and those needing flexibility. |

| Liquidity Mining | Add liquidity to enhanced AMM-based pools, use leverage to boost your share, and maximize returns. | DeFi-curious investors, long-term yield seekers, and those trading in volatile markets. |

| Dual Asset | A short-term trading tool for potentially higher returns. Choose “Buy Low” or “Sell High” based on market conditions. | Flexible investors comfortable holding USDT or crypto, and those aiming to accumulate during downturns. |

| ETH2.0 Liquid Staking | Stake as little as 0.1 ETH, earn daily yield via stETH, and use staked tokens as collateral while maintaining liquidity. | Investors seeking passive income with flexibility. |

| Double-Win | A structured product offering potential returns when market prices move beyond a set range. | Short-term traders, market movers, and hedgers. |

| Discount Buy | Acquire assets below the market rate in low-volatility conditions if price criteria are met. | HODLers, market-stability traders, and those with higher risk tolerance. |

| Wealth Management | Invest in professionally managed fund pools for steady growth, with auto-reinvest options. | Diversifiers and risk-averse investors seeking consistent returns. |

| Launchpool | Stake tokens to earn new assets for free, with the flexibility to unstake anytime. | Investors looking to harvest new assets while maintaining liquidity. |

Bybit Earn caters to all types of investors, whether you prioritize low-risk, high returns, or flexibility in managing your assets.

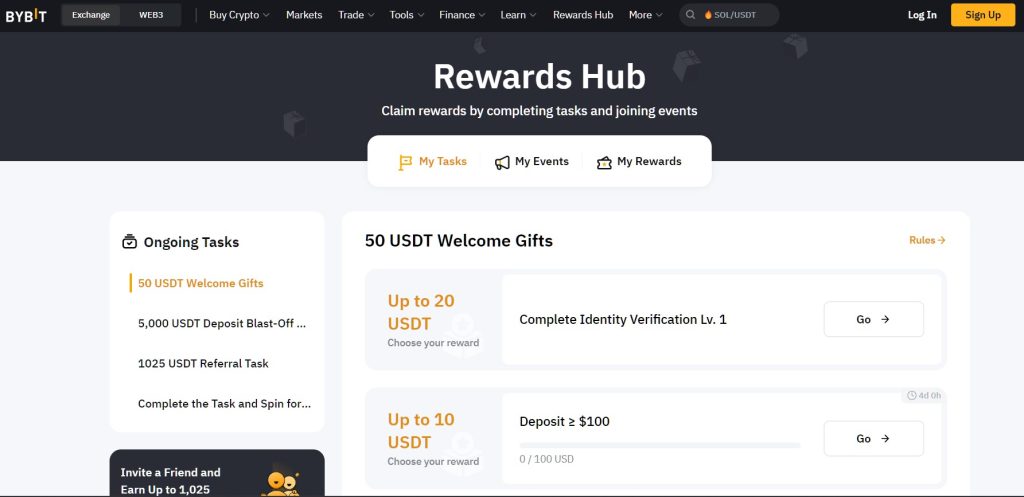

Bybit Reward Hub

The Bybit Reward Hub offers bonuses and rewards to loyal users. Users can earn incentives by completing specific tasks or joining promotions, fostering engagement and encouraging active trading within the community.

Bybit fees

Bybit’s fee structure can be complex, with variations across withdrawal fees, funding fees, deposit fees, and more. However, users can reduce their fees by meeting specific tier requirements.

Trading fees differ across markets, including Spot, Derivatives, Options, and Institutional Services. The newly introduced VIP Program revamps trading fee rates for both spot and derivatives markets, offering benefits based on a user’s tier—ranging from VIP 0 (regular users) to PRO-5 levels. These tiers are determined by a user’s trading activity and account type, such as a Unified Trading Account.

Institutional Services fees are distinct, with separate rates for market makers, adding another layer of customization for professional traders.

Here’s what the spot trading fees on Bybit can look like:

| VIP Level | Taker Fees | Maker Fees |

|---|---|---|

| Non-VIP | 0.10% | 0.10% |

| VIP 1 | 0.06% | 0.04% |

| VIP 2 | 0.05% | 0.02% |

| VIP 3 | 0.04% | 0.01% |

| Pro 1 | 0.03% | 0% |

| Pro 2 | 0.025% | 0% |

| Pro 3 | 0.02% | 0% |

Taker/Maker fees explained

Let’s recap the difference between the takers’ and makers’ fees on the cryptocurrency exchange in case you forgot.

- Taker fees: You pay this fee when you place an order that is immediately matched with an existing order in the order book. Essentially, you’re “taking” liquidity from the market. For example, if you buy or sell crypto at the current market price (a market order), you’re a taker.

- Maker fees: You pay this fee (often lower or even zero) when you place an order that isn’t immediately matched and instead adds liquidity to the market. For example, if you set a limit order to buy or sell at a specific price, and it doesn’t match instantly, you’re a maker because your order sits in the order book, “making” liquidity for other traders.

So, what does that 0.10% Taker and 0.10% Maker Non-VIP fee mean for an average trader?

Let’s say you’re trading $1,000 worth of Bitcoin on a platform with these fees:

Taker Fee

- You place a market order to buy $BTC at the current price.

- The exchange matches your order instantly, so you’re a Taker.

- Fee: 0.10% of $1,000 = $1.

- You’ll pay $1 in fees for the trade.

Maker Fee

- You place a limit order to buy $BTC at a lower price, and it stays in the order book until someone sells at your price.

- Because your order adds liquidity, you’re a Maker.

- Fee: 0.10% of $1,000 = $1.

- You’ll also pay $1 in fees for the trade.

In both cases, the fee is calculated as a percentage of the trade amount, so the larger your trades, the higher the fees. For smaller traders, these fees might seem minor, but for frequent or high-volume traders, they can add up significantly.