Crypto Bull Runs Explained: How to Make the Most of the Momentum

Vuk Martinovic

Ever get the feeling everyone’s making money in crypto except you? Welcome to the wild world of bull runs. It’s a period when prices (of virtually every coin) rocket, optimism soars, and crypto takes center stage in group chats.

But if you’ve ever wondered what actually sparks these runs, why they don’t last forever, or how to avoid FOMO, you’re in the right place.

If you’re investing or thinking about it, you need to know when the hype is real, what signals to watch for, and how to protect your profits before the music stops.

In this guide, you’ll find a simple breakdown of how bull runs work, how to spot the early signs, and practical steps for staying safe while chasing gains. It covers the typical market cycle, gives you clear ways to recognize when a run is heating up, and shares tested strategies to get in (or out) without losing your shirt.

Understanding crypto market cycles and bull runs

The price of crypto doesn’t just go up in a straight line. Most of the time, it moves through explosive surges called bull runs and deep drops known as bear markets.

Let’s break down what bull runs are, how the typical cycle unfolds, how to use cycle theories and on-chain clues, and the lessons we’ve had from each wild run so far.

What is a crypto bull run?

A crypto bull market is a period when coins see their prices climb faster and higher for months.

- Prices rise rapidly, sometimes hundreds or thousands of percent.

- There’s a contagious feeling of FOMO.

- News coverage goes wild, and your family members are asking about buying in.

- Trading volumes spike as old users pile back in and new money arrives.

Bear markets are the flip side:

- Prices drop or stagnate over months, even years.

- Fear, skepticism, and “crypto is dead” stories become the norm.

- Trading activity slows down, and many projects fade away.

In short, a bull run is a rocket ride up, while a bear market is a slow grind down. If you know which phase you’re in, you’ll avoid buying high and panic-selling low.

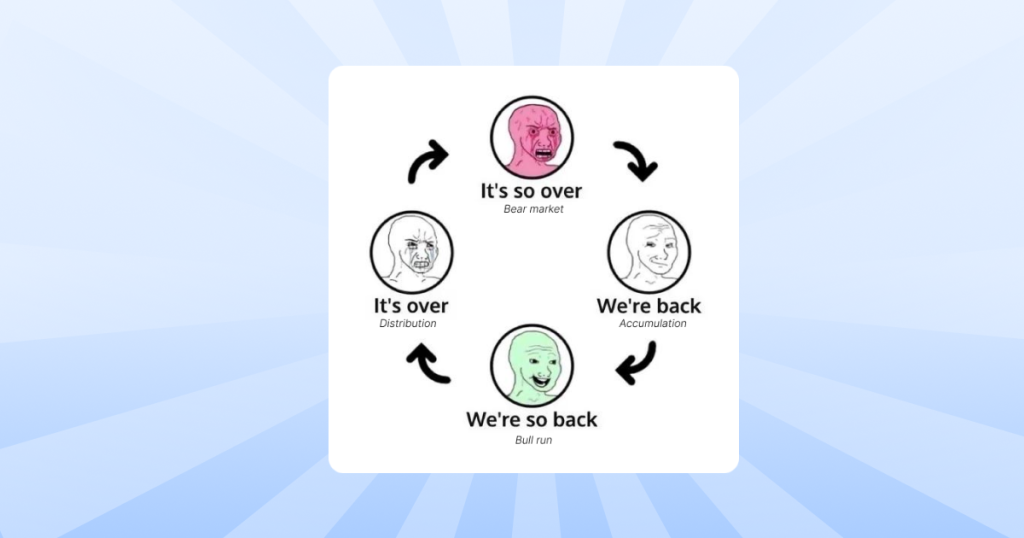

How crypto market cycles unfold

Crypto markets move through recognizable cycles. While the exact timing isn’t always predictable, the general stages play out again and again.

Here’s the classic sequence:

Accumulation

- Smart money and patient investors quietly buy while sentiment is low.

- Prices are stable or creeping up.

- On-chain signals: Spikes in wallets holding coins for over a year signal patience and quiet conviction.

Markup (Bull Run)

- Prices break out, and there’s a big unstoppable upward surge.

- Momentum grows, and new investors rush in.

- Social media and search trends explode.

Distribution

- Early buyers take profits as prices climb.

- Volatility increases and wild swings become common.

- Sentiment flips from euphoria to anxiety.

- Look for on-chain clues: Rising exchange deposits and old coins suddenly moving signal selling pressure.

Markdown (Bear Market)

- Sellers outweigh buyers, prices stall and then drop (sometimes fast, sometimes slow).

- New investors leave, and hype dries up.

- On-chain patterns show a spike in long-term holders again as survivors prepare for the next cycle.

Why do these cycles repeat?

- Incentives built into Bitcoin and crypto (like halving events) naturally spark fresh supply shocks

- Liquidity cycle: money flowing in and out of the investment markets, such as stocks and crypto

- Human psychology: Greed, hope, and panic drive much of the action

Historical bull runs: lessons learned

Looking at major bull runs shows what really sparks these wild surges and what ends them.

2013: The early boom

- Drivers: New exchanges like Mt. Gox made buying easier. Bitcoin gained its first real media coverage and saw usage as a payment method.

- What happened: Bitcoin’s price shot from $12 to over $1,100 within the year. Then it crashed hard as hype cooled and security issues appeared.

2017: The ICO frenzy

- Drivers: Fast adoption, Initial Coin Offerings (ICOs), and global hype. Retail investors piled in, chasing easy money.

- Result: Bitcoin soared from $1,000 to nearly $20,000. Ethereum and altcoins saw similar explosions. A regulatory crackdown and failed ICOs triggered a brutal bear market.

2020-2021: Institutions arrive

- Drivers: Big companies (think Tesla, Square, and Strategy, formerly MicroStrategy) started adding Bitcoin to their balance sheets. Wall Street attention grew. The Bitcoin “halving” in 2020 cut new supply by 50%.

- Result: Bitcoin hit $69,000. Fear of inflation drove many to seek “digital gold.” The run ended with rising interest rates, high-profile collapses (like FTX), and global market stress.

2025: Regulation, ETFs, and new narratives

What’s different: Spot Bitcoin ETFs launched, which lets anyone buy Bitcoin in their brokerage. Institutional investors now drive market momentum, especially around supply shocks like the 2024 halving.

Big factors:

- ETF inflows have poured money in, but have also changed how altcoins perform (Bitcoin dominance is now higher).

- AI and tokenized assets are leading storylines. Unlike prior cycles, sector-specific trends are more intense and sometimes decouple from Bitcoin.

- Macroeconomics — inflation, interest rates, and politics — set the tempo, not just crypto news.

Risks and observations: More institutional money helps reduce wild swings but can also drag out cycles or shift traditional patterns. Regulation is making the market less of a Wild West, but it can quickly change sentiment.

Key lessons from every bull run

- Hype and fresh money drive most of the uptrend, but every peak is followed by a steep reset.

- “Halving” events still work as launchpads, but outside forces (like regulation or global finance) now play a bigger role.

- Smart investors focus on timing entries and exits, not chasing every green candle.

The takeaway? Bull runs tend to follow repeatable patterns, but every cycle gets a plot twist or two. Learn the cycle, watch for the signs, and keep your head while everyone’s losing theirs.

How to spot a crypto bull run before and as it happens

You won’t find a neon sign flashing “Bull Run Now!”. But you can read the signs.

It’s about spotting the right mix of technical indicators, on-chain activity, and waves of hype (or fear). Here’s what you need to know.

Technical indicators and chart patterns

When the market starts taking off, it usually leaves clues in the crypto trading charts before the headlines scream “new all-time high.”

If you like spotting patterns and reading signals, keep your eyes on these:

- Parabolic moves: A price chart that turns from a gentle slope to a near-vertical rocket? Classic parabola. This often signals the middle stage of a bull run.

- Volume spikes: Real growth is fueled by big buying volume. When price jumps come with a serious jump in volume, that’s often the “real deal.”

- ‘Cup and Handle’ pattern: The cup and handle looks like, you guessed it, a teacup. It shows a rounded bottom followed by a brief dip (“handle”) before a breakout. When you see this on a daily or weekly chart, it’s bullish.

- Moving averages: Simple Moving Averages (SMAs), like the 50-day and 200-day, give you big clues. A “golden cross” is when the 50-day SMA crosses above the 200-day. Bulls love this signal, and it often precedes major rallies.

But remember: No pattern is foolproof, and nothing is guaranteed. Double-check signals with volume and broader sentiment before betting the farm.

On-chain metrics to watch

Unlike stocks, crypto lets you peek inside the factory. Blockchain data (“on-chain metrics”) tells you exactly what holders and whales are doing

Key on-chain signals for bull runs:

- New address growth: If the number of active wallets suddenly climbs, it often means fresh investors are piling in.

- HODL waves: These chart how long coins have been held without moving. When 1+ year HODL waves start shrinking, it often means old holders are finally taking profits — usually a late-bull signal. If HODL waves start growing during dips, that’s quiet accumulation. It’s a sign the next bull wave could be brewing.

- Exchange flows: Watch where the coins go. When more coins leave exchanges (withdrawals rise), whales are likely parking assets for the long haul. Increased deposits suggest selling is coming.

- ETF flows: Since spot Bitcoin ETFs launched, inflows/outflows are a strong barometer. Big, steady ETF inflows usually add jet fuel to the run.

Sentiment and external catalysts

Sometimes, it’s not what the charts say. It’s what the crowd screams, what the headlines pump, and what lawmakers do on that matter.

Key sentiment and outside triggers that signal a bull run (or its exhaustion):

- Social media trends: Exploding keyword searches, hashtags like #Bitcoin or #CryptoMoon trending, and meme coins turning up in casual conversation all mark rising excitement.

- Google search spikes: If you see “how to buy crypto” or “Bitcoin price” searches just exploding, that’s a major sign of fresh retail interest. In past bull runs, these surges have come just after new highs but before the mania stage.

- News cycles: Positive coverage from Bloomberg, CNBC, or your group chat’s self-appointed “crypto guy” boosts confidence. Institutional announcements, like a major company adding Bitcoin, are huge signals.

- Regulatory announcements: Approvals of Bitcoin ETFs, new laws making crypto more accessible, or major countries softening restrictions spark bull action. But be careful: suddenly negative news has ended more than one bull run in hours.

- Macroeconomic shifts: Falling interest rates, weakening trust in banks, or inflation fears can push money into Bitcoin. Stories like a country battling currency collapse (think Argentina) always drive an uptrend in those regions.

Quick hits that ramp up the FOMO:

- Crypto/AI crossovers get big headlines and can pump specific sectors.

- Declining crypto skepticism in the media draws in fence-sitters.

Bottom line: You’ll know bull run sentiment is peaking when everyone — your neighbor, your Uber driver, and your cousin’s dog walker — is asking how to buy. That’s often close to the top, but if you catch the buzz earlier, you can ride most of the wave.

Remember, spotting a bull run is about watching all three clues: the charts, the blockchain, and the noise around you. No single piece tells the whole story.

What to do during a crypto bull run: strategies and risk management

When the crypto market catches fire, it’s easy to get caught up in the hype and forget about the basics. Here are some crypto strategies to be sharp and in control when everything’s blasting off.

Position sizing and portfolio diversification

You wouldn’t put all your chips on one number at the roulette table, right? And if you would, well, you really shouldn’t. The same goes for crypto.

Spread your bets. Don’t let one coin or token decide your fate during a bull run.

Keep your balance with these tactics:

- Don’t invest more than you can lose. Always bear in mind that you can lose all your investments. You need to invest an amount you could accept losing.

- Diversify across sectors and assets. Hold a mix: large caps like BTC and ETH, promising mid-caps, and maybe a small allocation to new trends (AI, DePIN). Don’t overbet on a single token.

- Avoid doubling down. If one asset rallies, resist chasing it with more capital. Never chase green price action.

Taking profits: methods and timing

It’s thrilling to see your portfolio light up green, but unrealized gains can vanish if you don’t have a plan.

Here are simple, proven ways to lock in gains without leaving the party too early.

Top exit strategies:

- Dollar-Cost Averaging out (DCA):

- Sell in small batches as the price climbs.

- Set sell orders at intervals (e.g., every 5-10% price gain).

- Removes emotion and “all or nothing” panic.

- Staged exits:

- Define milestones (e.g., 2x, 3x, 5x your initial buy).

- Sell a fixed percentage (maybe 20-30%) at each stage.

- Keeps you in the game while guaranteeing some wins.

Common mistakes and how to avoid them

If there’s ever a time to make emotional mistakes, it’s during a bull run. Greed and FOMO can cloud your thinking just when you need discipline the most. Watch for these traps:

Greed

❌Believing every coin will “go to the moon.”

❌Refusing to take profits, convinced you’ll pick the exact top.

FOMO

❌Jumping into hot coins late after big gains.

❌Letting headlines and social media push you into bad trades.

Late buying

❌Entering positions after major rallies, when the risk of reversal spikes.

❌Chasing meme coins or new trends without research.

Neglecting exit strategies

❌Not setting stop-loss or take-profit targets up front.

❌Hoping you will “just know” when to sell (spoiler: you won’t).

How to stay disciplined:

- Write down your plan. Having entry, exit, and stop-loss numbers on paper (or at least your phone notes) keeps you focused.

- Don’t trade emotionally. Whenever you feel the pressure to do something fast, don’t. Instead, walk away and don’t do anything until tomorrow. Nothing is so urgent that one day will truly cause you to miss out.

- Scenario planning. Mentally rehearse both the “everything crashes” and “it runs higher” cases. Decide what you’ll do in each before it happens.

- Understand the risks. Crypto bull runs have made overnight millionaires. But they have also wiped out more wallets than bad passwords.

Final thoughts

The market rewards patience, discipline, and self-awareness, not just guts or wild bets. Success in crypto bull runs comes down to preparation and steady nerves.

You don’t need superhuman luck, just a solid plan, a clear head, and the guts to stick with your rules even when the crowd gets wild.

Use the signals and strategies laid out here as your playbook.