The Ultimate Guide to Memecoins: Everything You Need to Know

Vuk Martinovic

What if your cryptocurrency could make you laugh while potentially growing your wallet? Memecoins do exactly that. These quirky, community-driven digital currencies, born from internet jokes and trends, have grown in popularity a lot.

Backed by viral memes, online communities, and a sprinkle of celebrity buzz, they blend humor with high-risk, high-reward potential. In this guide, I’ll unpack everything you need to know — without the boring bits.

What are memecoins?

Memecoins come straight from internet culture, often fueled by jokes, viral trends, and memes. Unlike Bitcoin or Ethereum, which prioritize technology and utility, memecoins rely on community-driven hype and social media buzz to gain value.

Most of these tokens run on established blockchain networks like Ethereum, Solana, or Binance Smart Chain. They use the same decentralized ledger technology as other cryptocurrencies but with a very different focus.

Instead of being backed by advanced tech, real-world applications, or large-scale development, memecoins thrive on speculation, online engagement, and meme culture. Some projects try to add utility — through decentralized exchanges, staking, or NFT integrations — but for most, the real value comes from internet-driven momentum and staying relevant in the ever-changing world of crypto trends.

The origin of memecoins

It all started with Dogecoin. Created in 2013 by software engineers Billy Markus and Jackson Palmer, Dogecoin was meant to poke fun at the growing hype surrounding cryptocurrencies. Its logo? The Shiba Inu dog from the viral “Doge” meme, complete with comic sans captions like “much wow” and “such crypto.”

Despite its humorous beginnings, Dogecoin quickly grew in popularity, especially within online communities like Reddit. Users embraced it as a way to tip others for creating great content, fostering a friendly and charitable culture.

Over time, its playful image and strong community inspired other memecoins. It set the stage for coins like Shiba Inu and Pepe Coin.

Key characteristics of memecoins

Here’s what makes memecoins unique:

- Massive token supplies: Unlike Bitcoin’s capped supply of 21 million coins, many memecoins have billions (or even trillions) of tokens in circulation. This abundance often means individual coin prices are very low.

- Community-driven: These coins thrive on community support. From tweets to Reddit posts, their value mostly comes from online enthusiasm and viral trends.

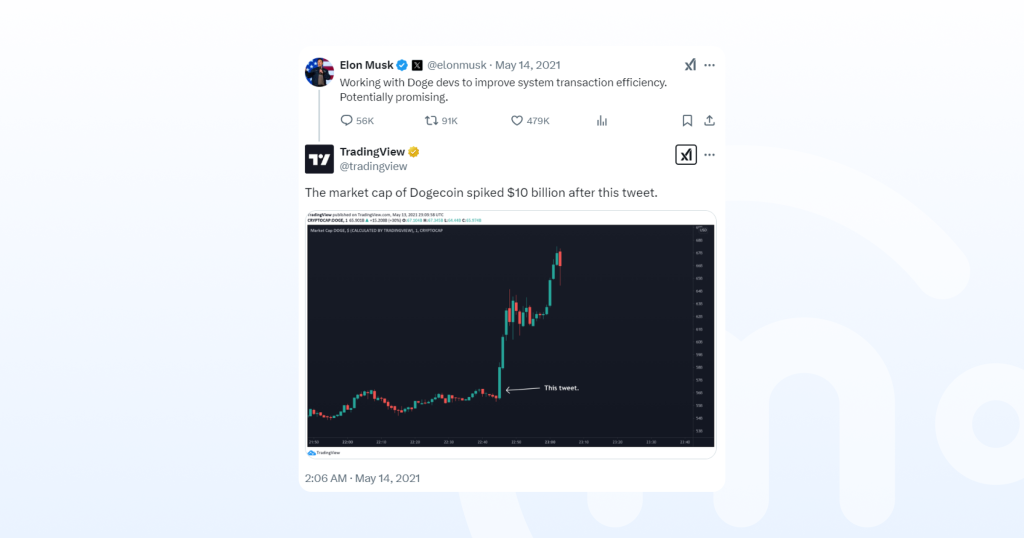

- High volatility: memecoins are notorious for their unpredictable price swings. One viral tweet or celebrity endorsement (looking at you Elon Musk!) can send prices soaring or crashing.

- Low initial costs: The cheap per-coin price makes them accessible to everyday investors, even if the total investment carries risks.

Memecoins live and die by their ability to capture attention. When their popularity wanes, so does their value.

Why do people invest in memecoins?

So, why would anyone put their money into something that started as a joke? I’ve boiled it down to three main motivations:

- Speculation: Many investors see memecoins as a high-risk, high-reward opportunity. If you bought Dogecoin early and held on, you probably made a nice profit during its meteoric rise. The thrill of potentially turning a few bucks into thousands, or a few thousand into millions is hard to resist.

- Community spirit: Memecoins often have tight-knit, passionate communities. Buying in is also an invitation to join a fun, engaged group. It’s like an entrance fee to an online club where you share similarities with other individuals

- Pure fun: I get how crypto can feel intimidating and overly technical. Memecoins inject humor and relatability into the mix. They’re less about “changing the world” and more about having a good time.

How memecoins work: The role of social media and influencers

Memecoins would be nothing without the internet. Platforms like X (Twitter) and Reddit amplify their popularity, while influencers and celebrities can make the prices skyrocket, or crash. Here’s how it works:

- Virality is key: Posts, tweets, and memes featuring a coin can ignite massive interest overnight. Remember Dogecoin’s “to the moon” rally? It all started with viral tweets.

- Celebrity endorsements: Figures like Elon Musk play huge roles in boosting memecoins. A single tweet from a well-known name can create buying frenzies.

- Reddit powerhouses: Communities like r/CryptoCurrency or r/WallStreetBets often band together to promote specific memecoins. The result? Significant spikes in price, driven by collective action.

- Influencer momentum: Crypto influencers on YouTube and TikTok frequently feature memecoin and encourage their followers to join in. This builds hype, increases market activity, and draws in more investors.

But there’s a downside. This same social media buzz also fuels extreme price volatility. A viral tweet can turn a joke coin into a goldmine in minutes — but it can also reduce prices significantly.

The pros and cons of memecoins

Let’s explore both sides of the coin. Get it?!

Advantages of memecoins

Here’s what works in memecoins’ favor:

- Community engagement: Memecoins thrive on the power of their communities. Online platforms are full of active discussions, memes, and camaraderie.

- Potential for high returns: Ever heard of Dogecoin millionaires? Memecoins are known for their explosive growth, often fueled by viral trends or celebrity endorsements. Coins like Shiba Inu went from being virtually worthless to skyrocketing in value. I can’t deny it, the allure of turning a small investment into massive gains is there.

- Accessibility for new investors: With their low per-coin price, memecoins are extremely approachable for beginners. Whether you’re putting in $10 or $1,000, you can easily get involved without the intimidating hurdle of hefty prices seen with coins like Bitcoin or Ethereum.

Disadvantages of memecoins

For all their charm, memecoins aren’t exactly foolproof investments. In fact, they’re highly risky. Here’s why you should think twice before jumping in:

- High volatility: Memecoins are extremely volatile, even by crypto standards. A single viral tweet can cause prices to skyrocket, and fading interest can send them into freefall. This extreme price unpredictability can cause you significant losses if you’re not careful.

- Lack of intrinsic value: Unlike coins like Ethereum, which power decentralized applications, memecoins often have no practical utility. Their value is almost entirely driven by community hype and social media trends. If they lose the hype, they become obsolete and essentially worthless.

- Susceptibility to scams: The memecoin space is notorious for pump-and-dump schemes, where prices are artificially inflated to attract investors. Then, the early adopters cash out — and leave latecomers holding the bags that are worth nothing.

I urge you to be cautious with memecoins. The same traits that make them exciting can also make them treacherous. Always do thorough research, and never invest more than you’re prepared to lose.

Top memecoins

Here are some of the best memecoins by market cap:

- Dogecoin: The original memecoin, Dogecoin started as a joke in 2013 but quickly turned into a crypto sensation. It’s got the iconic Shiba Inu dog as its mascot and a fun-loving community behind it. Dogecoin’s rise was influenced by vital moments, Reddit hype, and Elon Musk’s tweets. It lacks a fixed supply or serious utility, but it still remains the memecoin blueprint.

- Shiba Inu: If Dogecoin is the king of memecoins, Shiba Inu is the ambitious challenger. Launched in 2020 and dubbed the “Dogecoin Killer,” it went viral after sending 50% of its supply to Ethereum’s Vitalik Buterin. Unlike Doge, Shiba Inu is building an ecosystem — featuring ShibaSwap, staking tokens ($BONE, $LEASH), and even a Shiba Metaverse.

- Floki Inu: Named after Elon Musk’s pet, this coin mixes meme energy with a push for real-world use. With Viking-inspired branding, projects like FlokiFi, and charity initiatives, it has built a passionate following.

- Baby Doge Coin: A cuter, more playful spin on Dogecoin, Baby Doge wants to attract new investors with its deflationary model and (of course) strong social media presence. It’s also known for charitable donations to dog shelters.

- Pepe Coin: Inspired by the legendary Pepe the Frog meme, this coin thrives on internet nostalgia and meme culture. Like most memecoins, it’s fueled by community hype and speculative trading. Unlike some of the newer memecoins such as Shiba Inu and Floki Inu, which are at least trying to build some real-world use, Pepe is mostly focused on the fun, jokey, hype-based approach.

- TRUMP: Yes, it’s exactly what you’re thinking. This meme coin was launched and endorsed by Donald Trump himself, and has quickly become one of the top Solana memecoins in the market. It doesn’t have any actual utility. But as far as memecoins go, it’s got the best kind of hype around it — political branding.

Controversies and scandals in the memecoin world

Oh boy, where do I start?

Memecoins have for sure captured the internet’s imagination. But, they’ve also become a breeding ground for controversy, market manipulation, and outright scams. Their rise, fueled by viral social media trends and online communities, also ushered in a darker side of the crypto world.

In this section, I’ll explore the shadier aspects of memecoins, including pump-and-dump schemes and the role of niche online groups in stirring up scandals.

Pump-and-dump schemes

Pump-and-dump schemes are one of the biggest controversies plaguing memecoins.

These schemes occur when a group of insiders artificially inflates a coin’s price by hyping it up to unsuspecting investors. Once the price “pumps” and hits a peak, these insiders “dump” their holdings and cash out. The others are then left with massive losses.

Here’s how these schemes typically unfold:

- The build-up: It starts with whispers of a “hidden gem” memecoin on platforms like Telegram, Discord, or X. Insiders use keywords like “next Dogecoin” or “real world utility” to lure investors in.

- The spike: Coordinated buying by influencers or groups creates a massive price surge. This attracts buyers driven by FOMO (Fear Of Missing Out).

- The collapse: Once the insiders sell off their stakes, the coin’s price drops. Now, latecomers are left with worthless tokens.

A notorious example is SquidCoin, a token inspired by Netflix’s “Squid Game.” It skyrocketed by over 30,000% in a matter of days, only to crash to nearly zero when the developers abruptly exited, taking millions in investor funds.

Similarly, smaller Memecoins like $FEG or $Mooncoin have faced accusations of being fronts for such schemes.

The allure of quick profits blinds many investors to the risks. Always watch out for sudden price surges unsupported by real-world value. Research a token’s background and team before investing. You should always do this with every project, but especially with memecoins.

Impact of X and communities like Pump.fun

Social media platforms, particularly X, and niche communities such as Pump.fun have played a huge role in the meteoric rise — and occasionally ruin — of memecoins. They are often ground zero for hype and manipulation.

How does this happen?

- Viral tweets: An Elon Musk tweet has proven capable of skyrocketing coins like Dogecoin. Smaller influencers often push less-known memecoins with promises of massive returns. Popularity from a single viral post can spark a buying frenzy.

- Targeted pump groups: Platforms like Pump.fun are essentially private clubs where members coordinate efforts to pump (and later often dump) obscure coins. It’s like a secret society, but instead of cryptic rituals, they manipulate crypto prices. This behavior skirts the line of legality and ethics and draws backlash from regulators.

The main problem is the rapid spread of misinformation. Casual investors see trending hashtags or skyrocketing coins and jump in without realizing they’re part of an orchestrated ploy.

For instance, smaller memecoins like Floki Inu experienced massive upswings after aggressive community campaigns on X. In other cases, groups intentionally overhype coins with no functional purpose, leaving everyday investors to lose hard-earned cash when prices crate.

In many ways, memecoins reflect the extremes of the internet age: immense power to connect and mobilize, but also the ability to deceive and exploit.

Avoiding common scams with memecoins

To stay safe, here are the biggest red flags to watch out for:

- Watch out for unrealistic promises: If a project guarantees massive returns or claims to be the next “100x coin,” it’s likely a scam. Over-the-top marketing, exaggerated APY offers, and “get rich quick” schemes are classic tactics used to lure in investors before pulling the rug.

- Transparency matters: Legitimate projects have clear goals, a visible team, and a well-documented whitepaper. Be wary of anonymous developers, unverifiable partnerships, or missing project details—these are major red flags that a coin might be a scam.

- Beware of rug pulls: Some memecoins are designed purely for the creators to profit while leaving investors with worthless tokens. Check if a few wallets hold most of the supply, whether liquidity is locked, and if the project has undergone an independent audit.

- Steer clear of fake presales and airdrops: Scammers use fake presales and airdrops to trick users into sending funds or revealing personal information. Always verify if a coin is listed on trusted platforms, and never pay upfront to participate in a presale.

- Spot social media scams: Memecoin scams thrive on Twitter, Discord, and Telegram, often using fake influencer endorsements or hacked accounts. Just because a celebrity mentions a coin doesn’t mean it’s legitimate — double-check sources and don’t fall for hype-driven FOMO.

- Use blockchain analytics and tools: Before investing, use tools like RugCheck, Webacy, BscScan, or Etherscan to review token data, check for suspicious contract details, and spot concentrated ownership. A few minutes of research can save you from losing everything.

Conclusion

Memecoins are proof that the crypto world doesn’t always take itself too seriously. They’re fun, unpredictable, and packed with potential. But, they come with significant risks.

Always remember that these coins thrive on community enthusiasm and internet hype, not traditional value. Approach them like you would a fun bet: exciting, and thrilling, but not something you bet the family farm on.

If you’re ready to dive in, invest cautiously, do your homework, and never bet more than you’re willing to lose.