Crypto trading signals are like trading tips. They tell you when to buy or sell a cryptocurrency, usually through apps like Telegram, Discord, or paid groups.

You’ll see messages like:

“BUY BTC at $60,000. Target: $62,000. Stop-loss: $59,000.”

Sounds simple, right? Well… not always.

Some signals come from legit traders who study charts and market trends. Others? They’re just hype made to get you excited and make someone else rich.

In this guide, we’ll break it all down:

- What crypto signals are

- How they actually work

- When they can help

- And when they’re just marketing tricks in disguise

If you’re new to crypto, don’t worry, we’ll keep it simple and easy to follow. Let’s get into it!

How crypto trading signals work

Crypto trading signals are like cheat codes. Instead of doing all the research yourself, you just follow someone else’s instructions.

Here’s what a typical signal tells you:

- What to buy (Example: ETH or SOL)

- When to buy (Example: “Buy at $1,700”)

- Where to sell (They give target prices like $1,800 or $1,900)

- Where to place your stop-loss (To cut your losses if the trade goes bad)

A real-world signal might look like this:

- BUY: ETH at $1,700

- TARGETS: $1,800 / $1,950

- STOP-LOSS: $1,620

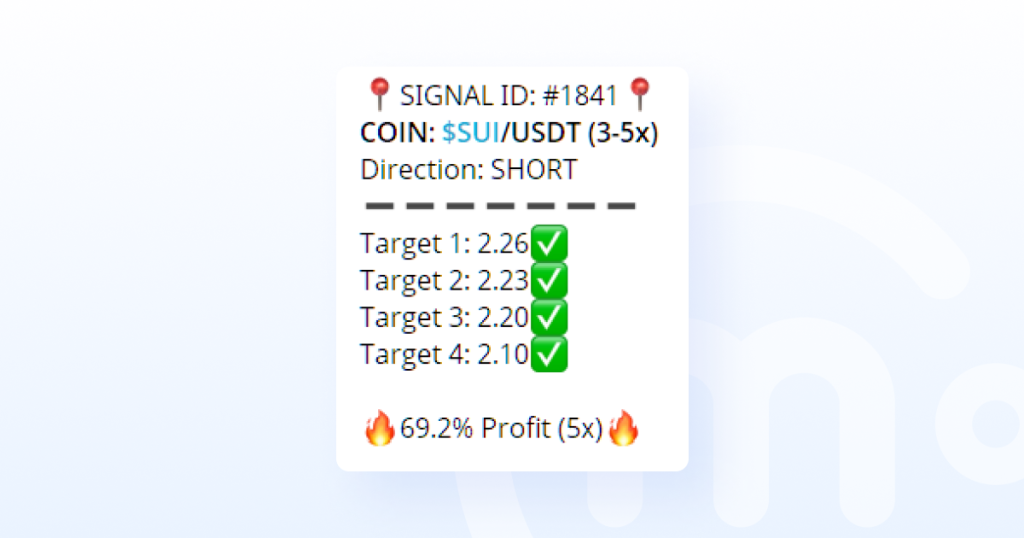

Or like this:

You copy these numbers into your exchange (like Binance or Bybit), and the trade runs automatically if those prices are hit.

Some signal groups also include trading charts or quick explanations like “Support at $1,790, bullish momentum,” but many don’t. It’s usually just the numbers, and you’re expected to trust them.

It’s simple in theory. But as you’ll see next, not all signals are correct. And, not all signals are given by people who have your best interests in mind.

Free vs paid crypto trading signals: What’s the difference?

Not all signals come with a price. Some free crypto trading signals are in Telegram groups, Reddit threads, Twitter posts, or even YouTube comments. Others? They’re locked behind a paywall — and sometimes an expensive one.

So what’s the difference?

Free signals

Free trading signals in crypto are often used as bait. A trader or influencer will post a few trades for free to get your attention. If they work, great, you’ll probably want more. That’s when they hit you with an upgrade offer.

Here’s what to expect from free signals:

- Basic info: buy/sell points and maybe a stop-loss

- Little or no explanation

- Big groups with thousands of members

- Signals can be hit or miss

Sometimes, the free ones are delayed versions of paid signals. By the time you see them, the price has already moved.

But not all free crypto trading signals are bad. A few genuine traders do it to build trust or help beginners. The challenge is knowing who’s real and who’s just pretending.

Paid signals

Paid signals promise the “real stuff.” More accuracy, more profits, more support. Some providers charge $10 a month, others ask for $100 or more.

With paid groups, you might get:

- Detailed charts and analysis

- Live trade alerts

- Personal feedback or coaching

- Access to private communities

- Risk/reward breakdowns

But don’t assume that paid = trustworthy. Or competent.

There are paid signal groups that delete bad trades, fake results, or use flashy graphics to make bad strategies look good. Some even copy free signals and resell them. That’s why you should always do your homework before you subscribe.

So, which one’s better?

It depends on your goals.

If you’re just starting out, free signals can be a decent way to learn how trades are structured. But take everything with a grain of salt. Don’t invest real money until you’ve tested a provider or followed along on paper.

If you’re thinking about joining a paid group, ask:

- Do they show real past results?

- Do they explain why a trade makes sense?

- Are other members getting value?

Most importantly: don’t pay for hype. Pay for clarity.

Who’s sending these crypto trading signals?

This is where things start to matter. Because not all signal providers are the same. And definitely not all of them are legit.

Let’s explain who can actually be behind these trading signals in crypto.

Real traders

These are the people who study the markets, read charts, watch volume, and understand price action. They use technical analysis, trading indicators, support/resistance zones, trendlines, and other tools to make educated guesses on where a coin might go.

You’ll usually spot them by:

- Sharing detailed explanations or charts

- Being transparent about wins and losses

- Talking about strategy, not just hype

They treat trading like a skill — not a lottery.

That said, even real traders don’t win every trade. Losses are normal. So if someone claims a 99% win rate? Run.

Pump-and-dump scammers

These guys are in it for themselves.

Here’s how they generally work:

- They buy a cheap, low-volume coin (usually one you’ve never heard of).

- They send out a “buy alert” to thousands of followers.

- The price spikes — because everyone rushes in.

- They sell at the top, while you’re left holding the bag.

They make money when you lose. And they don’t care.

A lot of “free” Telegram groups do this. They’ll hype up coins like “NEXT 100x GEM 💎🚀” with no real analysis, just emojis and FOMO.

Affiliate marketers in disguise

Some signal providers are just marketers pushing affiliate links. Their real goal is to get you to sign up on a trading platform (like Coinbase or Bitget) using their referral code.

The more trades you make, the more they earn (win or lose).

They might spam signals just to get you to open more trades. Doesn’t matter if they’re good trades or not.

That’s not always a scam, but it’s definitely not in your best interest.

Bots and copy/paste groups

These groups pull signals from other places and repost them, sometimes automatically. No analysis, no human review, just recycled trades.

You’ll see this a lot on Discord or “auto trader” Telegram bots.

The big problem is that nobody is checking if the trades still make sense. Prices change fast in crypto. A trade that looked good 30 minutes ago could be risky now.

The good: When signals actually help

Let’s be fair. Not all trading signals in crypto are useless. If you use them the right way, they can be a helpful tool especially if you’re short on time or still learning the basics.

Here’s when they can actually work in your favor:

You’re short on time

Maybe you have a job, school, or other priorities. You don’t have hours to spend staring at charts. Signals can save you time by pointing out trade setups that you can quickly review and decide on. They give you the “what” and “when” in a few seconds.

You use them as a second opinion

Let’s say you’re looking at a trade yourself, and a signal pops up that says the same thing. That’s confirmation. Or maybe it gives you an idea you hadn’t thought of, and you go check the chart yourself. Either way, you’re still making the final decision, not blindly following someone else’s move.

You already know basic trading

If you understand stop-losses, entry points, and position sizing, signals can be a nice add-on. They become a tool, not a crutch. Beginners who treat signals as gospel often get burned. But traders with even a bit of knowledge can filter out the noise and spot the real opportunities.

The bad: When signals are just hype

Crypto signals can look exciting, especially when they come with rocket emojis, “100x potential” claims, or screenshots of massive profits.

But here’s the truth: most signals are more hype than help.

Signals that chase FOMO

Some groups send out trades based on hype, not analysis. A coin pumps, and they tell everyone to “BUY NOW!”. But by the time you get in, it’s already too late. You buy high, the price crashes, and you’re stuck holding the bag.

No risk management

Many signal groups don’t talk about stop-losses or how much to risk. That’s dangerous. Even good traders lose trades. Without risk control, one bad signal can wipe out your account.

Cleaned-up track records

Some providers delete losing trades from their chat or only post the winners. It looks like they never miss. But it’s all fake. In reality, their win rate might be 50% or worse.

Designed to sell, not help

A lot of signals are just marketing. The goal isn’t to help you win, it’s to keep you subscribed. They give just enough wins to keep you hopeful, but never enough consistency to succeed on your own.

Red flags to watch out for

Not all signal providers are scammers, but many red flags show up if you know what to look for.

Here’s how to spot the ones you should avoid:

- “Guaranteed profits”: No one can guarantee profits in crypto. The market is volatile. Even pros take losses. If someone says “100% win rate” or “guaranteed gains,” that’s your cue to leave.

- No losses ever: Scroll through their past signals. Do they only show winners? No losing trades, ever? That’s fake. Real traders share both wins and losses. It’s part of the game.

- Constant pressure to upgrade: Some groups give a few weak free signals, then push hard for you to buy the “VIP” version. They promise better trades, insider info, or “lifetime access.” But once you pay, the quality rarely improves.

- No explanation or strategy: Good signal providers will explain why they’re calling a trade. Bad ones just post numbers with no logic. If it feels like they’re guessing (or just copying trades from elsewhere), they probably are.

- Sketchy payment requests: Be careful if they ask you to send crypto directly to a wallet address to join. Legit services use secure payment systems or platforms. Direct wallet transfers = no refunds, no safety net.

How to use signals safely

Still curious about using crypto signals? That’s totally fine, as long as you treat them like tools, not magic formulas.

Here’s how to do it safely:

- Start small: Never go all-in on your first few trades. Use small amounts, or better yet, try demo trading first with tools like Cryptomania. Get comfortable before risking real cash.

- Always use a stop-loss: This is your safety net. If the trade goes the wrong way, a stop-loss cuts your losses automatically. No stop-loss = you could lose everything on a single trade.

- Don’t blindly trust — double-check: Before following a signal, check the chart yourself. Ask: does this setup actually make sense? If the market looks shaky, it’s okay to skip the trade.

- Diversify your risk: Don’t put all your money into one trade or one signal group. Spread your bets. That way, if one fails, it won’t wipe you out.

- Track your results: Keep a simple trading journal. Write down the signal you followed, what happened (win or loss), and what you learned.

Over time, you’ll spot which providers are helpful and which ones aren’t worth your attention. Using signals isn’t a bad thing. But using them without a plan is.

Final verdict: Are crypto signals worth it?

So, are crypto signals a secret weapon, or just smoke and mirrors?

The truth is: it depends.

Some signals are helpful. They can save you time, give trade ideas, and even teach you a thing or two, if you already know the basics and treat them with caution.

But most signals? They’re more hype than help.

- Some are pumped by marketers chasing referral bonuses.

- Others are run by people who profit off your FOMO.

- And many just guess and hope they’re right.

If you’re a beginner, your best investment isn’t in a paid signal group. It’s in learning how the market works. Understand charts, risk management, and how to think for yourself.

Use signals if you want, but don’t depend on them. They’re a tool. Not a shortcut. Not a magic trick. And definitely not a replacement for your own brain.